Like many retailers during the pandemic, American Eagle has had to navigate tough financial decisions and constantly changing consumer sentiment. The apparel and shoe retailer has shown mostly positive year-to-date numbers, but sources say the upcoming earnings call could go either way.

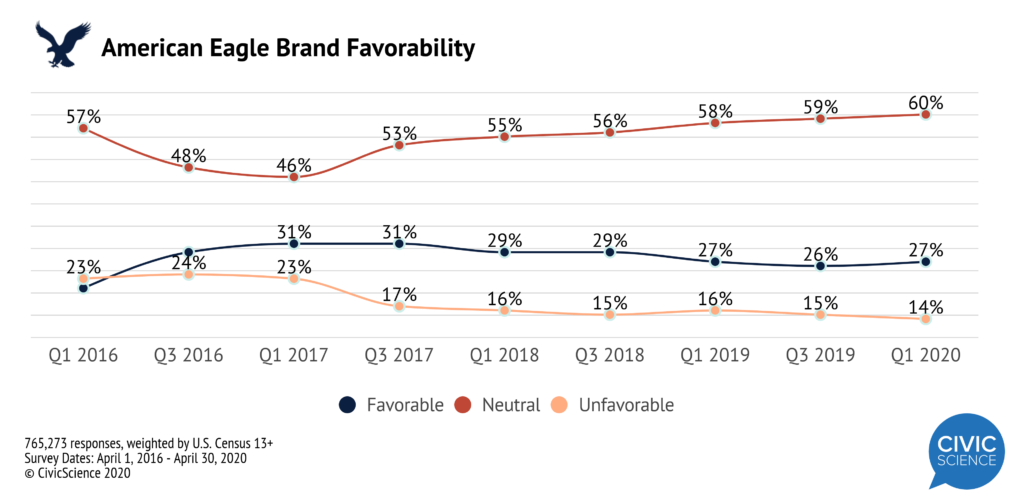

Overall Favorability Ratings

CivicScience tracking of the American Eagle brand shows a gradual increase in neutrality coinciding with a gradual decline in both favorability and unfavorability over the last several years.

Today, American Eagle’s overall favorability among American consumers 13 and older rests at 25%, which is actually the same favorability rating the store had back in June of 2016. Despite the increasing neutrality, overall approval ratings in the last four years have seen little change.

Demographics

A breakdown of age shows Gen Z is currently the most favorable age bracket of American Eagle, which suggests the brand is doing a decent job reaching its target market (high school and college-age men and women). Although, a year-over-year look at Gen Z favorability shows a peak of 47% in 2017 followed by a gradual decrease to 44% in 2019.

Zooming in on the last few months (during the onset of the coronavirus outbreak in the U.S.), CivicScience data reveals a monthly drop in Gen Z favorables and a slight increase in Gen Z unfavorables.

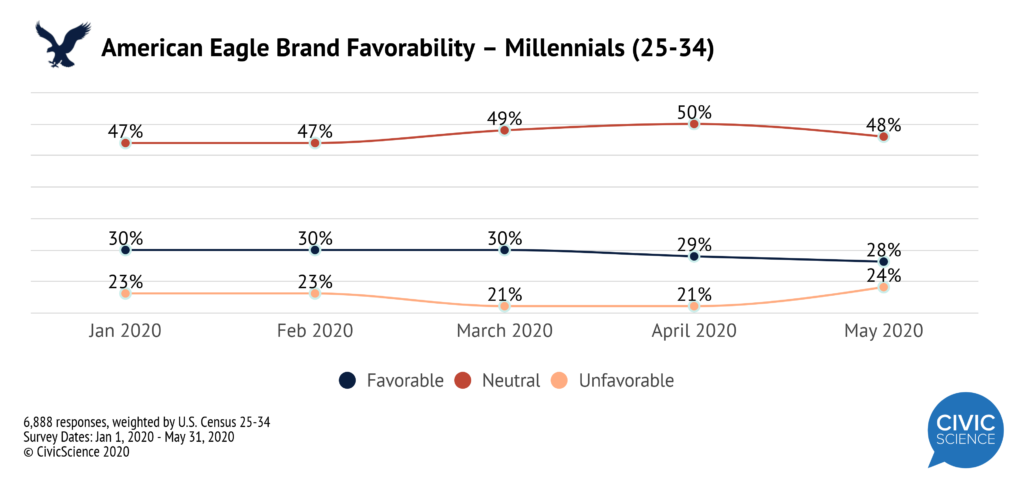

Millennials – who have presumably ‘outgrown’ the brand – so a slow decline in favorability beginning in March and then joined by a rise in unfavorables in April.

Gen X, more likely to be buyers rather than wearers of American Eagle apparel, saw no changes in favorability January through May.

Given the fact that American Eagle products are intended for Millennials and under, it isn’t too surprising to see those making $50K or less a year are most favorable toward the brand. Although American Eagle makes both men and women’s wear, women are more favorable than men towards the brand (and have been for a while).

The Pandemic Effect

Retailers across the country are preparing for (or are in the process of) a gradual reopening of their brick-and-mortar locations. This is good news for American Eagle because its favorables under 35 (Gen Z and Millennials) are 17% more likely than the Gen Pop to be comfortable returning to a physical store in under a month. When it comes to shopping online, American Eagle favorables in general reported shopping online more than usual during quarantine. This suggests that, for American Eagle, unlocking its doors again will only help them reconnect with their target market in person.

Interested in finding out when favorables of your brand will be comfortable going back to a brick-and-mortar store? Those insights are reserved for our clients, but we would love to show you what it’s like to be on the other side of the database with CivicScience. Sign up for a demo!