The Gist: As of late, we have been seeing a ton of press regarding employee loan assistance programs that FinTech visionaries like CommonBond and SoFi have been spearheading. Given that an employee’s benefit package is a major factor in accepting a job, we were curious to take a deeper look. When you couple the tremendous student debt burden of Gen X and Millennials, this benefit would seem to make sense on the surface.

HISTORY

In August 2016, CivicScience and SoFi both performed research on the topic of student debt, independently. SoFi surveyed 1,024 individuals via SurveyMonkey, whereas CivicScience used its speed-savvy data platform to query 2,164 respondents then cross-tab those respondents with our Economic Sentiment Index (ESI). Both research efforts bore similar findings that student debt is stressful, prohibitive to retirement savings, and employees would be more happy, productive, and loyal with a student loan assistance benefit.

THE PRESENT

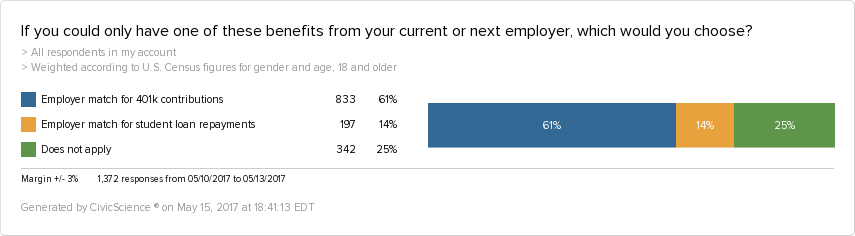

Given this tremendous dynamic, we wanted to dig a little deeper on this topic to see how badly potential employees valued loan repayment assistance offerings. This time around, we structured the research in an “either or” – not both.

QUESTION RESULTS

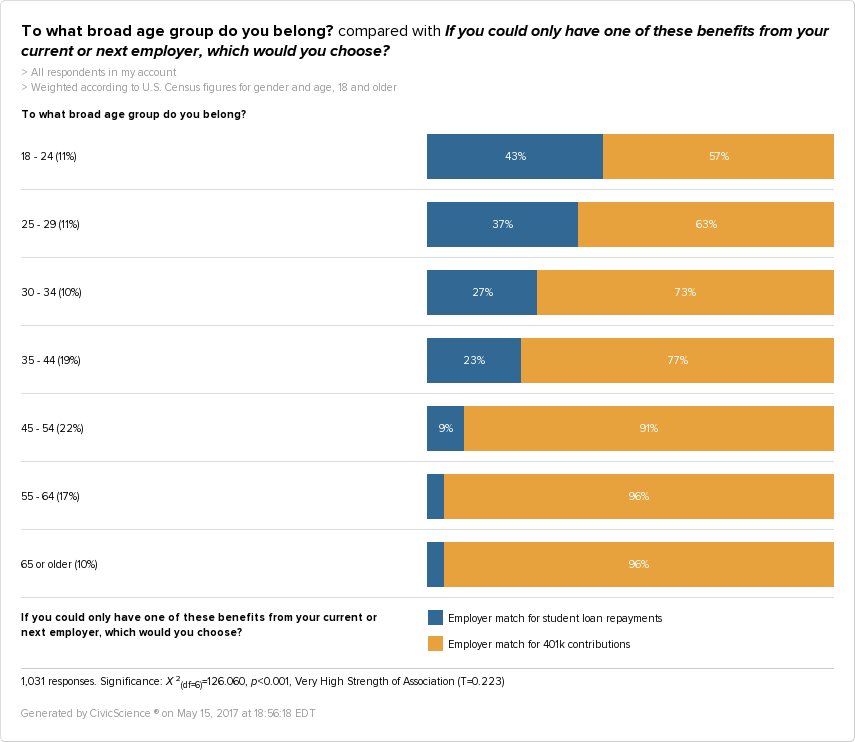

BROKEN DOWN BY AGE

RESULTS

Pretty interesting results given how we structured the question. There is a large amount of interest among college students and recent undergrads – or at least in that age range. A significant number would prefer student loan assistance rather than a 401k offering. In the 35-44 age range, there is still almost 25% who would choose loan assistance over 401k.

CONCLUSION

The data unequivocally shows that this offering is highly valued in the marketplace, and it appears that there are two paths of approach. First, there may be a potential tradeoff offering for SoFi’s and CommonBond’s employer clients where they offer a loan repayment assistance match benefit instead of a 401k. After the debt is repaid, then the employee enrolls in a 401k. This option could provide the maximum benefit to employees while reducing employer costs.

Second, If the aforementioned is not feasible or desired, then a standard offering of both 401k plus loan payment assistance (defined or matched) would surely make any employer more attractive to potential employees.

If you’re interested in reading more, take a look at these recent findings:

The Top Financial Insights of 2016

America is Divided on Credit Cards

The Plight of Financial Literacy in America