Amazon.com, you may have heard, is expanding its private-label business again. They already sell household goods, electronic accessories, and even clothes, but now they’re getting into items such as nuts, tea, coffee, diapers, and detergent.

Experts are busy trying to predict whether this is going to be a hit for the company, but over here at CivicScience we’re a little bemused by that exercise. Amazon has something like 200 million products and new data every time a transaction is made on one of those products (or even searched for, for that matter). We don’t think Amazon is wondering if it’ll be a hit–we think they know it will be.

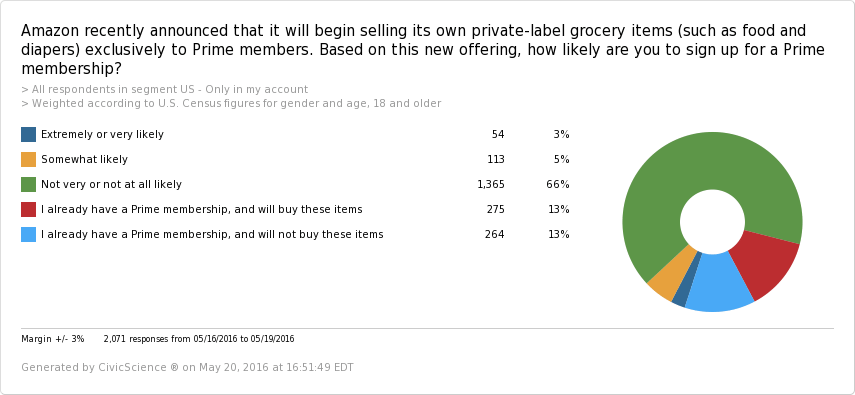

Our own data bears this out; we posed several questions about this move to people across the US, and collected 2,000 responses for each from May 16th-19th. Half of all Prime members over the age of 18 (represented by the color red in the below chart) will buy these items. Looks like a win to us. So the question really is: How can Amazon make this a blockbuster?

For the time being, only Prime members will be able to buy these private-label items; sounds like a shrewd move to encourage new sign-ups. We can see that about 3% of adults (shown in dark blue), are extremely or very likely to sign up for Prime to take advantage of this new offer, which is modest growth of their current base. How can they nudge some of that 5% of people who are just thinking about it (yellow) to definitely sign up? And why are 66% of people (green) utterly unconvinced?

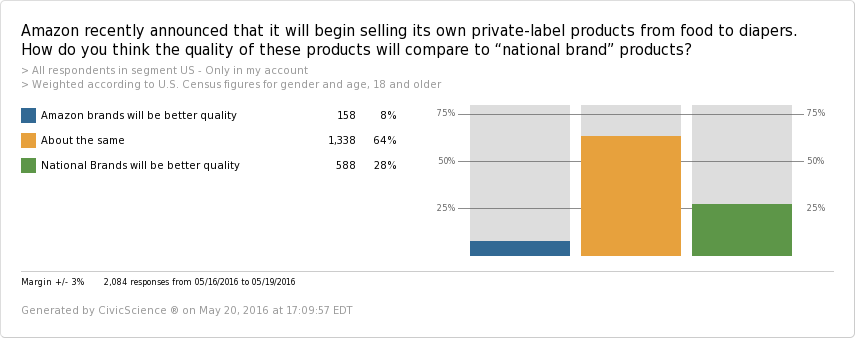

To dive into this, we looked into how adult consumers thought the quality of Amazon private-label products would stack up to comparable national brand products. This is one place where Amazon may run into problems:

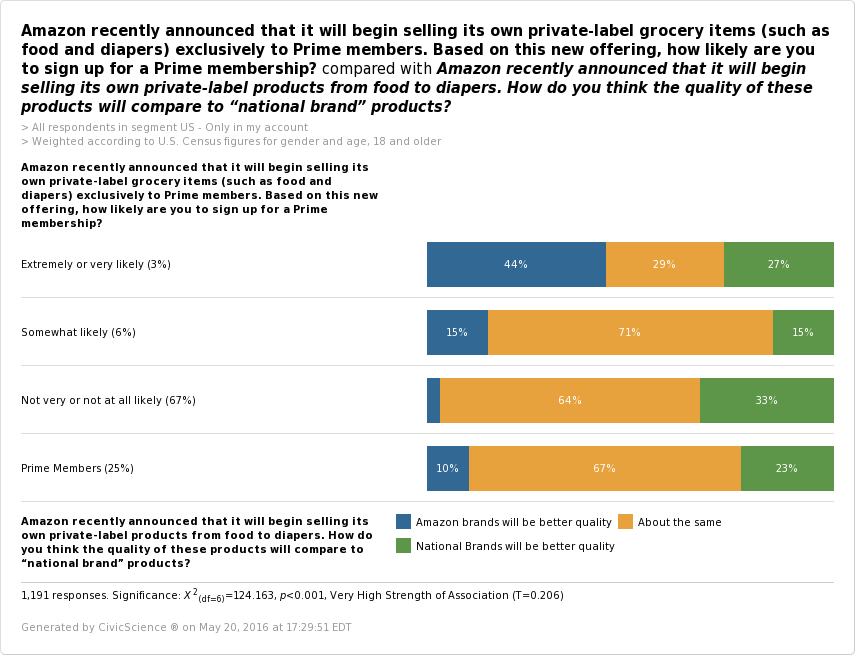

From the above chart, we can see that only 8% of adults think that Amazon brands will be better quality than national brands, and 28% think they’ll be worse quality. This is a huge deal; the chart below suggests that the quality of these products could be a big driver in people’s decision to commit to Amazon Prime specifically for its private-label products:

It should also be very concerning to Amazon that only 10% of current Prime members think the quality of their private-label brands will be better–that’s almost no different from the population at large! If they can’t convince their own customers that their products will be better quality, they’re going to have difficulty gaining converts.

Is this move going to be a win? Almost certainly. Moving half of their customers over to their private brands and gaining a few extra Prime members along the way seems well worth the effort. However, if they can overcome their quality perception problems, this could be a truly monumental victory for Amazon.