The Gist: Pittsburgh City Councilman, Corey O’Connor, is proposing a program to forgive student loans in exchange for acquiring or refinancing a mortgage. We found that almost ¼ of respondents would be at least somewhat likely to move to a new city that had this initiative in place. We profiled those who would and would not act on this policy.

While scrolling through my social media feed one day, I came across this article about Pittsburgh City Councilman, Corey O’Connor, proposing that Pittsburgh waive student debt for people who acquire a mortgage. Now, this is in the very early stages, so don’t get too excited yet, but we’re curious to see how this kind of policy might affect migration and home ownership.

This is especially pertinent based on the numerous studies that have been released recently. Two from the Pew Research Foundation indicate that Millennials are living with their parents at the highest rate since the 1940’s and that those who do venture out on their own are renting over buying at the highest rate in 50 years. ApartmentList released a study as well, citing affordability as the #1 reason behind delaying home purchases.

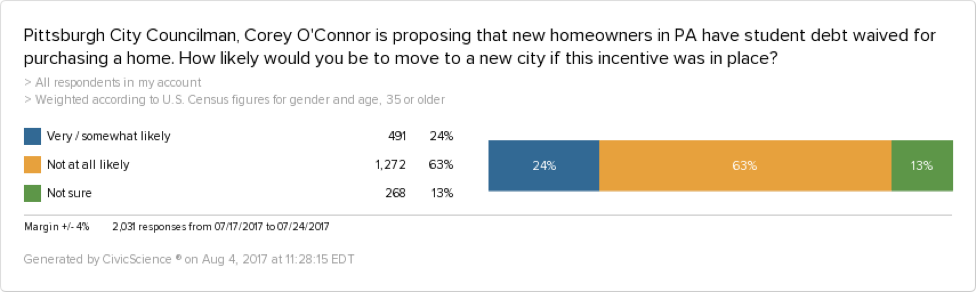

To get our own gauge on the impact this kind of policy would have, we asked the following question. Note: Since the average first-time homebuyer is 32, we weighted our data accordingly by age:

Immovable Forces- Those Who are Not At All Likely

As you can see, a whopping 63% of respondents answered that they are not at all likely to move to a new city even if their student loans were repurposed into a mortgage.

As a Millennial who’s currently in graduate school and acquiring my own bit of debt, I must insert my bias here and say I was absolutely shocked by this number…until I stepped back and looked objectively at who these people are.

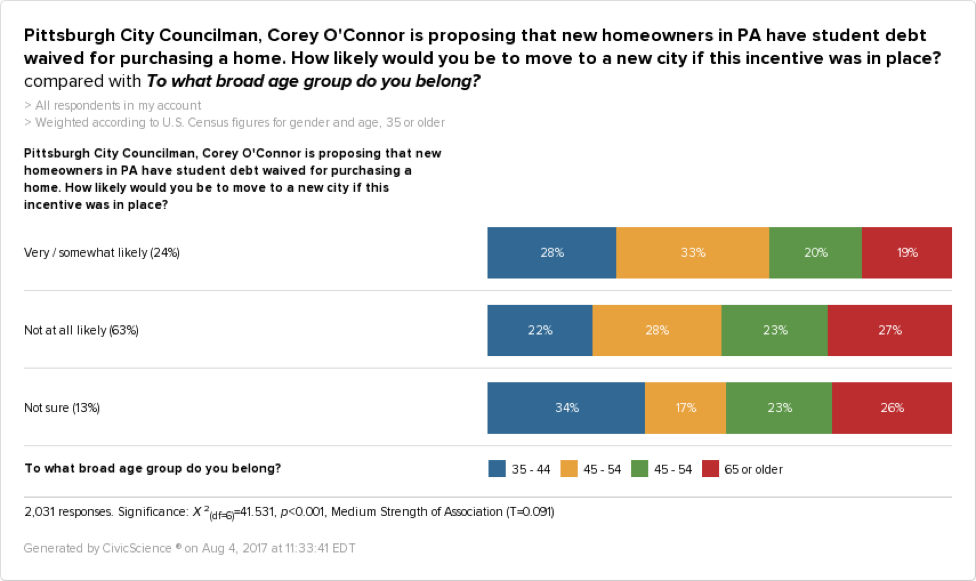

People who answered not at all likely have a fairly even age split.

However, 27% (almost the majority!) are 65 or older, as opposed to just 19% of people who answered that they would be at least somewhat likely to move if this policy was in place.

