Saving money is something everyone knows they should do. It’s ingrained in the very mythos of the country: work hard, save what you earn, and someday you can achieve the American Dream. How well reality conforms to that ideal can be debated, but no one can deny the basic advantages of saving your hard-earned money. If you want stability and peace of mind—especially when you get older—you need to save for it.

Yet, as straightforward as it sounds, saving can be hard. A person’s income and debt often restrict how much money he or she can put away. Not being able to quiet that little spending devil on your shoulder can also keep you from saving money. And then there’s the arcane language of finance, and the sheer number of investment possibilities, which leave people feeling puzzled and helpless, a condition dubbed “analysis paralysis” according to a recent Forbes article.

In order to gauge how people truly feel about saving and investing, and how well they were saving for the future, CivicScience asked respondents to share some of their financial habits and perspectives. The results might not be what you’re banking on.

Knowing When to Start

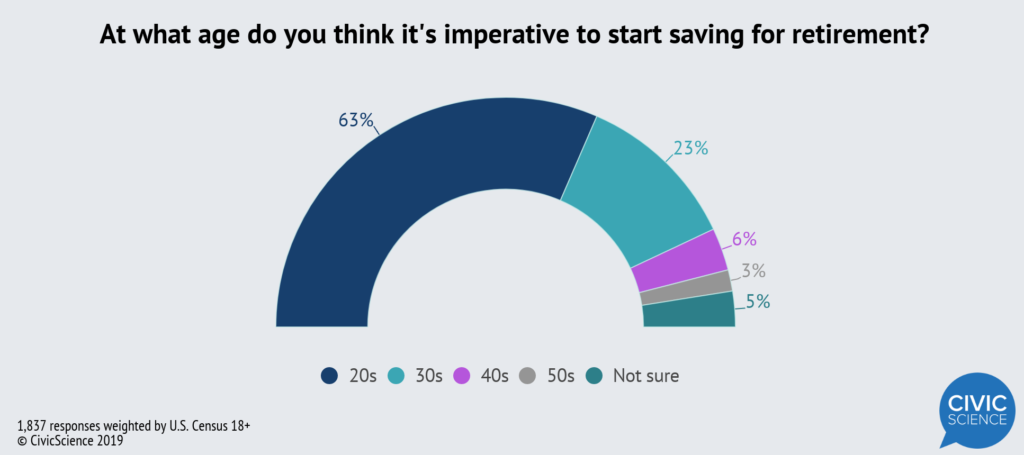

If asked for the best time to start saving for retirement, any decent financial planner will say the same thing: as soon as possible. Time is an ally when it comes to investing, and it seems that most people know it. 86% of adults, when asked at what age it’s imperative to start saving for retirement, say either in your twenties or thirties, with the vast majority opting for the former.

