I have news.

If you told me when I wrote the first installment of this email in November 2016 that I would still be writing it six-and-a-half years later, I would’ve confiscated your edibles. They probably weren’t legal where you lived then, anyway.

I can’t even stay on an exercise regimen for more than two weeks. The idea that I could write over 320 weekly missives like clockwork – notwithstanding a couple holidays and hangovers – was as fathomable as me shaving my luxurious head of hair. Don’t be ridiculous.

Some weeks, this thing can be a grind. Far more often, it’s the highlight, if occasionally because the rest of my job was exhausting that week.

It has been a blessing in the truest sense. I’ve made countless new friends (and clients) and been allowed to reflect on the world, my business, and my personal life, all for an appreciative audience. If I ever get around to writing a book, I have a gigantic head start.

Alas, all good things must come to an end. This will be my last What We’re Seeing, for now at least.

I just teared up writing that.

They say you should leave ‘em wanting more. Don’t wear out your welcome. That’s part of it.

Getting a couple hours of my life back every week won’t suck either. Maybe I’ll finally beat Super Mario Odyssey on the Nintendo Switch I stole from the office during lockdown. I’ve never watched The Wire. A few more trips to the gym wouldn’t hurt my high cholesterol.

Who am I kidding? I’ll just work more.

I’m going to miss you all very much – even those of you who read this religiously, snag data and charts for your work, share it all over your company, don’t pay us a penny, and refuse to entertain a single sales call from our team. I forgive you.

You should follow me on Twitter, although I didn’t spring for a blue check, so you might not be able to find me. I’m on LinkedIn, but Dick jokes don’t land as well there. I’d sign up for TikTok, but they’ll ban it as soon as I do.

One way or another, I hope we’ll stay in touch.

For now, farewell.

Also, April Fools’.

They’ll have to pry this email from my cold dead hands.

Here’s what we’re seeing:

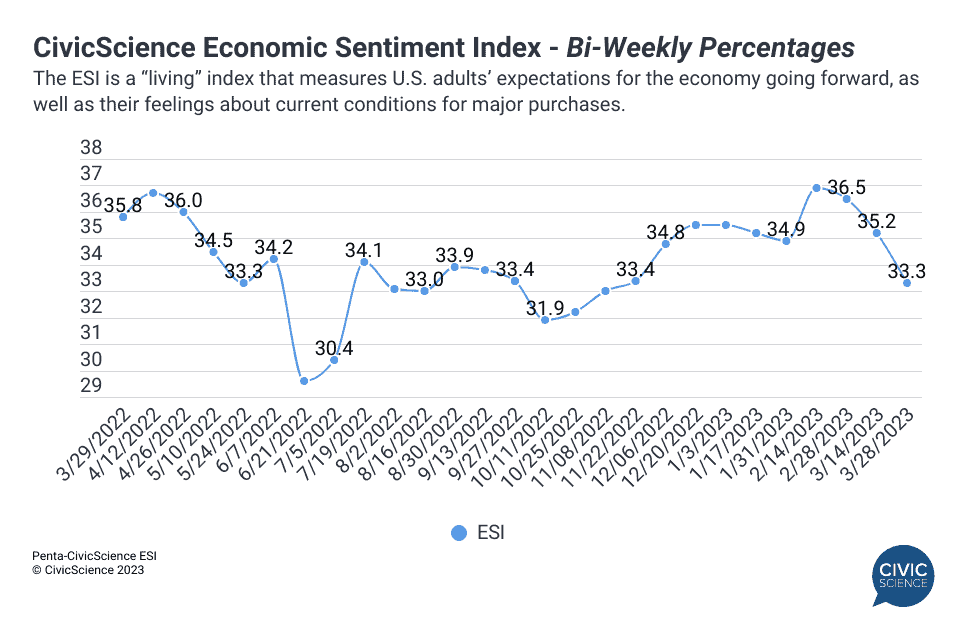

We have a consumer confidence problem. Recently, I’ve taken our Economic Sentiment Index with a grain of salt, because there’s typically a mix of good numbers and bad, or maybe people are overreacting to one shred of news. But this one is just plain bleak. Maybe all the tech layoff headlines are finally getting to people – confidence in the job market is the worst we’ve seen it since March of 2020. Or maybe the SVB shit-show freaked people out. Or maybe it’s real. We don’t know yet. Regardless, it’s not pretty.

