Gone are the days when athletic apparel could only be found in the gym or the sports field. Today you can’t go anywhere without seeing yoga pants and sneakers everywhere you look. According to Morgan Stanley, sales of sports apparel and footwear have grown 42% in just the last seven years, and more companies are adding athletic clothing to their inventory to try to compete with big players like Lululemon and Nike. As consumers adopt healthier and more fitness-conscious lifestyles, the so-called “athleisure” trend of people wearing athletic clothing in public, outside of the gym, continues to grow. After breaking down the differences and similarities of athleisure super fans and casual fans, there are some findings that athleisure brands, marketers, and advertisers should keep in mind.

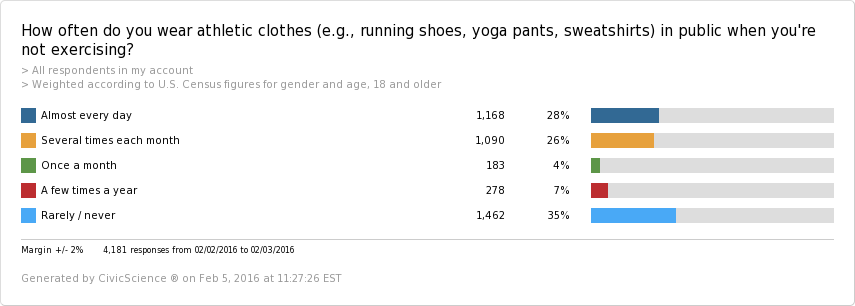

We asked over 4,000 U.S. adults in early February how often they wear athletic clothes in public when they’re not exercising. The results were pretty surprising.

Twenty-eight percent of U.S. adults say they wear athletic clothes in public almost every day. This shows just how much this fashion trend has taken off among consumers. An additional 26% of adults do it several times each month. In other words, over half of adults wear athletic clothing in public when they aren’t exercising at least several times per month.

Another interesting point is that consumers either buy into the trend or they rarely/never wear athletic clothes while in public. Only 4% wear them once a month and 7% wear them a few times a year. It’s all or nothing.

So we dug a little deeper to find there are two types of consumers at play; those who wear athletic clothing almost every day or several times per month – the “athleisure super fan,” and those who wear athletic clothes in public once a month or a few times a year – the “casual fan.” The athleisure super fan can usually be found sporting active-wear like Lululemon outside of the gym, while the casual fan is rarely spotted wearing their yoga pants in public.

Let’s take a look at some of the top findings.

Demographics

The demographics of casual fans look very similar to the demographics of the super fans. Women are slightly more likely to participate than men and 40% of athleisure super fans and casual fans are parents. When looking at age, the trend seems to be a little more popular among the 24-44 year old set. 25-44 year olds are more likely to wear athletic clothing in public.

The two notable demographic differences between super fans and casual fans are their income and urbanicity. Casual fans are more likely to have a slightly higher household income than super fans and super fans are more likely to live in the suburbs while casual fans are more likely to live in the city.

Shopping Behaviors

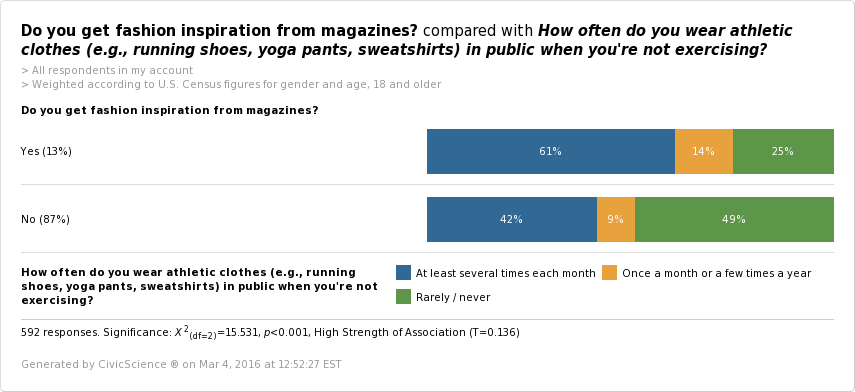

The casual fan is 65% more likely to consider themselves fashion followers when compared to the super fans. This leads us to believe that as the athleisure trend continues to grow, casual fans will be more likely to adopt the trend. When it comes to coupon usage, casual fans are 27% more likely than super fans to use coupons more frequently for non-grocery items, which is interesting given they are likely to have a higher income. Those who receive their fashion inspiration from magazines are more likely to participate in the athleisure trend, so placing ads in magazines are a valuable opportunity for athletic brands:

High-end athletic apparel companies have a large opportunity among athleisure fans. Those who splurge on luxury designer products are more likely than average to wear athletic clothes in public; 67% wear athletic clothes in public at least several times each month. Given the super and casual fans’ higher than average incomes, it would be smart for designer brands to get into the athleisure space.

