The Gist: Data show that each new generation places more trust in digital solutions than traditional banks. We looked at the youngest generation that’s approaching adulthood, and discussed ways in which banks can win back trust. Our data seem to justify the notion that young people don’t find new financial technologies as exciting as the prospect of a financial partner.

There’s been a lot of emphasis on Millennials lately. They’ve been the new, shiny generation that’s changing all the rules. We’ve jumped on this train too, reporting that they prefer student loan repayment to 401K’s, and choose social consciousness over brand loyalty.

But now, there are new kids on the block. They’re called Generation Z, and they have the potential to change the banking game…again. In fact, by 2020 they will account for 40% of U.S. consumers.

Who is Generation Z and How Do They Bank?

Generation Z is generally defined as those born after 1995. For ease of segmentation, we will define them as respondents ages 13-18.

An article published recently on American Banker indicates that all the technological bells and whistles banks have rolled out lately, from mobile banking to person-to-person payments, have fallen short in appealing to the kids.These are the kids that grew up with a computer in every home and an iPhone in every hand, so it takes a pretty lit piece of technology to impress these guys.

Consider that the older half of Generation Z is applying to college and is staring down a future of student loans and debt. This generation likely watched its Millennial older siblings struggle to find employment after graduation. As a result, we expect that Gen Zers want stability, they want partnership, they want their bank to feel like part of their squad.

We did some digging through our data and what we found seems to confirm this conjecture.

Generation Z and Trust in Banks

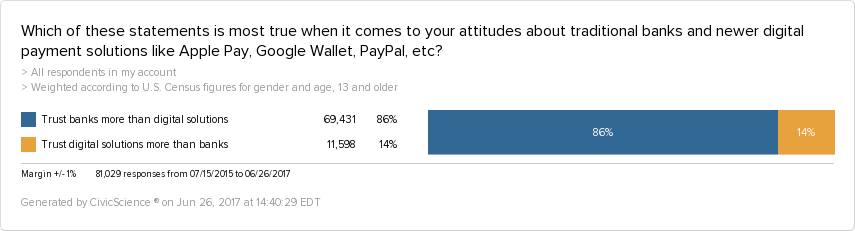

When we looked at our long-running question asking Americans aged 13 and older whether they trust banks or newer digital solutions (such as ApplePay, PayPal, etc…) more, this is what we found when simplifying to two answer options:

As you can see, trust in banks is still high, at 86% among the general population, but then there’s that 14% that has more trust in digital solutions. Let’s break down that 14% a bit more.

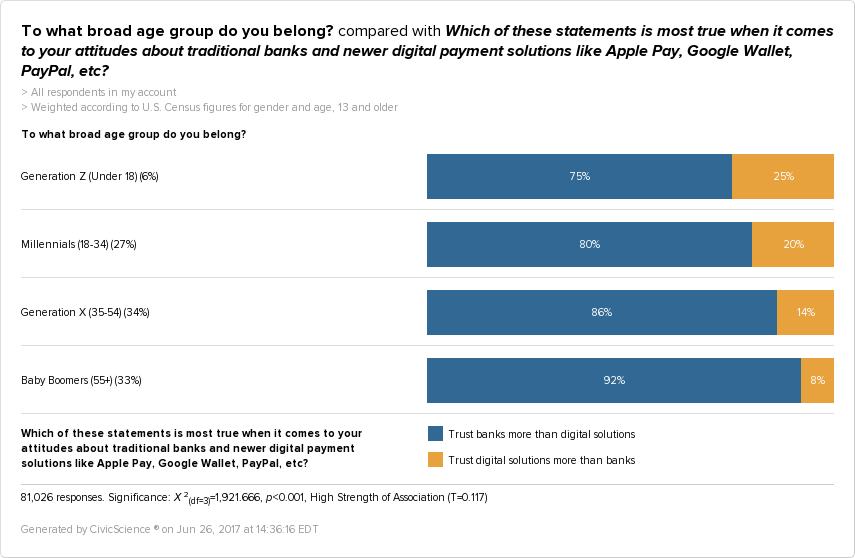

Of the 14% of the general population that trusts digital solutions over banks, 25% of Generation Z are among them. That’s 25% of a whole generation! The amount of trust in digital solutions over banks decreases incrementally – and pretty evenly – from there, with Baby Boomers having the most trust in banks over newer digital solutions.

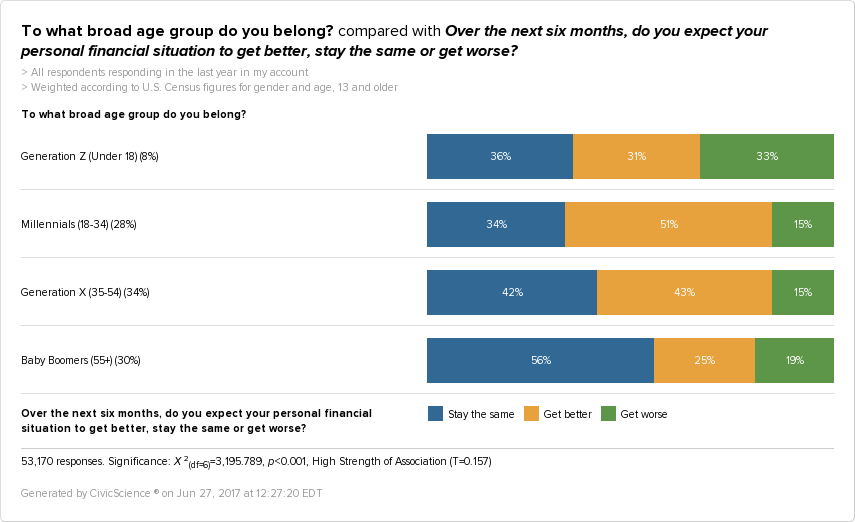

In digging into the situation further, we looked at how different generations feel about their financial future in general, and found the following while focusing only on answers from the past year.

While these data show that Millennials have the most positive outlook on their financial future, Generation Z has the most negative outlook. Of course, people younger than 18 are less financially experienced, so we should take their answers to this question with a grain of salt. However, we’ve reported recently that Generation Z has been active in reading accurate news sources, so they’re not completely out of touch.

What Does This All Mean?

The ubiquity of technology in the lives of Generation Zers means they are likely less impressed by tech-savvy banks.

If banks want to gain back the waning trust of the generation that’s just reaching adulthood and earning discretionary income, they need to prove to the kids that they’re bae. Or, in adult-speak, big banks need to prove that they can be a trusted partner during Generation Z’s transition into adulthood.

Without this, it seems fair to expect the trend of placing more trust in digital solutions to grow.

Click here for a guide on the teen slang used in this blog post.