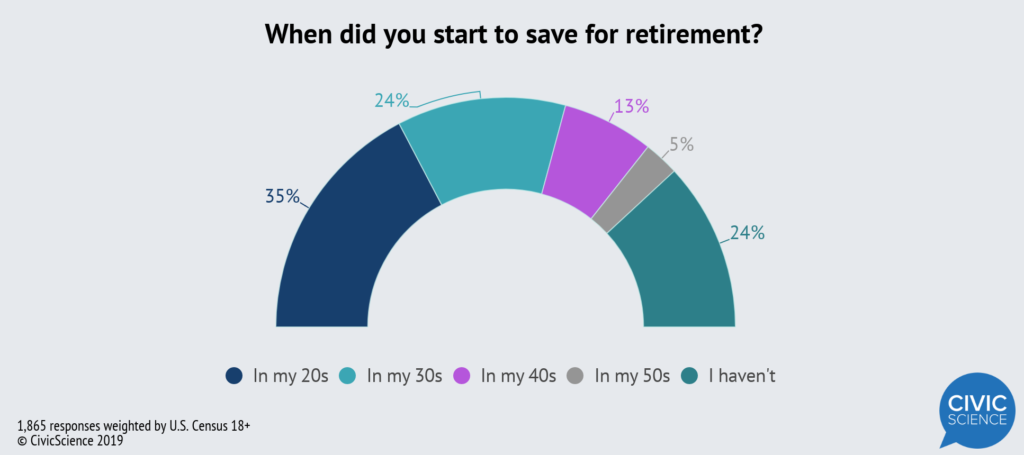

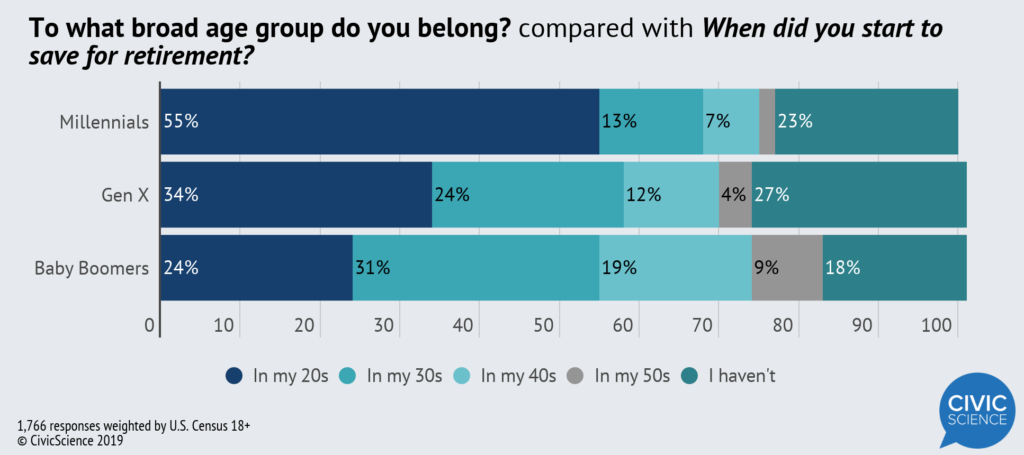

Life tends to get in the way of most things, though, and despite knowing that we should start saving early, we don’t always do it. Although 63% of adults say it’s imperative to start saving for retirement in your twenties, only 35% say they actually did it. 13% didn’t start saving until they were in their forties, despite only 6% indicating it was a good idea. 24% of adults say they haven’t started saving for retirement at all.

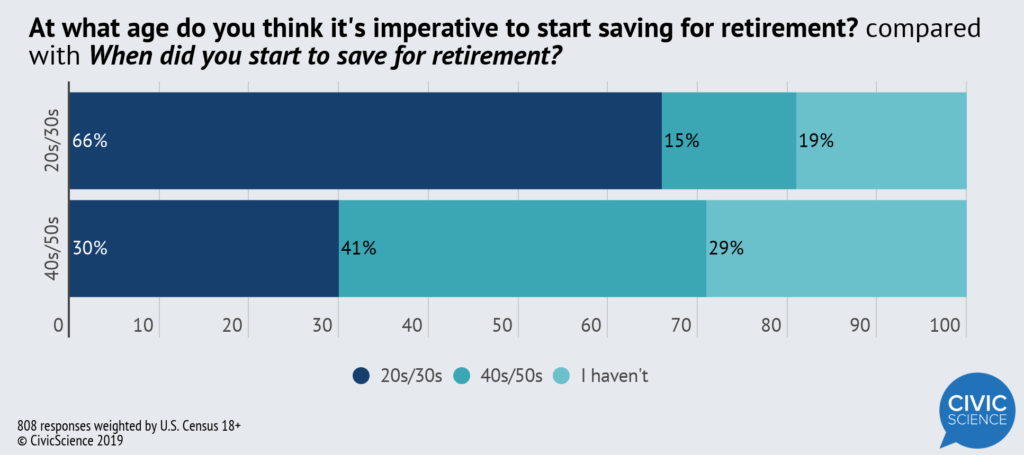

Fortunately, knowing you should start saving tends to coax people into saving. 2 out of every 3 adults who think it’s imperative to start saving for retirement early in life started saving while they were in their twenties or thirties. Just 15% of those adults waited until their forties or fifties. Likewise, not understanding how early to start tends to delay people from saving. Only 30% of people who think it’s okay to put off saving until your forties or fifties actually began earlier than that. Another 29% of those adults haven’t even begun saving yet.

