Plant protein that “looks, feels, tastes and acts like chicken without the cluck.” That’s the guarantee of California-based vegan meat brand Beyond Meat – and it’s a guarantee people are buying. Microsoft, Bill Gates, and General Mills have all purchased Beyond Meat stock. Adding to this already impressive list, Tyson Foods just acquired 5% of the company.

Beyond Meat has most recently released the Beyond Burger, and has been previously known for the infamous Beast Burger.

“This investment by Tyson Foods underscores the growing market for plant protein. I’m pleased to welcome Tyson as an investor and look forward to leveraging this support to broaden availability of plant protein choices to consumers.” – Beyond Meat CEO, Ethan Brown.

These investors have jumped in at the perfect time, as vegan meat and clean food options are no longer just niche. They’re mainstream. Consumers are more willing to try new food brands than ever before. In addition, alternative meats are poised to make up 1/3 of the meat market by 2054.

2054 is a long way away, however, and not everyone is on board just yet.

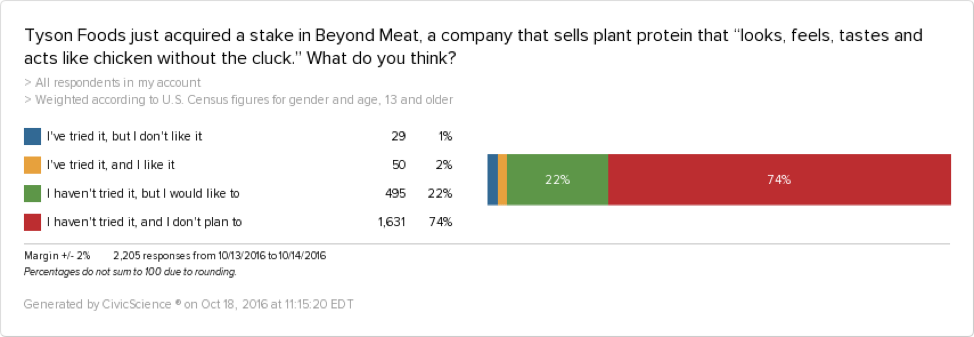

Given that Beyond Meat is currently offered only in select stores, it’s no surprise that very few people have tried it. It’s important to note that of those who have already tried its products, more people have liked them than those who have not.

Let’s take a look at those who have not yet tried Beyond Meat, burger or otherwise, and specifically at those who are reluctant to dig in.

I Haven’t Tried Beyond Meat, But I Would Like To

The most important distinction about this group is their age. These folks who are open to venturing Beyond Meat are more likely to be 18-34.

Along with their young age comes all of the expected social media habits. They are more likely to be addicted to their digital devices, more likely to actively use Instagram, and are more likely to follow tech trends. Beyond Meat has done an excellent job appealing to these preferences with a very active online presence.

In terms of their consumer habits, we found that they are more likely to read nutritional information on their groceries. They are also more likely to follow health and fitness trends. Based on this, it’s no surprise that they would want to try Beyond Meat.

The company website boasts that its newest burger has more protein than that from an animal, 6% higher iron, less saturated fat, and less cholesterol. It also cites that animal-based meats come with an increased risk of cancer and Heart Disease.

These consumers are also more likely to be conscious of price when shopping for food. Fortunately for them, Beyond Meat founder Ethan Brown has promised that the products will cost less than other meat.

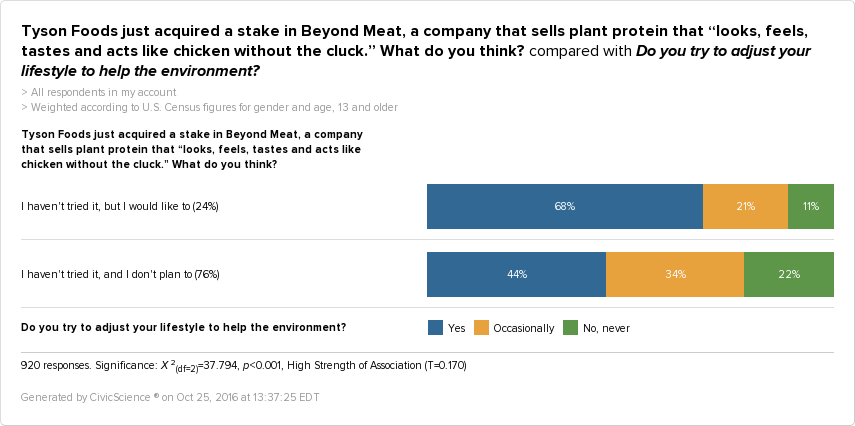

Additionally, they are more likely to favor socially-conscious businesses, and to adjust their lifestyles to help the environment.

