CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

Legal sports betting continues to solidify its role in American sports, with industry revenue on track to surpass last year’s totals. New survey data from CivicScience offers a fresh glimpse into who’s betting, how much they’re wagering, and the ways sports betting is shaping fan behavior:

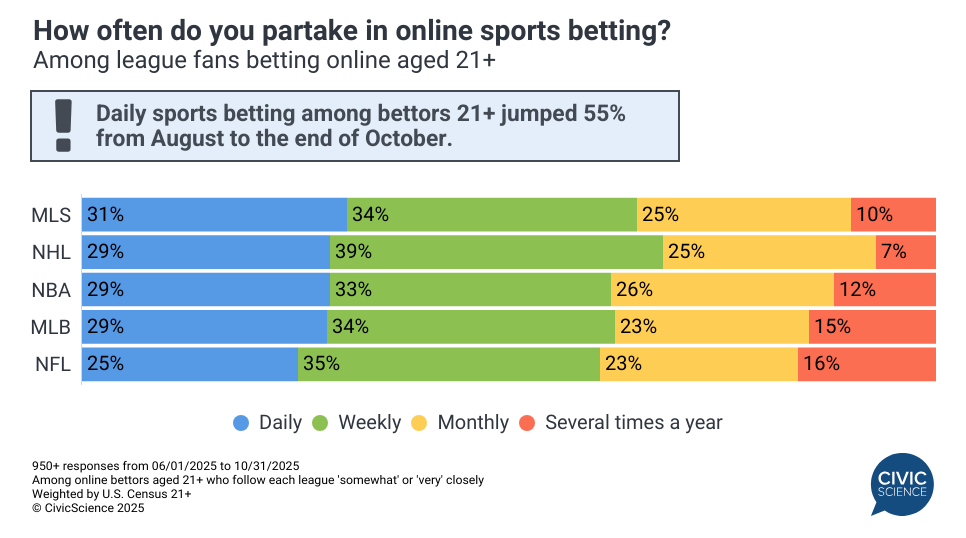

Recent polling shows that 26% of Americans aged 21+ (the minimum age requirement in most states where it is legal) say they place online sports bets at least a few times a year, including 15% who report betting weekly. Among online bettors, the percentage who bet on sports daily has jumped from 20% in August to 31% through the end of October. Looking at league-specific trends among bettors, MLS fans are the most likely to bet online daily, while NHL fans lead in weekly online betting.

DraftKings Takes the Crown, While Average Wager Amount Regains Ground

Honing in on the specific online platforms bettors 21+ say they use, DraftKings commands the table as the most used (36%), with FanDuel (32%) close behind. Additional major platforms, such as ESPN Bet (22%), BetMGM (20%), Fanatics Sportsbook (19%), Bet365 (18%), and Caesars Sportsbook, all trail by a wider margin. Given the vast landscape of online sports betting and the platforms available for betting, an additional 20% cite ‘other.’

Following a down year in the consumer-reported average online wager size, as per CivicScience’s ongoing data, the percentage of sports bettors wagering over $50 per bet is trending back up, even as economic pressures due to rising costs mount. While these averages are still below 2023 levels across the board, it’s women bettors who have regained the most ground (+3pp) from 2024.

Betting Is Driving Engagement With Sports That Fans Don’t Normally Watch

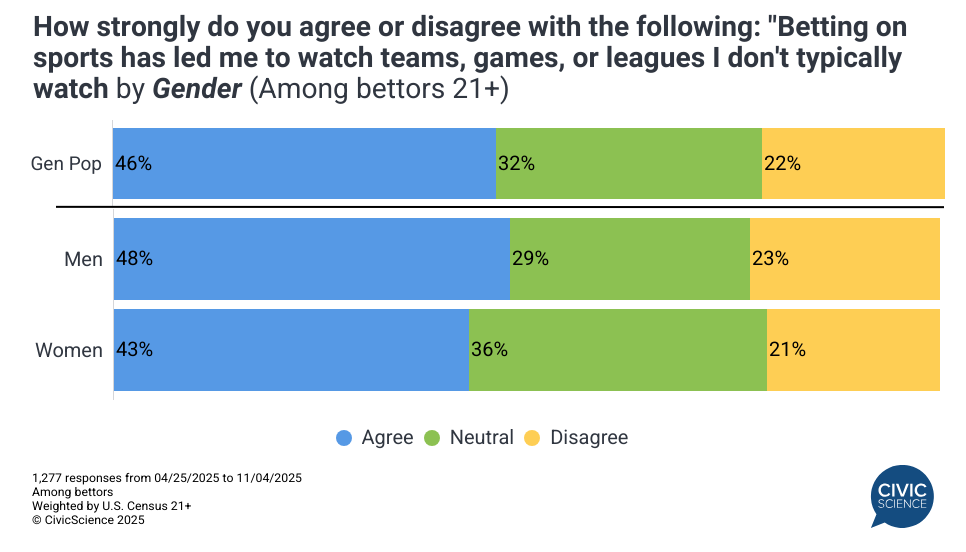

With a wide array of sports available to bet on, additional CivicScience survey data indicate that betting is driving consumers to watch sporting events and teams they don’t typically follow. Nearly half of those who bet aged 21+ agree that sports betting has driven them to tune in to teams, games, or leagues they don’t usually watch. Those who agree more than double those who say their betting activity has not inspired them to watch new sports or teams.

Online Sports Bettors Are Ready to Spend and Travel

Online sports betting activity does not appear to be slowing spending in other areas, even as wager sizes increase. According to consumer-declared data, those partaking in online sports betting (aged 21+) are nearly three times more likely than non-participants (21+) to believe now is a ‘good’ time to make a major purchase (44% to 13%). This positive outlook extends to online sports bettors who are holiday shoppers—49% say they will spend ‘more’ on holiday shopping this year compared to last year, while just 16% say they’ll spend ‘less’ in 2025. Finally, most sports bettors will be on the move — 86% say they plan to travel within the next six months.

But Sports Betting Has Its Headwinds

With sports betting platforms partnering more closely with leagues and featuring prominently in live game broadcasts, some sports fans aren’t sold. Nearly half (49%) of U.S. adults who watch sports hold an unfavorable opinion of betting integrations in broadcasts — such as in-game odds and segments — compared to 21% who view them favorably (30% are neutral).

Concerns deepen when it comes to the gameplay itself, with recent headlines still fresh in mind. Seventy-one percent of sports fans 18+ say they’re at least ‘somewhat’ concerned that sports betting could compromise the integrity of professional sports, with NHL fans reporting the strongest concerns.

What do you think? Do you think sports betting should be more heavily regulated in the US?

Legal sports betting is shaping not only who watches and bets on sports, but also how fans interact with the broader sports ecosystem. While it encourages new engagement and spending, concerns over game integrity and in-broadcast promotions suggest the path forward won’t be without challenges.