Fitness

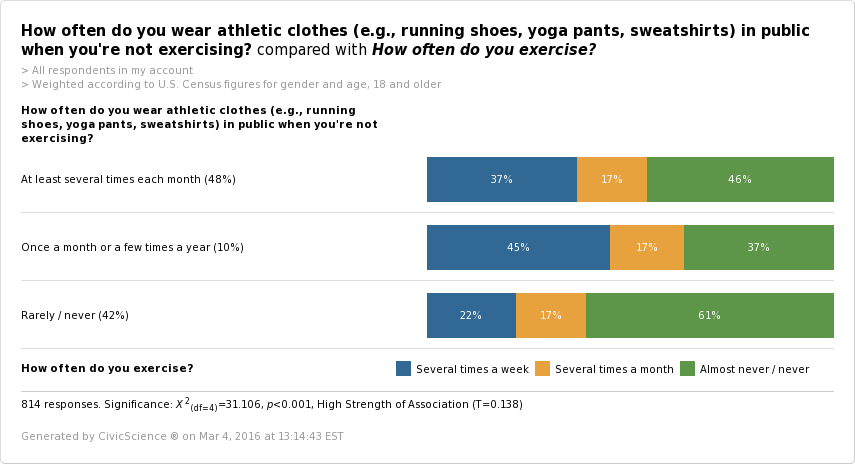

As we noted above, this trend is becoming more popular because people are trying to live a healthier lifestyle. You would think super fans are into fitness and exercising more than casual fans, but that’s not necessarily the case:

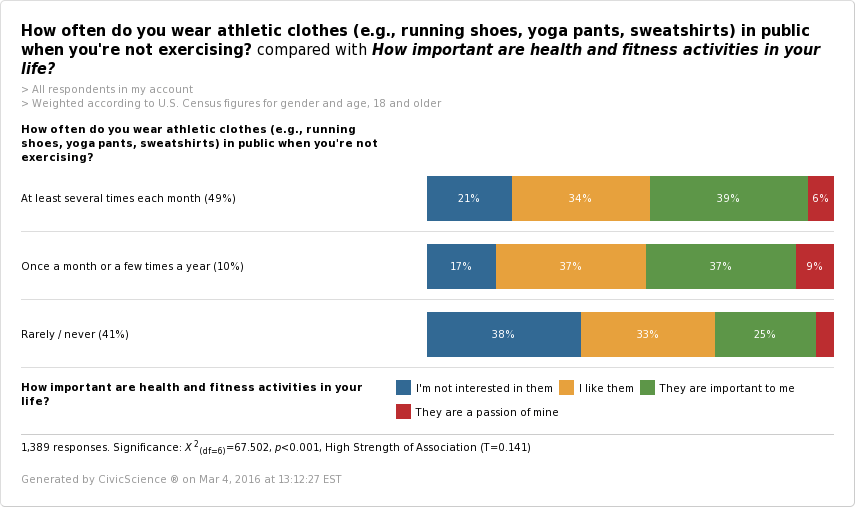

45% of casual fans exercise several time a week, compared to 37% of super fans. Almost half (46%) of super fans never exercise. Casual fans are also slightly more likely to value health and fitness activities than super fans:

If athleisure brands want to try to attract more casual fans to purchase their products, they may have to play up the performance of their apparel. However, if brands are trying to target the super fans they may want to consider playing up the trendy style.

Key Take-Aways

There seem to be two different athleisure consumers – the super fans and casual fans. Both have similar demographics, but their fashion and fitness behaviors differ slightly. In order to reach each consumer group, marketers and advertisers will need to develop slightly different messages. It seems casual fans would be more receptive to a message about the apparel’s performance, whereas super fans may be more interested in style. And casual fans may need a little more incentive to purchase athletic wear, so offering coupons may persuade them to make more purchases. It’s evident that many consumers participate in this trend and that’s not likely to change anytime soon, so don’t be surprised if you see more people in public sporting yoga pants or dri-fit shirts.