The unexpected and well-documented decline in restaurant spending over the past several months has left those of us who study the industry scratching our heads. The typical harbingers of restaurant ill-fortune – things like rising fuel prices – don’t line up with this trend.

In reports to Wall St., many public restaurant CEOs have blamed deflation in grocery prices, which encourages more consumers to cook at home because it’s cheaper. This explanation, however, doesn’t hold water. As Bruce Grindy, chief economist of the National Restaurant Association has pointed out, lower grocery prices should increase consumers’ disposable income, the kind of disposable income that typically bolsters restaurant spending. Ask Kroger or other grocery retailers if they’re benefitting from people buying more groceries. They’re not.

Other prevalent theories, like the increase of restaurant choice (the notion that there are more small and local restaurants eating away at large company share) have some merit, at least according to CivicScience data. This has been a slow-building trend, though, not one that single-handedly explains a sudden downturn for big brands in the past few months, or one that explains an overall decline in restaurant spending.

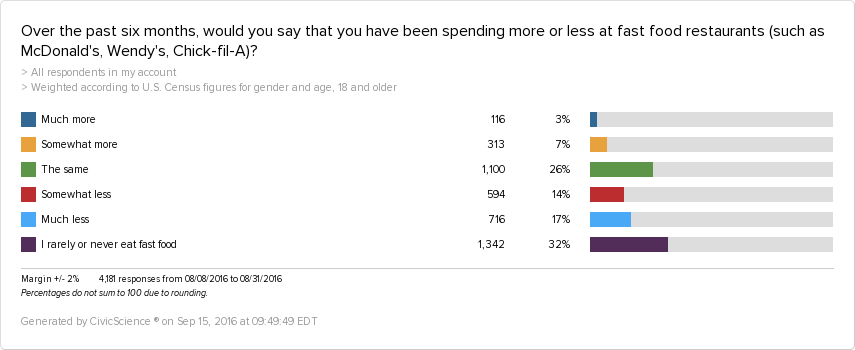

With a number of restaurant clients and industry journalists tugging at our sleeves for insight, we’ve been delving deeply into this trend for weeks. The first thing we confirmed was that consumers are acknowledging their restaurant spending cutbacks – by large margins.

The number of people cutting back spending at QSRs is more than 3X greater than those who are spending more. We asked identical questions about the fast casual and casual categories and found very similar results. Across the board, a trend is evident.

WHY ARE PEOPLE CUTTING BACK AT RESTAURANTS?

We first tried to figure out the problem the easy way – by simply asking people. My personal theory was that many consumers are tightening their belts and staying home because of the uncertainty of the upcoming election and the general socio-political environment. I was wrong. When surveyed, only 9% of people cited this as a reason for reduced restaurant spending.

One third of our respondents acknowledged that they have been cooking more at home, which could support the “cheaper groceries” claim but also includes people who are using meal kit delivery services, farm co-ops, and the like. The number one reason people say they are cutting back – duh – is a worsening of their personal financial situation in recent months.

ANSWERING “THE WHY” BY UNDERSTANDING “THE WHO”

But WHY are so many people experiencing a bleaker financial picture? Gas prices are still reasonable. The job market is healthy. The housing market is pretty good. It doesn’t make sense. To find the answer, we scoured our database to examine WHO is cutting their restaurant spending. We hoped we could find a silver bullet or two.

Basic demographics provided very few clues. Men and women were equally likely to say they were cutting back spending. Every age group is cutting back, with GenXers cutting back the most. Millennials were the most likely to say their spending has increased. Baby Boomers were the most likely to say their spending is unchanged, but the least likely to say they are spending more. Blacks and Hispanics were more likely than average to say their spending has increased.