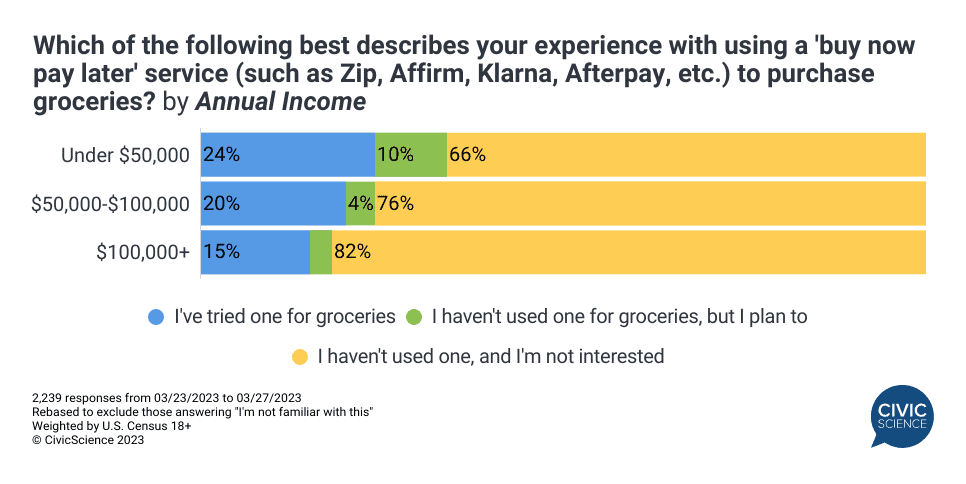

Buy Now, Pay Later services are having their moment in the sun…or the dark clouds, I guess. Apple, this week, became the latest company to jump into the BNPL craze with its Apple Pay Later service, which basically allows people to pay off new purchases over six weeks, without interest or financing charges. Expect the service to excel, as more and more consumers are relying on BNPL to stave off inflationary headwinds – particularly in the grocery category. Good for Apple, Afterpay, and the like, but let’s be honest. The fact that so many people have to float their grocery bills isn’t great.