Scared Straight

Waiting to start saving for retirement appears to be losing steam. In fact, to say there’s been a sea change in how we manage our money would be an understatement. Concern for financial security is high, which could be attributed to the internet and the proliferation of resources which simply didn’t exist before. Much of it probably has to do with recent history.

Parsing saving habits by generation, one thing becomes clear: younger people today are more likely to have begun saving for retirement earlier in life than people used to. Only about ¼ of Baby Boomers, who grew up in the relatively stable postwar era, started saving in their twenties. This custom increased for Gen Xers, but it more than doubled for Millennials, who cut their teeth during the Recession and watched older people’s savings evaporate; 55% started saving for retirement in their twenties. Remarkably, Gen Xers are the most likely to have not started saving yet. 27% of Gen Xers say they haven’t begun putting away money for retirement, versus 23% of Millennials.

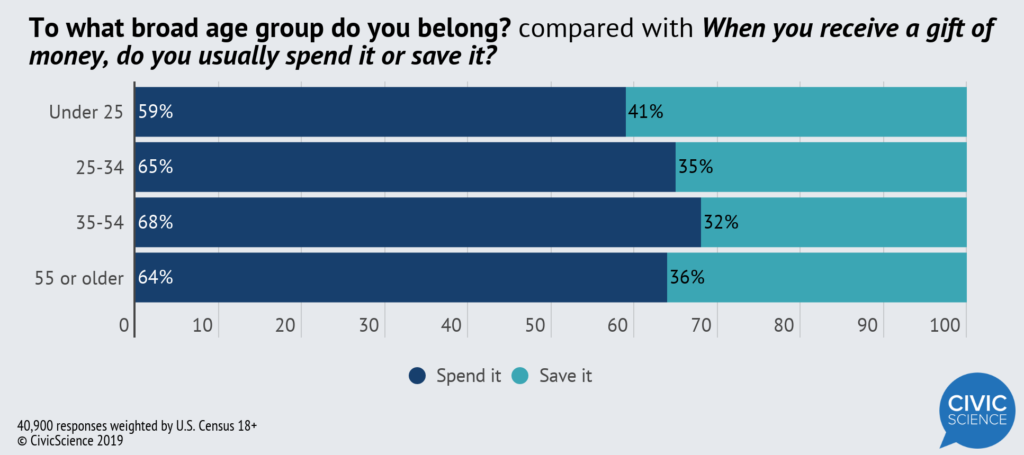

Evidence of a shifting mentality toward money can also be seen in spending habits. When asked if they usually spend or save a gift of money, most adults choose to spend it. But younger Millennials (adults age 25 and under) are more likely to save that money. 41% say they usually save gifts of money, compared to just 32% of Gen Xers and 36% of Boomers. The largest downturn since the Great Depression shocked everyone, but it likely jolted younger people into being especially cautious with their money.