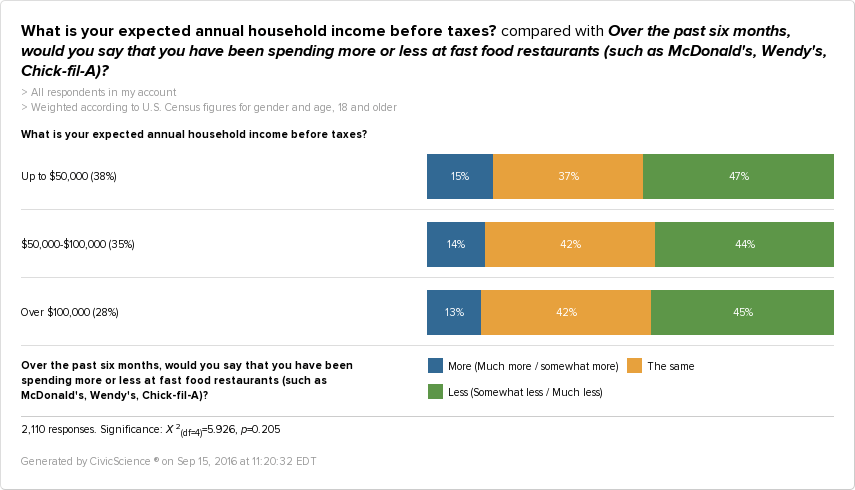

What surprised me most is that household income showed almost no effect. See for yourself:

While, as expected, the lowest-income respondents cut back spending the most at QSRs (and elsewhere), they were also the most likely to increase their spending. In any event, the statistical differences are tiny. Income is not a critical driver.

While, as expected, the lowest-income respondents cut back spending the most at QSRs (and elsewhere), they were also the most likely to increase their spending. In any event, the statistical differences are tiny. Income is not a critical driver.

UNCOVERING THE CULPRIT

So now what? We let our algorithms work their magic, crossing our restaurant spending questions with the thousands of other questions in our database to see what factors are most closely correlated. One thing jumped off the screen: Health Care.

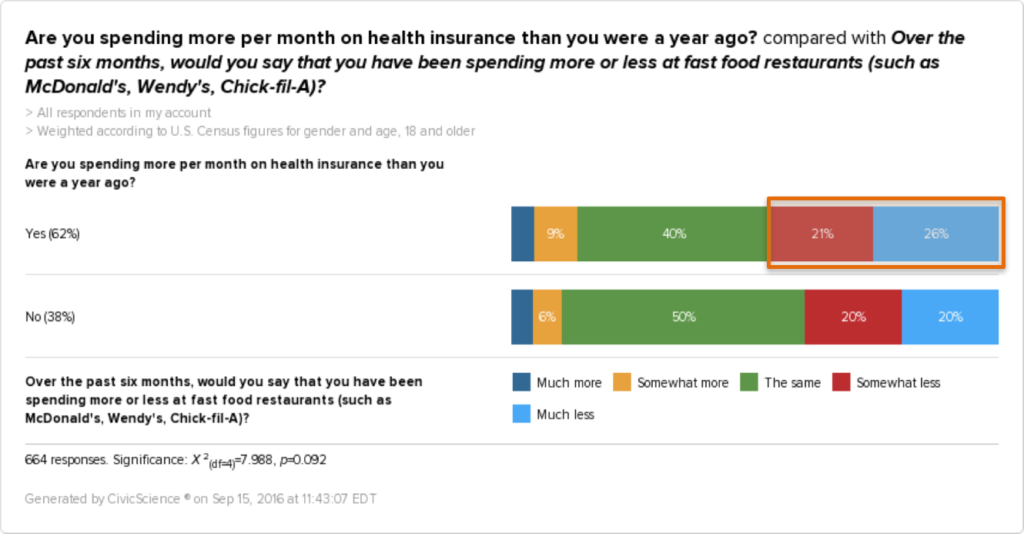

Start here:

As you can see, 47% of regular QSR diners who have experienced increased health insurance costs over the past year have cut back their QSR spending at “least somewhat.” Only 40% of those with unchanged health insurance costs said the same. The big difference, however, is among the group who said they are spending “much less” at QSRs. Those with higher health insurance costs are a full 30% more likely to say they are cutting back spending significantly.

This correlation between rising health insurance costs and decreased restaurant spending was highest among regular QSR diners but the effect could be seen clearly among casual restaurant diners and among fast casual diners, but only slightly. The small increase in higher-health-insurance-cost diners who are spending “somewhat more” at QSRs could be explained by cost-cutting casual or fast casual diners who have moved their dining downstream.

