The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

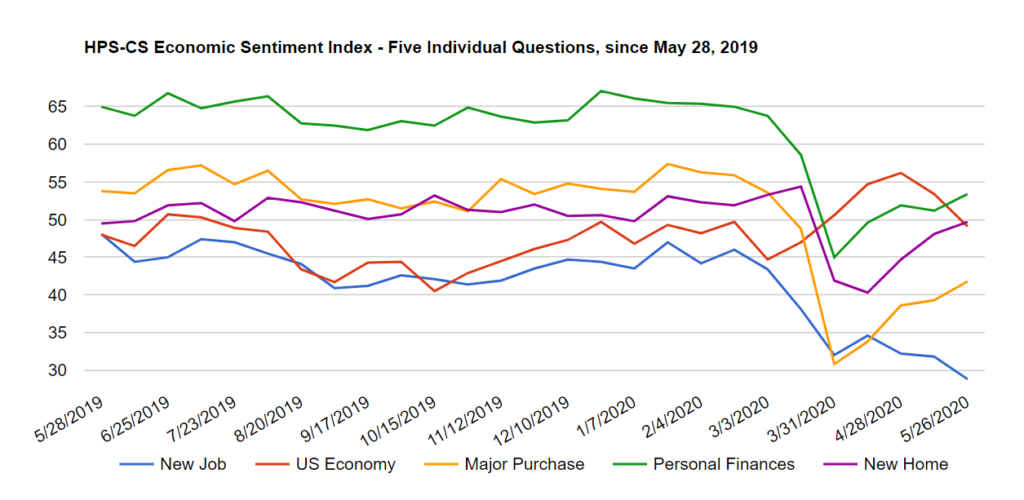

Economic sentiment continued to plateau over the past two weeks as gains in confidence in personal finances and making a major purchase balanced out record-low sentiment towards the job market and a major decline in confidence towards the overall economy. The HPS-CivicScience Economic Sentiment Index (ESI) fell 0.2 points to 44.6, marking the third consecutive reading within this 0.2 point range and indicating a steady position of low consumer confidence. The reading was particularly weighed down by a continued drop in confidence in the job market, which surpassed last reading’s record-low to a new historic low of 28.8.

May’s individual indicators have been marked by a substantial divergence between confidence towards the job market and the overall U.S. economy and the remaining indicators. Though overall confidence has remained steady, May has seen dramatic declines in the job market and broad economic confidence, which have now fallen 5.8 and 7.1 points, respectively, from their April highs. Confidence in the job market broke last reading’s record-low, falling 3.0 points over the past two weeks to a new historic low of 28.8, while confidence in the U.S. economy fell 4.3 points to 49.1. Simultaneously, confidence in making a major purchase, personal finances, and the housing market all recorded sustained rebounds. Confidence in making a major purchase and personal finances rose the most over the past two weeks, increasing by 2.5 and 2.2 points, respectively. Confidence in the housing market also increased by 1.6 points to 49.7.

Changes in sentiment come amid continuously high jobless claims as 2.4 million Americans filed for unemployment last week, bringing total filings during the pandemic to 38.6 million people. The sobering numbers highlight that businesses are still laying off workers while states are increasingly moving to reopen their economies. There has also been a large economic impact on small businesses. Over 100,000 small businesses have permanently closed, including three percent of all restaurants, and many of those left standing are still concerned about reopening. There are, however, signs of economic life as air travel, hotel bookings, and mortgage applications all seem to be rebounding.