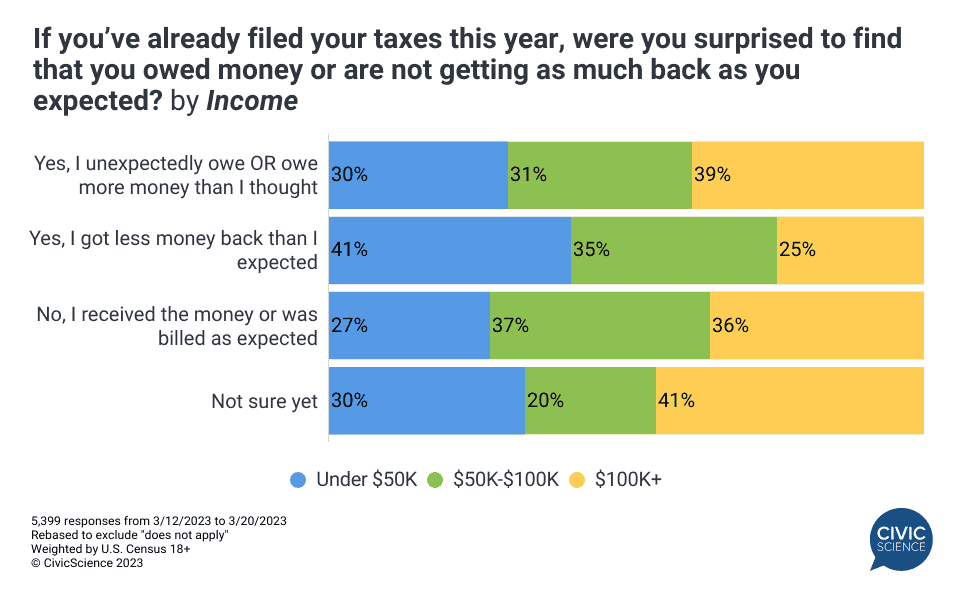

Consumer expectations – and their impact on spending – are shifting as Tax Day approaches. Fifty-six percent of U.S. taxpayers who anticipate refunds this year will use the proceeds to pay down debt or put it aside for a rainy day, up from 54% last month. The percentage who plan to spend their refunds on retail, travel, or other discretionary items is down from last year. Surprisingly (for them and for us), upper-income Americans are the most likely to say they owe taxes (or more taxes) unexpectedly this year. To see our comprehensive report on the 2023 tax season and all its nitty-gritty details, you should download it here.

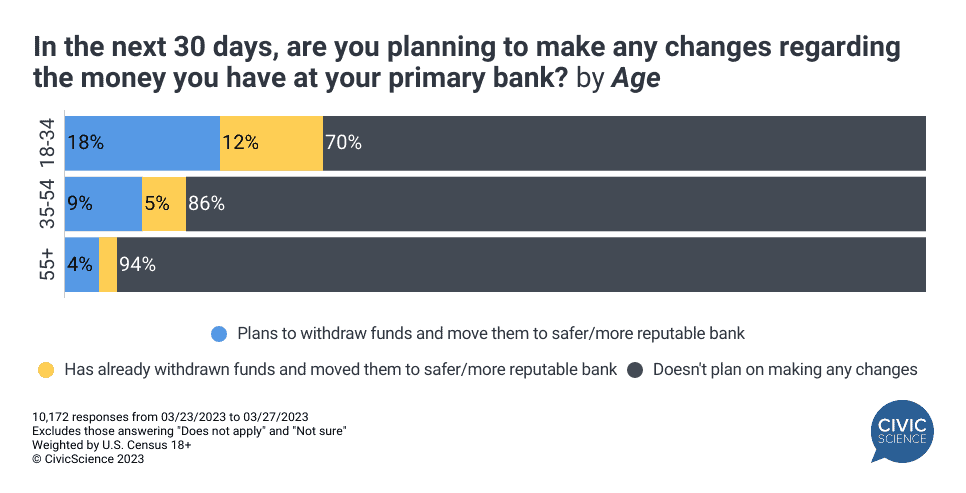

Community banks are being hit hard by the SVB aftershocks. Five percent of U.S. adults say they have moved some or all of their money from one bank to another, more reputable one. Another 8% say they are thinking about it. Customers of community banks are 50% more likely than those at large national or regional banks to say they already shifted. The biggest moves are coming from those with $100k-$500k in liquid assets and younger adults between the ages of 18-34 (many of whom are hedging against online-only banks). I suspect a lot of the “intenders” are bluffing. For now.

