Dick’s Sporting Goods grabbed big headlines with their decision to stop selling assault rifles and raise its minimum age for gun sales to 21. The socio-political underpinnings are being debated, ad infinitum, all over the web. We don’t do that here.

What we want to talk about is the commercial implications, particularly for Dick’s and its customer base. And, at least from our initial analysis, those implications cut both ways.

THE POSSIBLE BAD NEWS

This decision has the potential to alienate a large group of Dick’s customers.

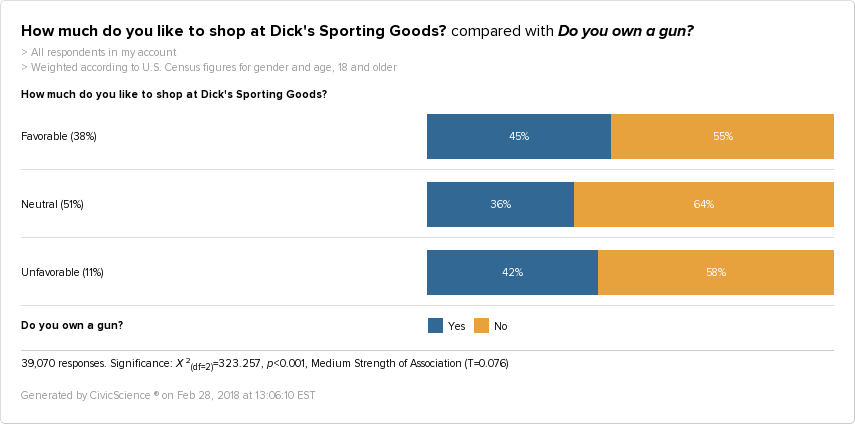

As you can see from the chart above, nearly half of favorable Dick’s customers own a gun, a rate significantly higher than those with a neutral or negative opinion toward the company. While not all gun owners are opposed to stricter gun control policies, for sure, a large number of them will view the company’s decision as an affront.

BUT MAYBE THEY NEEDED TO DO IT

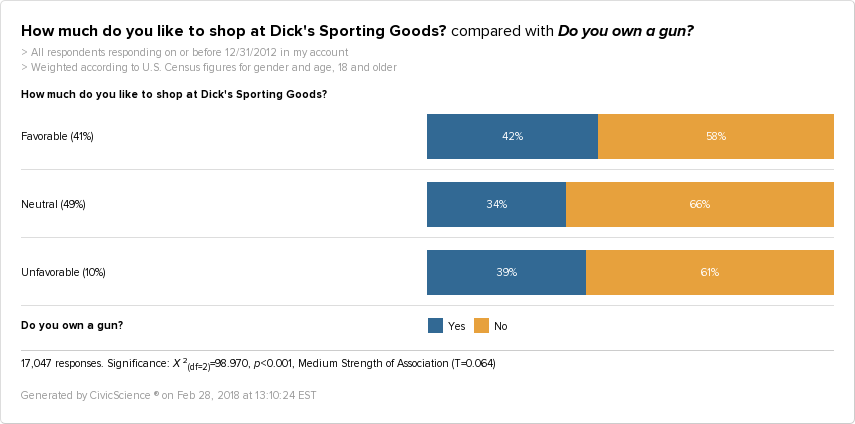

Our data also tell us that favorability toward Dick’s among gun owners has been on a sharp rise, even as the brand’s popularity, among the Gen Pop, has declined. Take a look at our Dick’s Sporting Goods tracking question, crossed by gun ownership, from 2011 through 2012.

A little more than five years ago, 41% of U.S. adults were favorable toward shopping at Dick’s. 42% of those favorable consumers were gun owners. In our first chart, overall favorability was only 32%, with nearly the majority of those being gun owners. What this tells us is the popularity of the Dick’s brand was slipping, most precipitously, among NON-gun owners.

Indeed, when we dig deeper into the demographics of these respondents, we see that unfavorable consumers are far more likely to be women – not that there aren’t lots of female gun owners but the correlation between being male and owning a gun is off the charts.

THE BUSINESS CASE

Time will certainly tell but this could turn out to be a smart business move for Dick’s, even if its motives were purely intrinsic. Here’s why:

1) Dick’s has significant upside to gain among political moderates and liberals.

When we looked at the political leanings of our respondents, the results were pretty clear. Conservatives were over 20% more likely than Liberals to have a favorable opinion of Dick’s Sporting Goods. Liberals were almost 30% more likely to have an unfavorable view of the brand. Taking a stance for stricter gun laws is sure to appeal to these detractors. This could bring a new wave of female and other socially-conscious consumers who have otherwise shunned the brand for some time.

But wait, won’t Dick’s alienate their larger base of customers? I’m glad you asked. The answer is ‘probably not.’ And here’s why:

2) Gun owners are unlikely to flee the brand in droves.

Why did we choose the 2011-2012 time frame in our second chart? Because after Sandy Hook in December 2012, Dick’s made a very similar decision to suspend sales of assault rifles in their stores. Although it turned out to be a temporary decision, even the announcement could have alienated gun owners. Aside from the fact that gun owners with an unfavorable opinion of Dick’s increased by 3% after 2012, the impact on the brand was minimal. The popularity of Dick’s among gun owners only increased in the 5+ years since that decision. It’s likely, therefore, that pro-gun outrage will be minimized this time as well.

BUT WHO THE HELL KNOWS

It’s no overstatement to say that 2018 is a lot different from 2012. People are hypersensitive to the political landscape and its impact on their consumer choices. Nearly 1 in 4 U.S. adult in 2017 had boycotted a brand because of its political positions – but Liberals were 28% more likely than Conservatives to do it.

Dick’s Sporting Goods should survive the political fallout from its decision. The question is whether they will be better off for it.