Consumers are walking a fine line between resilience and recklessness.

In fairness, I had the same concern a year ago – namely, that we’d borrow our way through Christmas, then get whacked with credit card bills by February, forcing a slowdown in spending. It happened for a minute in places like restaurants and travel.

Liberation Day shuffled the deck again, driving a wave of pull-forward purchases, as Americans tried to get ahead of impending tariff costs. Once it became evident that the tariff threats were overblown – or at least once the whiplashing news became white noise – discretionary spending slowed in categories like home goods and sports equipment. Retailers began feeling hot under the collar.

But, as fall arrived, people returned to their shopping for self-care ways. It quickly became evident to those of us who prognosticate about these things that holiday retail would grow by upwards of 3% or more, net of higher dollars and lower units. Cue record Black Friday and Cyber Monday sales – where Buy Now, Pay Later usage surpassed $1 billion for the first time.

So, here we are again, staring down the barrel of what should be a bleak Q1, when the realities of holly jolly Christmas splurging come home to roost. Add in the prospects of evaporating healthcare subsidies (although I’d be shocked if Congress actually lets that happen in a midterm year), the reneging of federal student loan repayments, and retailers’ warnings that they can’t shield consumers from tariff costs much longer. 2026 could finally be the year when our economic gravy train jumps the tracks.

Then again, maybe not. Wage growth continues to hover above inflation. Workers are feeling uneasy about the job market, but the bottom is nowhere near falling out. Before next summer, the fruits of the One Big Beautiful Bill (I can’t believe we have to call it that) Act will come to harvest, yielding what many expect to be record tax refunds for millions of Americans. An extra $1,000 in everyone’s pockets could stimulate consumer spending just long enough to roll right into the holiday retail season. Rinse, repeat.

As we enter the season when the pundits and experts broadcast their predictions for the year ahead, I’ll choose to keep my mouth shut this time. Nobody – and I mean nobody – truly knows how this will play out.

All you can do is plan for every scenario, keep your head on a swivel, and make sure your organization is able to move fast when the picture comes into focus.

Godspeed.

Here’s what we’re seeing:

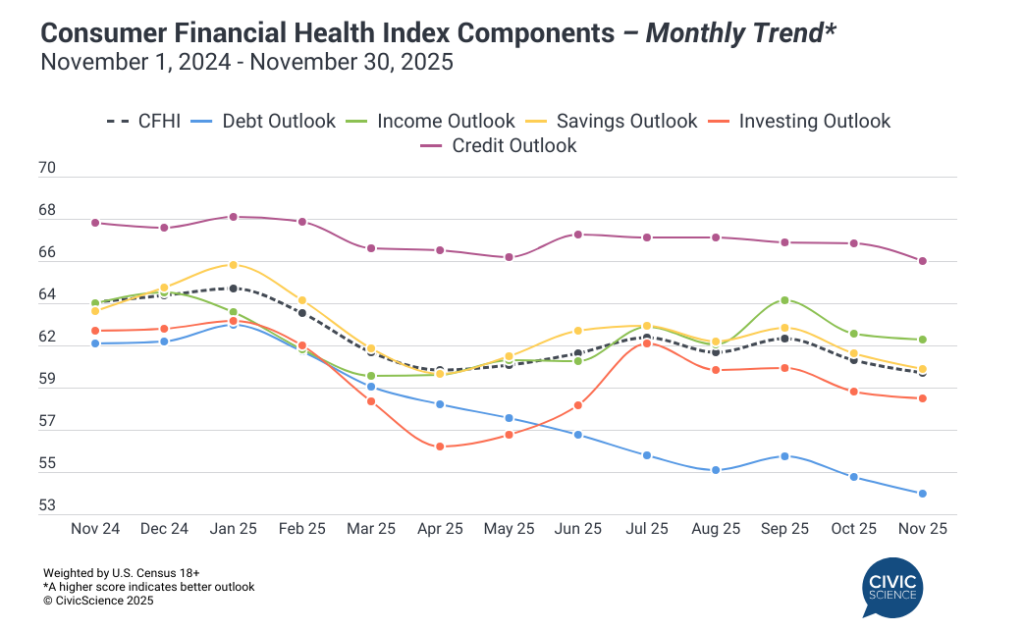

On the cup-half-empty side, Americans are feeling more gloomy about their personal financial outlook than they’ve been all year. Our November Consumer Financial Health Index was hot off the press this week, and it dipped below April’s previous low point – and remains significantly down YoY. Dour sentiment about household debt continues to be the biggest culprit, dropping for the ninth time in the last ten readings. Income and credit outlook remain above water, despite both metrics dipping last month.