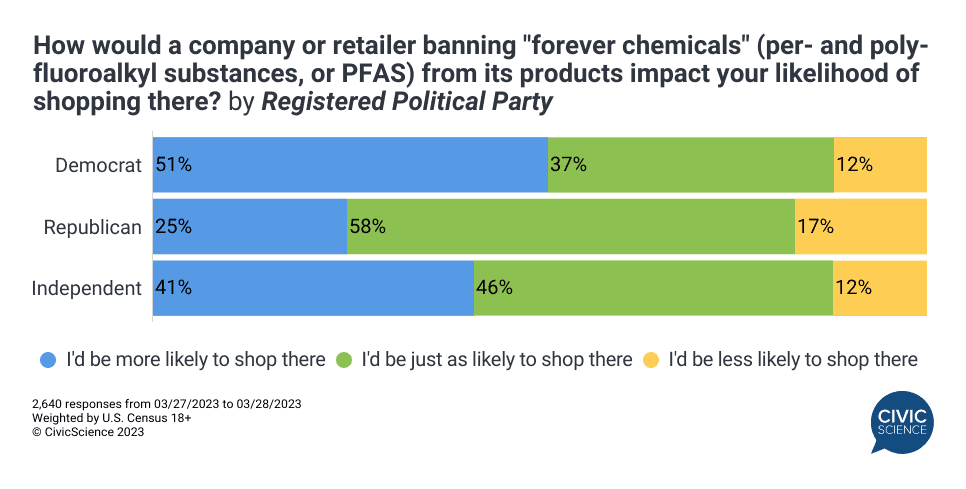

We have a long way to go to educate Americans about PFAS. Did you just ask yourself, “What are PFAS?” You’re far from alone. PFAS, aka “forever chemicals,” are used in all kinds of consumer goods, most commonly to make things waterproof (clothes) or non-stick (kitchenware). Let’s just say it’s not great when PFAS make it into our drinking water. And, while the EPA is working feverishly to regulate them and several companies, like 3M, are phasing them out, the average consumer doesn’t know enough about PFAS to be as concerned as they should be. Kudos to the companies taking proactive action – it will be good for business in the long run, as consumers who are aware of the PFAS problem say they’re more likely to buy from companies that eliminate them.

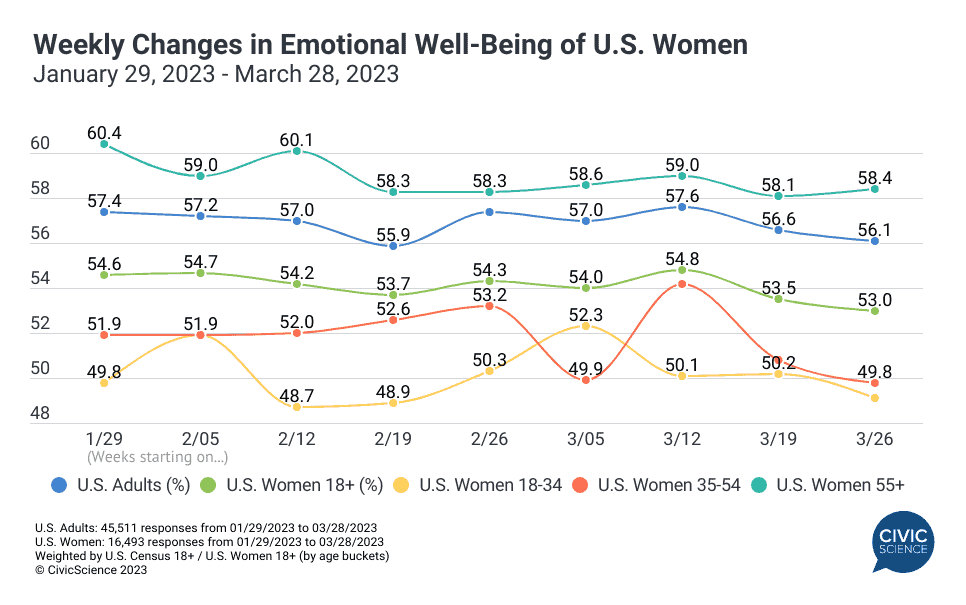

Our collective emotional well-being improved for the third straight month in March. I’ve been paying closer and closer attention to our Well-Being Index lately, and you should too, because it reverberates through all kinds of consumer categories. In March, the index reached a level not seen since November 2021.But the banking crisis and the tragedy in Nashville this week ended March on a sour note. I often lament the sad numbers among younger women – and they’re not improving. But, one thing I hadn’t noticed before is the superlative level of emotional wellness among women aged 55+ – it’s consistently better than the general population, as a whole. Good for you, ladies, keep it up.

More awesomeness from the InsightStore this week:

- Our 3 Things to Know, including cutbacks at the grocery store, rising concerns about public education, and the demise of the microwave among Gen Z;

- Likely mobile carrier switchers love billboards and other things;

- People seem to dig the new MLB rule changes;

- Here are 3 Key Shopping Trends for Market Researchers – like the rising impact of social media influencers.

The most popular questions this week:

- How likely or unlikely are you to say something inappropriate on live television?

- Do you believe your life’s backstory is interesting enough to help you advance in a reality TV competition?

- In your opinion, is emotional pain a necessary or unnecessary part of the creative process?

- How important, if at all, is patriotism to you?

- How comfortable are you with giving a speech at a wedding?

Answer Key: Very; Very; No; Very; Very, very, very.

Hoping you’re well.

JD