These products are a definitive change from the status quo. On average, U.S. adults eat half a pound of meat a day, so making a switch to plant-based protein may be challenging. It comes as no surprise, then, that these folks are more likely to try new products before other people do.

On another interesting note, we found that 76% of these consumers do eat meat. So, for one reason or another, Beyond Meat has captured their attention, and convinced them to take the plunge into plant-based protein.

Given their preferences for meat, it’s a useful strategy that Beyond Meat will sell its new burger among other meat in grocery stores, and not next to – say – tofu. Beyond Meat’s branding of its beefless burgers, among other products, is well-suited to capture these younger consumers – vegetarian and meat-eater alike.

Vegan Meat Just Isn’t for Me

This large group is where Beyond Meat may face the greatest challenge. Among other reasons, 92% of this group eats meat – significantly higher than those who would like to try the beefless burger, or the vegan meat brand’s other products.

Similar to those who do plan to try the company’s vegan meat, we found that one of the most prominent characteristics of this group is age. These folks are more likely to be over the age of 55. Naturally, then, they are likely to have children, grandchildren, and be married.

Food Preferences

Over 71% of this group eats dinner most often at home, so capturing their interest may prove financially beneficial for Beyond Meat. Though its advertising may be doing well at capturing the younger audience, the company may have to pivot slightly if it hopes to capture this audience. Unlike the other group, these folks are less likely to read nutritional information on groceries, and are less likely to buy organic food.

We found that 10% of these folks don’t eat healthier because it’s too much time or work, and 17% don’t eat healthier because it’s too expensive. To win these folks over, then, it might be useful for Beyond Meat to emphasize the ease of cooking its burgers (especially given that they cannot be unsafe if undercooked), as well as the cost-effective price.

The company also will want to play up the burger’s comparability to animal-based burgers, given that the majority of this group consists of meat-eaters, and 15% don’t eat healthier because they are picky about what they eat.

We also found that 20% of this group most associates the word “organic” with healthy food items, and 25% most associate “all-natural” with healthy food items. The company may want to further incorporate these words into its advertising efforts.

Though Beyond Meat mainly sells its products in Whole Foods, among other stores, that might not be the right place to reach these consumers. Only 16% of this group has a favorable view of Whole Foods.

On the other hand, 60% do their grocery shopping at large, regional grocery chains such as Safeway and Giant Eagle. 22% do their grocery shopping at supercenters such as Costco. To meet these consumers where they already are, Beyond Meat may want to incorporate its products into the meat aisle at more of these stores in addition to more niche stores, like Whole Foods.

Media Preferences & Politics

Similar to the general demographic of those over 55, 27% of this group watches FOX News for national news. Only 15% watch CNN.

These media characteristics present several opportunities. First, FOX News may be a great place to advertise Beyond Meat’s beefless burgers in order to capture the attention of the older, unconvinced audience.

Next, 75% of this group is concerned with the state of the economy and jobs, so Beyond Meat will want to illustrate its positive impact in these two areas. Factory farm jobs that include raising animals for meat are known to be exploitative, and have one of the highest job turnover rates in the country. In what ways will these animal-free jobs be better and safer?

Moo-less Burgers and Cluck-less Patties

This is a pivotal time in the food industry. Foods that used to seem niche no longer are. Organic food has gone mainstream, and talk of GMOs flood the market. Regardless, it seems that these trends have yet to reach the older population.

Taking media preferences and reasons for not eating healthier into account may help Beyond Meat, and companies like it, to welcome these older groups into the clean eating fold.

For the most part, however, Beyond Meat is doing an excellent job at reaching the younger population. Its strategy of placing its new product in the meat aisle of grocery stores is a great way to reach the large majority of meat-eaters among both groups.

Lastly, our numbers show that of those who have already tried Beyond Meat, more people like it than don’t. And with online reviews raving about these products’ indistinguishable difference from beef or chicken, it may be safe to assume that if Beyond Meat can convince other folks to try its products, there is a solid chance they’ll love them as much as everyone else.

Animal lover? Check out our recent post for National Adopt a Shelter Dog Month!