We’re learning a lot about the relationship between mental health and spending. We published some (warning: super-nerdy) analysis on the state of emotional well-being in America this week and discovered the critical role “control” plays in all of it. People with a low score on our Emotional Well-Being scale feel the least amount of control over their job or career opportunities. Conversely, those with a high score on the scale feel the highest amount of control over their mental health. It matters because those control factors are highly correlated with spending behavior. Anyway, it might be best to finish your coffee before you read the study.

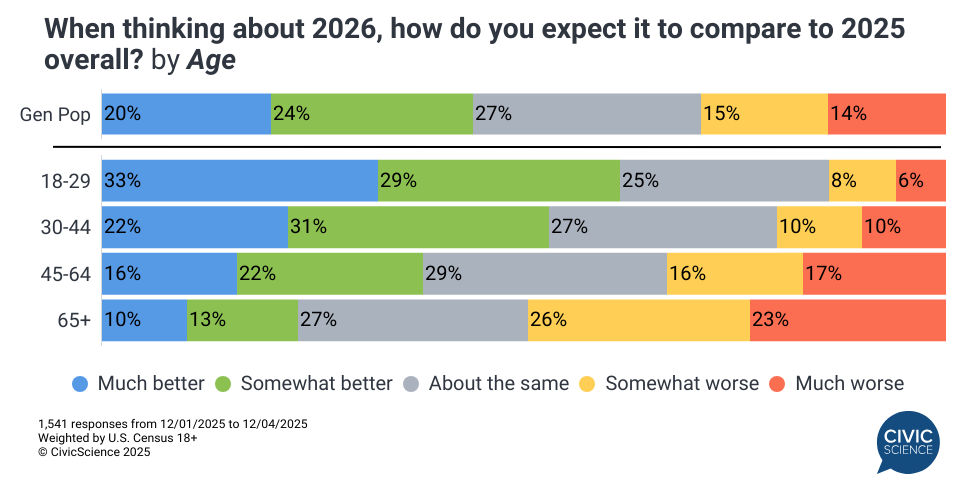

Young people are much more optimistic about 2026. While I’m resisting the temptation to make any predictions about the year ahead, it hasn’t stopped us from asking everyone else what they think. In our 3 Things to Know this week, we first looked back at Americans’ predictions for 2025 (they were optimistic last year, too), while finding that a plurality (41%) of U.S. adults feel that this year has been worse than last. Looking to 2026, people are less optimistic overall than they were a year ago, owing mostly to older respondents. Gen Z and even Millennials are much more bullish. We also shared new insights about online recipe-seekers and interest in the newly rebranded Vine video platform (now “diVine”).

