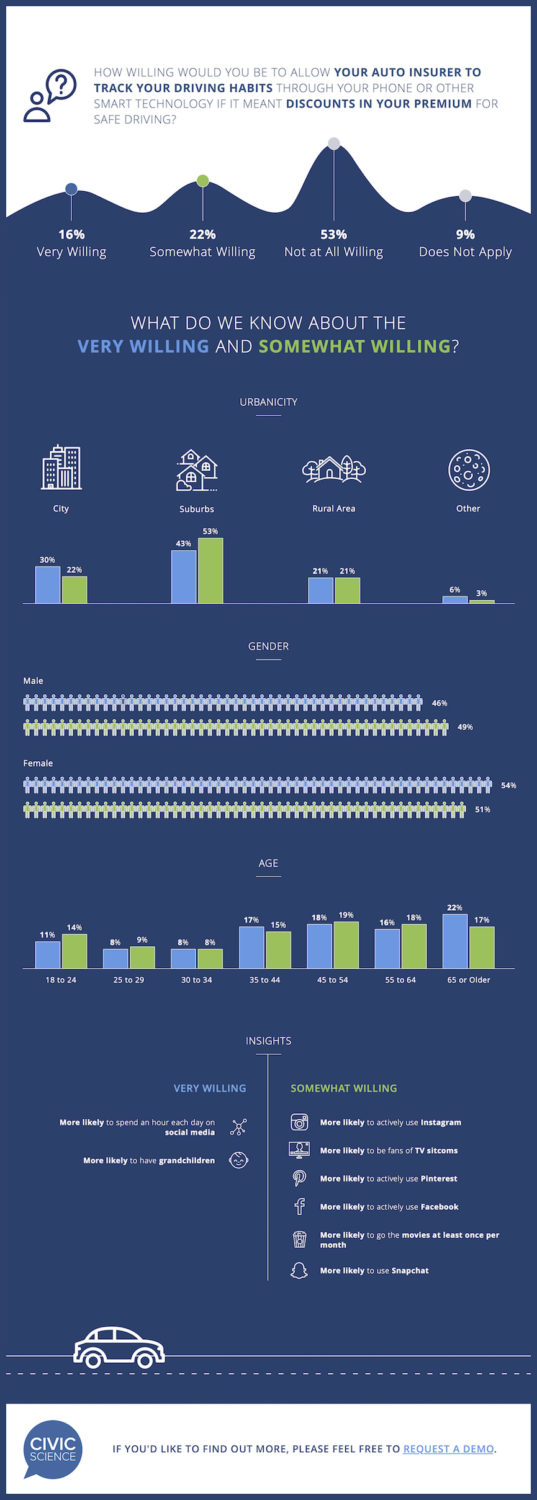

The Gist: 16% of US Adults are “Very willing” to equip their cars with tracking technology if it means saving money on their auto insurance.

It makes sense that we want to keep ourselves and others safe when we’re on the road, and with new technology such as blind spot protection and lane assist, it’s becoming easier than ever.

But, does that desire for safety stop at a certain point? Recently, some auto insurers, including State Farm and Progressive, have started offering customers discounts for safer driving. The catch is – they have to install a small tracker in their car to monitor safe (or not safe) behaviors.

Could a perceived violation of privacy keep customers from savings and safer driving? After all, consumer privacy is a concern for many.

Based on what the data tell us, it’s perhaps not the technology, but the interest in budgeting that draws drivers to the tech.

Of all US Adults, 53% are not at all willing to implement this technology to save on auto insurance. This unwilling group is more likely than the rest to have a household income over $100k. Conversely, those “Very willing” to use a tracker are more likely to manage their money very well.

Check out more insights on the persuadable drivers below.