Soon we will have enough SVOD services to rival the plethora of channels in your cable package (if you still have one). CivicScience data currently tracks 27 different streaming options available (or available soon) to consumers. The most recent addition to the list was Quibi.

Quibi, born amid a global pandemic and into a very competitive market, is a mobile app that provides short episodes of scripted and unscripted content across genres. What’s different about Quibi, in addition to its content being broken up into 10-minutes-or-less segments, is that it’s a mobile app not currently available for traditional TV streaming (although there is talk of that coming soon).

Quibi said its platform was designed for people to use on-the-go so getting 2.7 million downloads in less than a month is impressive, considering most people are quarantined and not on-the-go as usual.

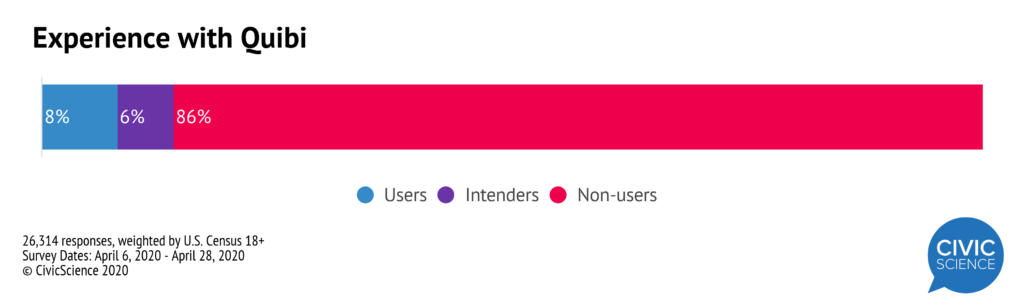

In a recent survey of over 26,000 U.S. adults, 8% were users of Quibi and 6% intended to subscribe.

Right now, Quibi users span most ages. Millennials, Gen Xers, and even Baby Boomers hold similar claims of current subscribers. Users are slightly more likely to be men rather than women (by 2 percentage points), and slightly more likely to be high-income earners (but again, only by 2 percentage points).

What does this tell us about this unique platform? It has broad appeal. But is this just a quarantine effect as people look for new ways to entertain themselves during a lockdown? CivicScience dove deeper into its data on Quibi and was able to unveil a series of key insights that tell a larger story.

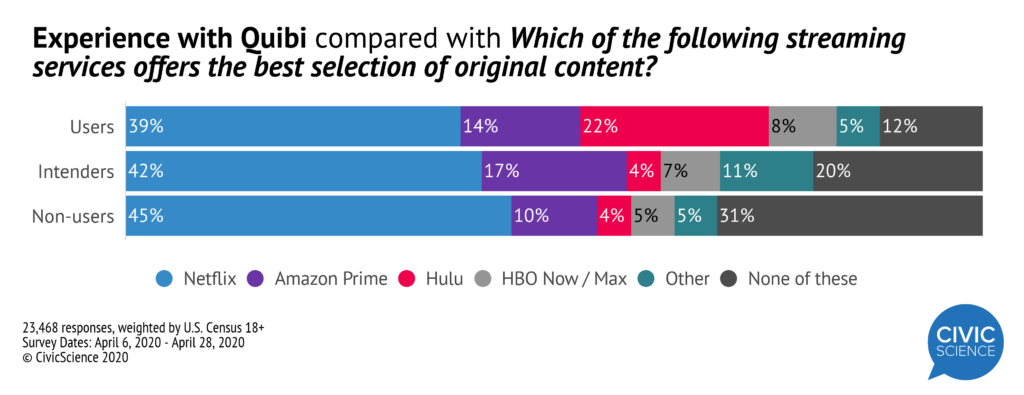

Quibi’s format is primarily how it stands out amid competing SVOD services. When asked about the best original content, Quibi subscribers had a strong preference for Netflix (in line with the general population) but not as much as non-users and intenders. Quibi users were far and away the most likely to say Hulu had the best original content. To put it in perspective, without crossing the data below by Quibi users, Hulu would only claim 6% of U.S. adults. Because Quibi is a mobile app, CivicScience looked at social media users to see if the mobile format pulled in users from a specific social channel. Among the top platforms (Facebook, Twitter, Instagram, and TikTok) TikTok users were much more likely than users of the other three platforms to be current a Quibi user.

Because Quibi is a mobile app, CivicScience looked at social media users to see if the mobile format pulled in users from a specific social channel. Among the top platforms (Facebook, Twitter, Instagram, and TikTok) TikTok users were much more likely than users of the other three platforms to be current a Quibi user.

To return to the question of whether or not Quibi’s popularity has been driven by lockdowns or true interest, CivicScience data suggests Quibi’s rising favorability is genuine.

Quibi users compared to intenders and non-users were the least concerned about the impact of the pandemic on the economy. And only 11% of users said they would avoid in-store shopping and stay quarantined for 6 months or more if lockdowns were lifted, indicating most users will be headed back to daily life. And an on-the-go “quick bite” of content might be just what they want.