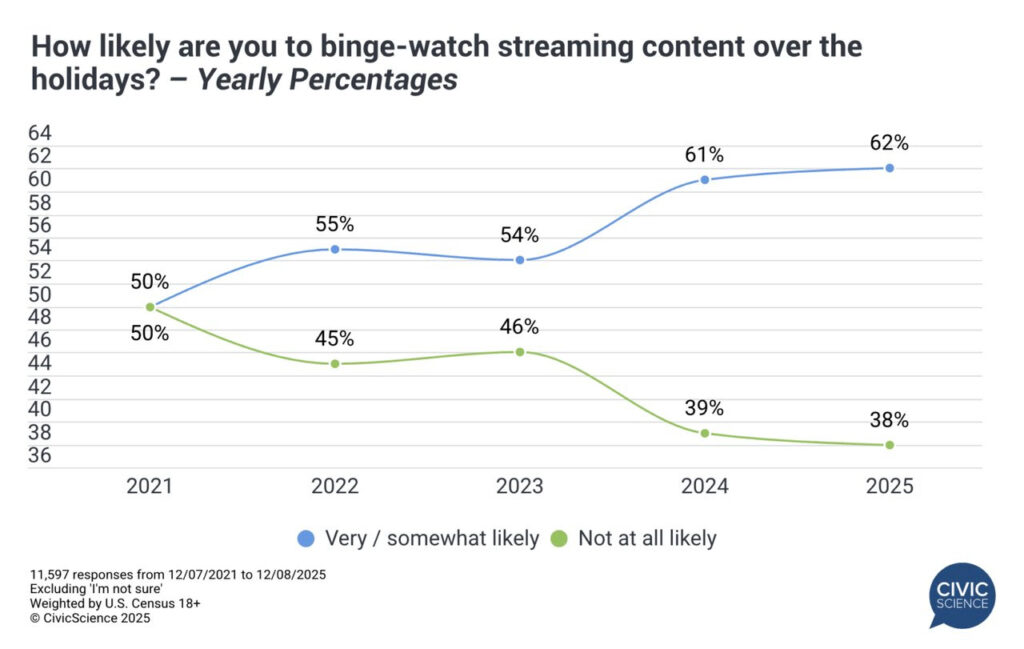

People are gearing up to binge-watch a lot of streaming content over holiday break. In our Weekly Holiday Insights report, we looked at the continued rise of binge-watching as a major holiday pastime – 62% of U.S. adults now expect vegging out in front of the TV to be a central part of their plans. We also learned that the appeal of in-store holiday shopping is evolving toward more practical benefits, like being able to see and touch the products people plan to buy (as opposed to in-store deals, which drove physical shopping more in 2024). Finally, we examined the growing popularity of Advent calendars – up six percentage points from last year.

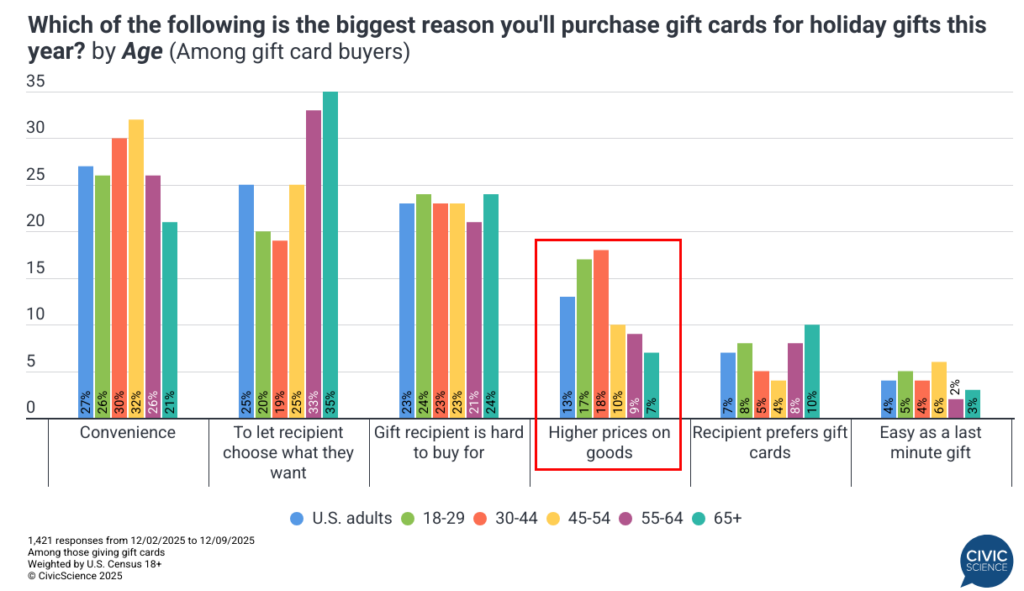

Holiday stress is driving the gift card boom. Over two-thirds of U.S. holiday shoppers say they will give one or more gift cards as a holiday gift this year (on par with last year). Gen Z and Millennial consumers are the most likely to do it, citing convenience as the main motivation. Gen Xers and Boomers are much more likely to default to gift cards because they don’t want to have to make any decisions, particularly for people who are hard to buy for. Whether it’s because someone is overwhelmed with life (young) or simply tired (old), gift cards are the cure for what ails us.

More awesomeness from the InsightStore™ this week:

- The biggest differences between Saks OFF 5TH and Nordstrom Rack shoppers;

- And, similarly, for JCPenney versus Kohl’s shoppers.

The most popular questions this week:

Would you be interested in visiting a restaurant that had a robot server?

How do you cope with holiday stress?

How would you describe your overall Christmas decor style?

How often do you struggle with motivation?

Do you listen to much bluegrass music?

Answer Key: Sure, if the food doesn’t suck; Wine; Kitschy, Every single day; Like it’s my job.

Hoping you’re well.

JD