The Gist: Over the past two years, those who say fashion trends affect what they wear “A lot” have more than doubled. Further, this group of consumers is more likely to be brand loyal, and less likely to be price-conscious when it comes to clothing. This makes them a prime demographic for retailers. While some brands are already bringing in these fashion followers, others, such as Skechers and Under Armour, have yet to capture the group.

Did you also sit at home alone, in your snazziest attire, waiting for photos to surface from the Met Gala? No? Just me?

In following the Gala, I wondered how many people were also tuning in, which led to a broader question, “How many people follow fashion trends in general?”

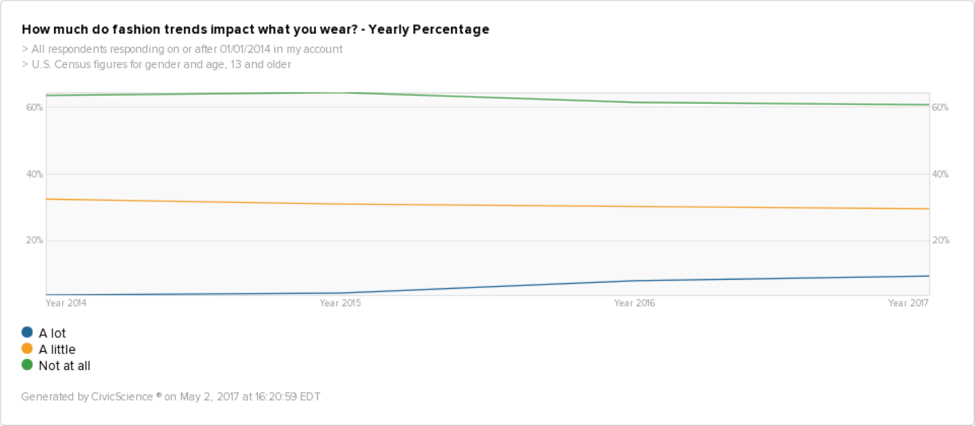

Luckily, we have a question on that, and the results were not what I expected:

Over the years, the percentage of Americans whose wardrobes are heavily impacted by fashion trends has remained relatively flat. However, do you notice something?

From 2015 to 2016, the percentage of Americans who say fashion trends impact what they wear “A lot” doubled from 4% to 8%. What’s more – the trend seems to be continuing this year – with that number now at 9%. However, it’s still too early to tell what the rest of 2017 holds.

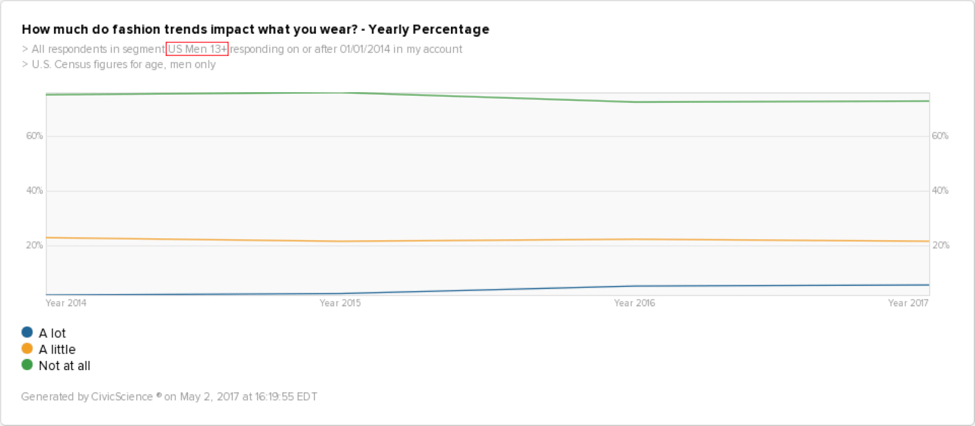

Though women are much more likely to say that fashion trends impact what they wear “A lot,” the trend encapsulates men as well.

WHO IS THE NEXT COCO CHANEL?

First off, this group of fashion followers leans younger, and are more likely to be under 18. With their young age in mind, it’s no surprise that this group is 3x as likely to use Snapchat, and 2x as likely to use Instagram. Like other younger folks, they are also more likely to try new products before others do.

Here’s where it starts to get a bit more interesting. This group is much less likely to be conscious of price when shopping for clothing. Further, they are 4x as likely to dine regularly at upscale restaurants. For the fashion followers under 18, it’s safe to assume that it’s not their money which they’re spending, but they don’t seem too cautious of using someone else’s.

So, whether they’re using a family credit card or their own, they have major purchasing power.