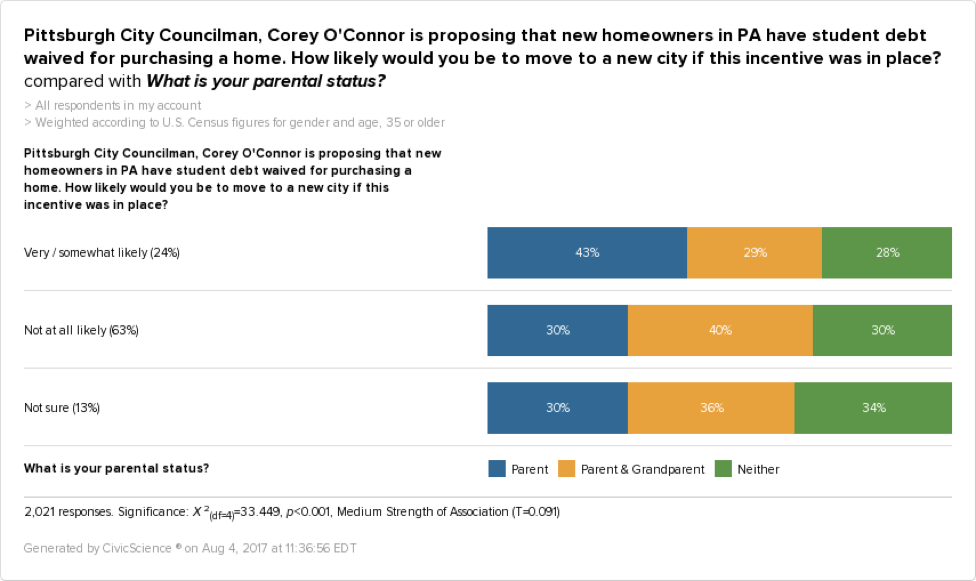

Those who answered not at all likely are also 11% more likely to be grandparents, at 40% of respondents in this segment — the majority by a long shot.

Finally, these people are less likely to be Facebook users, or make decisions based on social media influence. They are also more likely to say they manage their money well.

So, it looks to me like those who answered not at all likely, despite 81% having at least some college education, is more or less past this stage of life. They’re mostly older, likely already established somewhere, and may have debt already paid off if they ever had it at all.

So then, who’s mobile and at least somewhat likely to move to a new city to repurpose their student debt into a mortgage?

Movers and Shakers – Those Who Are Very / Somewhat Likely

This group makes up 24% of total respondents.

The majority of this group, at 33%, is 45-54 years old, with the next closest age group, at 28% of respondents, being 35-44.

I’ll take this moment to remind you of this post we did about parents’ acquiring a good amount of debt by supporting their kids throughout their pursuits of higher education. In fact, 43% of these respondents are parents, and 29% are also grandparents.

These people are also very tech-savvy. They’re more likely to:

- Own or want a smart watch

- Own or want virtual reality equipment

- Own or want a smart home automation product (Alexa or Google Home, for example)

- Make clothing, music, and food decisions based on social media influence

- Write positive reviews online

They are also more likely to follow professional sports, like the NFL, NHL, and NBA, as opposed to the group who answered not at all likely, who are more likely to follow college football.

Furthermore, this group is more likely to be environmentally-conscious and socially-conscious consumers, use mobile banking, and subscribe to Sprint Wireless.

Considering Education

Finally, I noticed a tidbit of information that’s worth speculation.

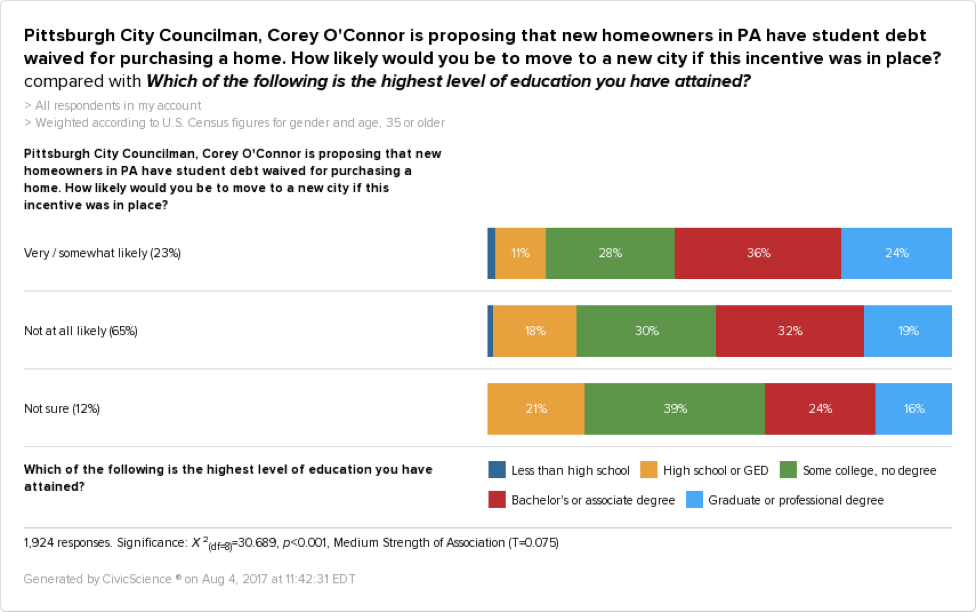

When looking at the graph about education, I noticed that 28% of respondents who answered that they are at least somewhat likely to move to a new city if their student loans were repurposed into a mortgage have some college education, but no degree.

This feels like a particularly high number. If we include all people who have no college degree who are at least somewhat likely to move if this policy was in place, the number jumps to 39%.

I can’t help but wonder how many of these people would find it worthwhile to pursue or finish their degree if their student debt could be waived or repurposed into the acquisition of an asset like a home.

Of course, this is just speculation. Many people opt out of a college education altogether based on their interests and opportunities. But it’s worth considering how this policy could positively affect education trends as well as migration and home ownership.

For now, we’ll keep watching this proposal to see what comes of it.

Click here to learn more about the pros and cons of this kind of policy as backed by Fannie Mae.