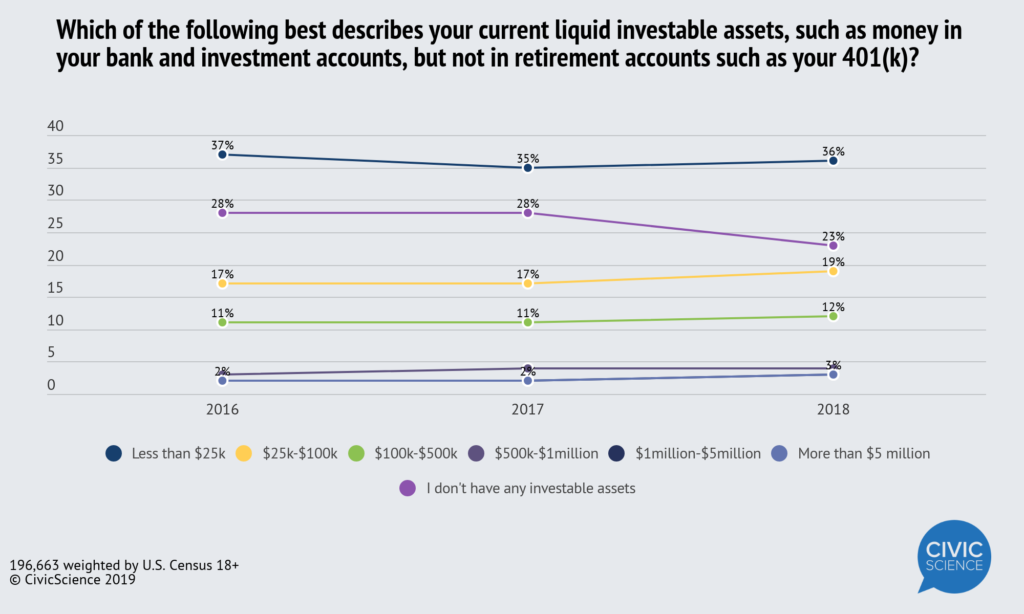

Lots of people know they should start saving early in life if they can, and knowing this can nudge people into doing it. Economic issues can certainly hinder saving, though as the following chart shows, investable assets (aside from retirement accounts) are now slowly on the rise, and the amount of people without investable assets has shrunk by 5 percentage points since the beginning of 2017.

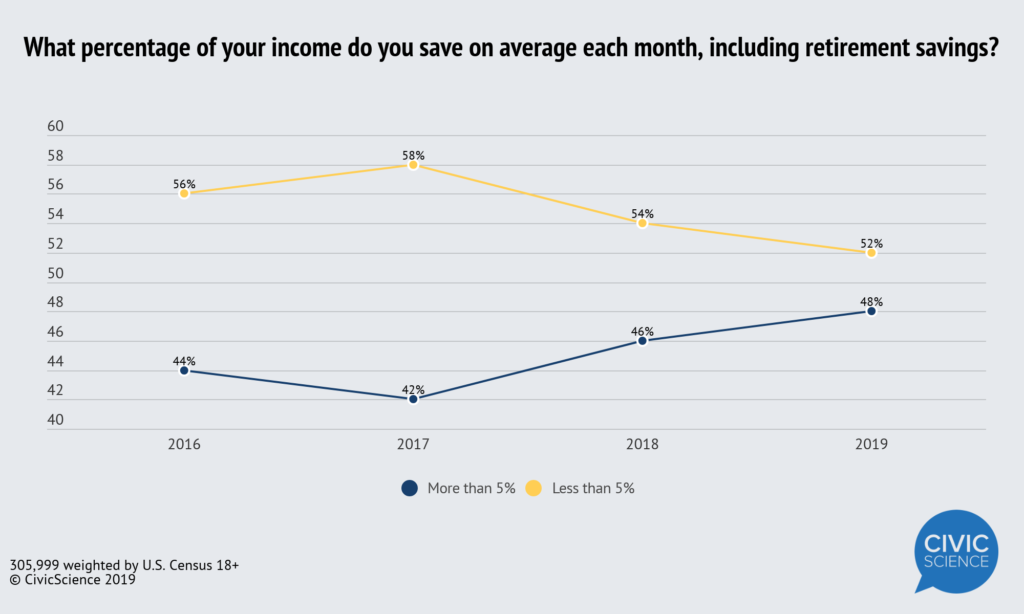

In terms of the percentage of income people save each month including retirement, we see a similar trend:

Tough economies can also spur people into taking more caution, saving whatever they can. Younger people who grew up during the Recession appear more adamant about shifting their behavior than anyone, and more are interested in starting to save for retirement early in life. We’ll see if that trend survives through sunnier economic times.