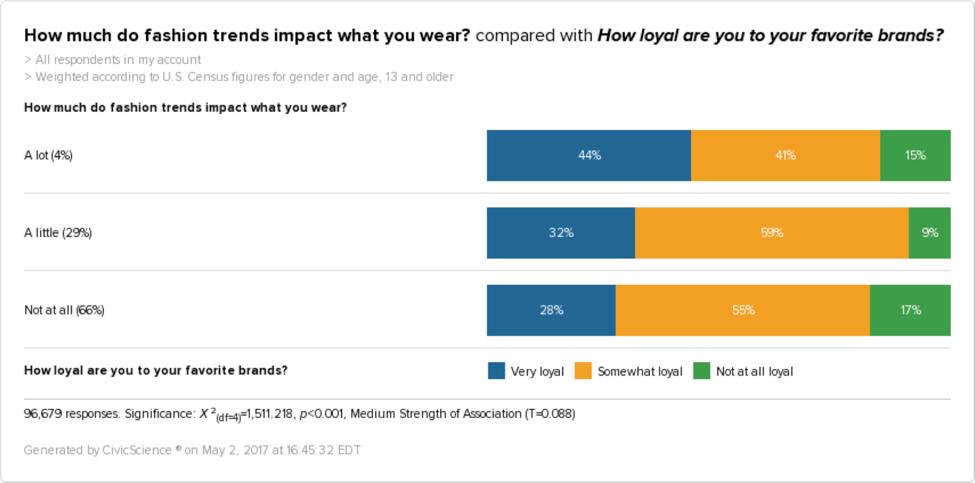

Lastly, and maybe most importantly, is the fact that these fashion followers are much more likely than others to say they are “Very loyal” to their favorite brands. In an age where brand loyalty is on the decline, this characteristic makes this group especially important for retailers to capture.

WHAT STORES CAN BENEFIT FROM GROWING INTEREST IN FASHION?

In our research, we came across several retailers that may want to be particularly observant of this rising fascination with fashion trends. Our data show that some retailers already seem to be bringing in these fashion-forward followers, such as H&M, Nordstrom, and Victoria’s Secret, while others may want to curb their offerings to bring in these loyal and well-off consumers.

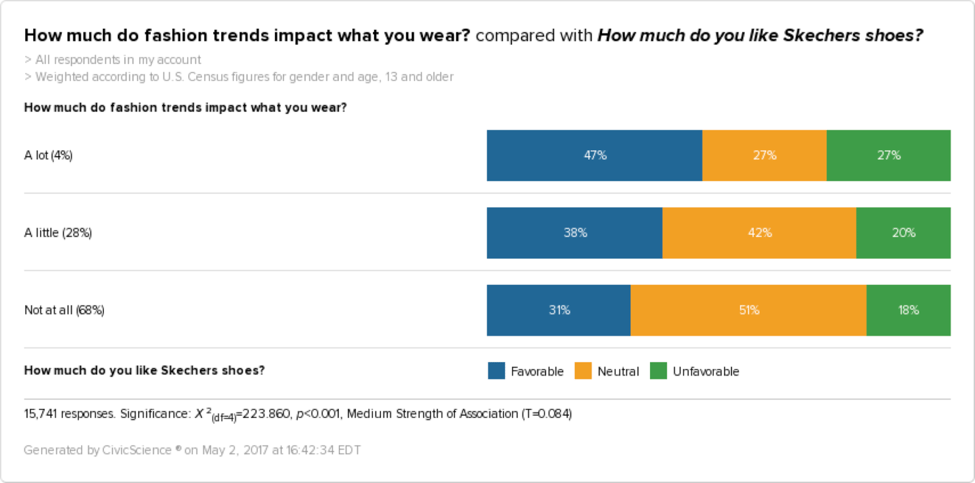

Skechers Shoes. 27% of those heavily influenced by fashion trends hold an unfavorable view of Skechers shoes. If the shoe chain wanted to bring in this group of consumers, with the knowledge that it may not even want to, Skechers may want to find shoe inspiration from new trends.

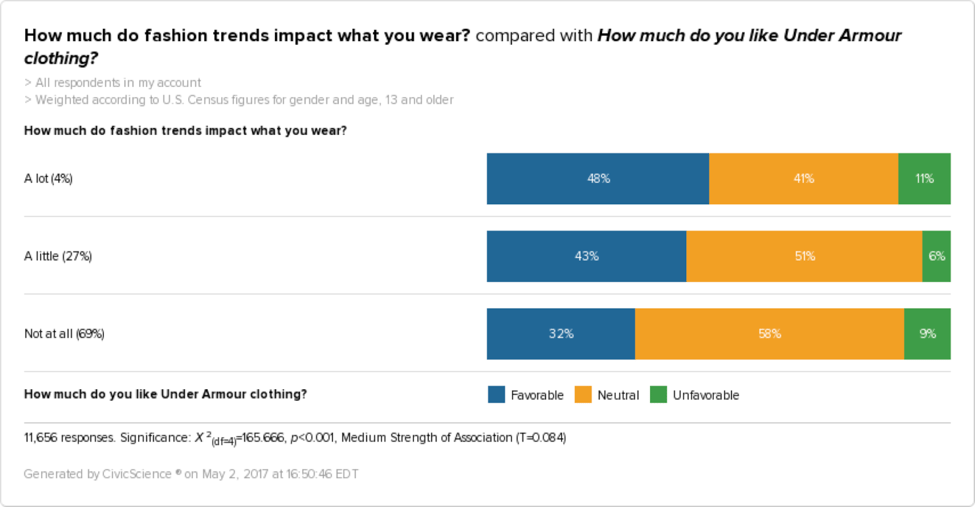

Under Armour. Although Under Armour has been currently expanding its fitness repertoire, the latest offerings might not be bringing in fashion followers. Though 48% of fashion followers hold a favorable view of the brand, there are still 11% who don’t, which is significant considering the group’s purchasing power and loyalty to brands.

WRAPPING UP

If interest in the latest fashion trends continues, particularly among the younger population, the retail landscape could change. Whether that’s good or bad we’ll not weigh in, but the data seem to predict a continuing spike.

Interested in other fashion insights? Find out how Neiman Marcus can benefit from size inclusivity, or how Levi’s new mission could bring in big bucks.