It could be an ugly August for Snapchat. After the upstart social networking platform reported modest user growth of just over 2% in Q1, things may have gotten even worse in Q2.

CivicScience data were consistent with Snapchat’s Q1 report, with daily tracking showing the percentage of Americans aged 13 and older who used the platform rising, just slightly, from 12% to 13%. If the correlation between the CivicScience figures and Snapchat’s official numbers continues to hold true, Q2 won’t be pretty.

For the period beginning April 1 through June 30, the CivicScience tracking data showed Snapchat’s daily active users (DAUs) falling to 11% of U.S. consumers aged 13 and older. For just the month of June, the percentage of U.S. DAUs fell to 9%. This is the first notable net decline seen in the tracking figures since the company began studying Snapchat usage in early 2015. At that time, DAUs represented 6% of the U.S. population 13+.

LEAVING SO SOON?

Coinciding with that user decline was a slight bump in the number of lapsed users (those who said they previously used the platform but no longer do). For the full second quarter, the number of U.S. consumers aged 13+ who’ve left the platform rose from 8% to 9%. In June only, lapsed users rose to 10%. In other words, daily active users aren’t just using the platform less – they may be leaving altogether.

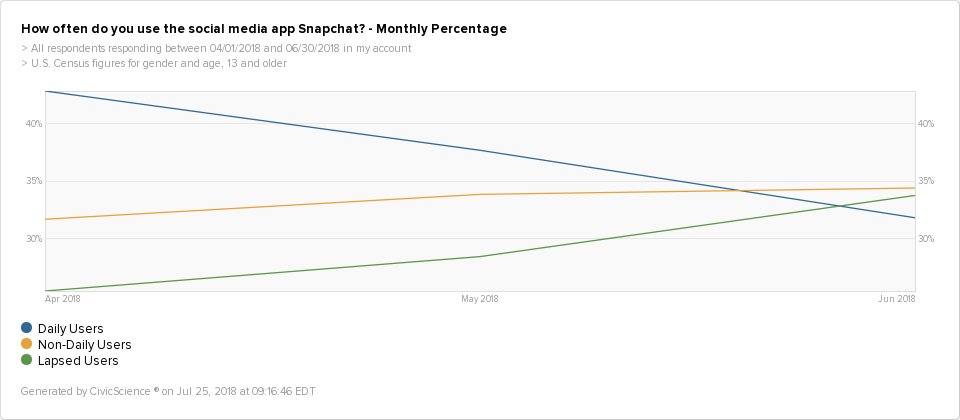

The chart below shows the month-by-month trend among current and lapsed Snapchat users. By June, the percentage of lapsed users seems to have surpassed that of current DAUs for the first time since CivicScience began tracking the platform’s usage.

You may not want to run off and short Snap Inc.’s stock right now based on these numbers alone. Other notable experts like Deutsche Bank are forecasting “robust user growth” for Q2 based on social media data. They could be right.

First, the CivicScience numbers only measure U.S. consumers, while a non-trivial share of Snap’s user base comes from Europe and elsewhere. Growth outside of the U.S. could easily offset any erosion experienced domestically. Second, the differences highlighted in the CivicScience data are based on very small, single-digit percentages – well within a standard margin of error for and sampling method.

Still, given the consistent correlation between CivicScience data and Snap’s reported figures over time, this first-of-its-kind downturn in U.S. DAUs is an ominous sign, at the very least.