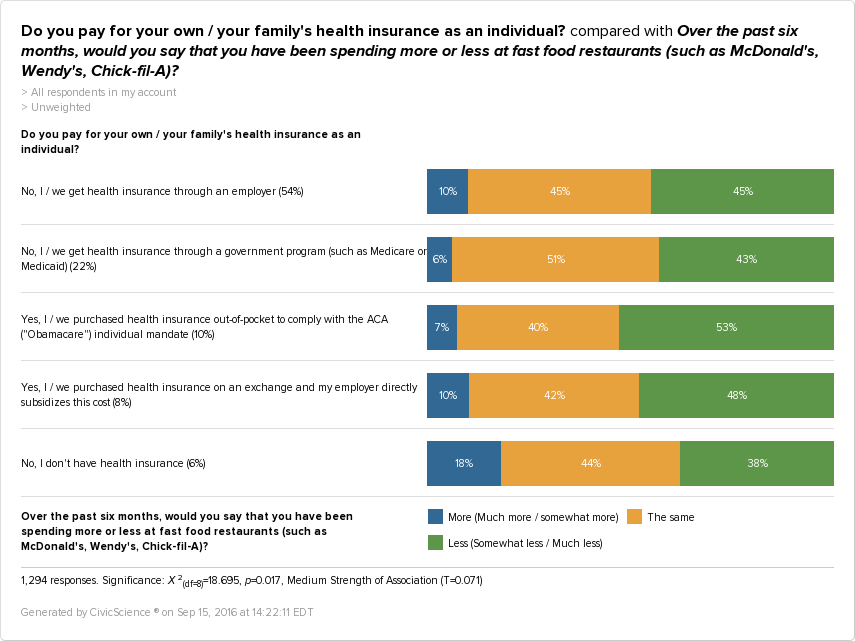

Let’s go a step further. What if we look at the type of health insurance our respondents have?

You can’t miss the one clear correlation in this chart. People who pay for their insurance “out of pocket” to comply with the Affordable Care Act (ACA) are much more likely than all other insured and uninsured groups to have cut back their restaurant spending. In fact, of all the cross-tabulations we examined, this ACA group has the highest ratio of decreased-to-increased restaurant spending (7.5 to 1) of any we uncovered.

We’re not trying to ignite a political debate here. Many people would argue that any group cutting back on eating fast food is a net positive. We make no judgment. We just report the numbers. And the fact remains that nothing we could find better predicts an individual’s likelihood to cut back on their restaurant spending more than changes in their health insurance costs.

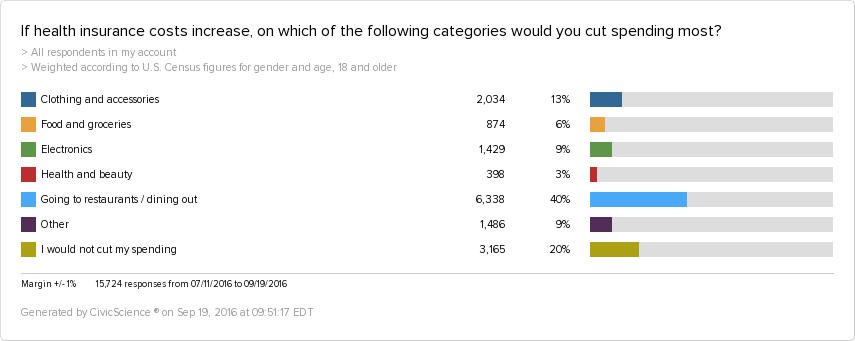

With overall health insurance costs expected to rise and a forecast for “huge” premium hikes for ACA enrollees in 2017, there’s reason to believe the downward trend for restaurants could continue. Indeed, public restaurant execs are already signaling that the challenging environment may not subside anytime soon. We asked people where they would be most likely to cut the most spending in the future if health care costs continue to increase. Restaurant spending equals all other categories combined.

WHAT ARE RESTAURANTS TO DO?

I empathize with the restaurant execs reading this. Healthcare costs are completely beyond your control. The harsh truth is that, as long as consumers are forced to spend more on healthcare, they will look for cheaper food options at the grocery store or elsewhere. And restaurants will be fighting for a flat or shrinking pie among a growing list of local competitors, start-ups, home delivery services, and somebody sitting in a garage right now with an idea we’ve never even thought of.

But the pie is still huge. Restaurants with the resources, the wits, and the agility to compete in today’s marketing environment can still win big. Advertising platforms like Facebook or others could allow you to target consumers based on insights into their health insurance situation – sites they visit, things they search for. You can identify people who are most likely to cut back their restaurant spending in the future and reach them with discount offers. Marketing tools enabled by large-scale data allow you to segment consumers in nearly unlimited ways – you just need to understand the most critical driving force. Right now, we believe, it’s health care.

[shade-close-form]