The jury is still out as to whether or not this was a successful holiday season for retailers. Looking back at our data from earlier in the shopping season, we saw that spending intent and shopping progress was pretty much in line with last year’s numbers. Not great news for retailers who were hoping to hit the forecasted 3.6% sales increase.

However, it started looking up for retailers in mid-December when there was a jump in holiday spending intent. In October, only 16% of adults said they would spend more in the 2016 holiday season compared to the 2015 holiday season. As of December, that number climbed to 21%. A rise in consumer economic confidence was a factor in the increased spending intent.

Although retailers are still assessing the holiday shopping season, it seems like it could be a win for some. And at least one retailer made out this holiday season – Amazon.

We have been tracking how much consumers spend on certain categories at Amazon.com each month, and in December, there was a bump in most categories.

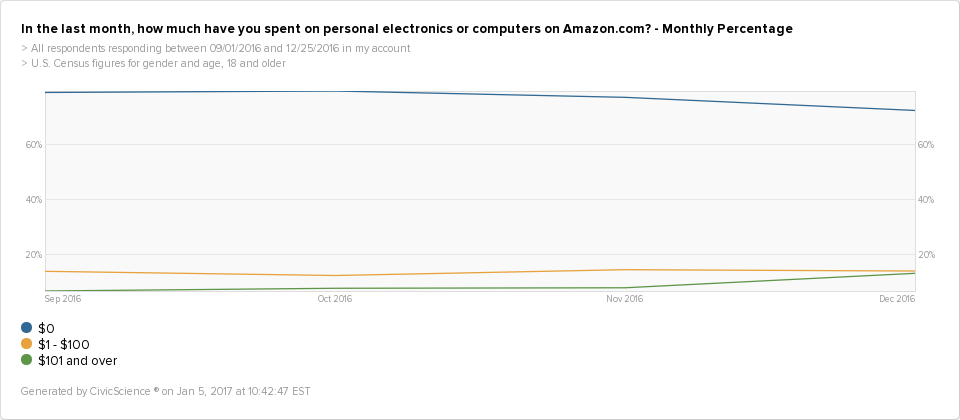

Amazon electronics purchases were big around the holidays. In September, 79% of adults said they didn’t buy any electronics from Amazon, which dropped to 72% in December.

7% of adults said they spent more than $100 on electronics in September, as compared to 13% in December.

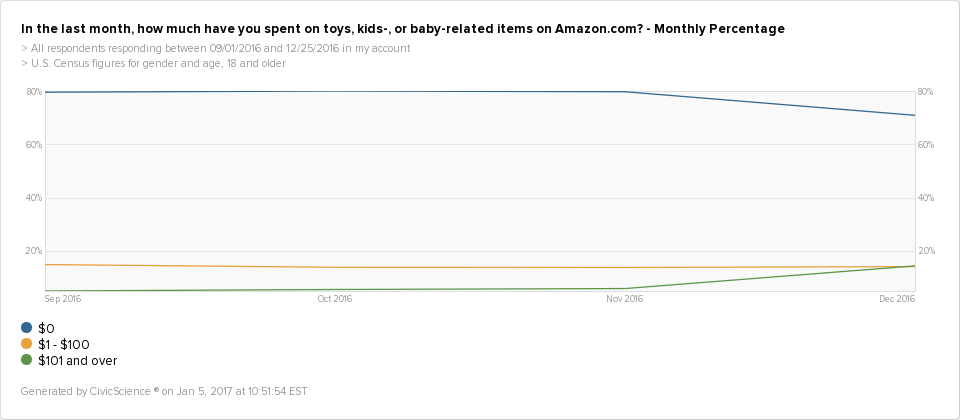

Toys and kids or baby-related items also saw a big bump in December. In September, 80% of adults didn’t make toy/child-related purchases on Amazon, which dropped to 71% in December.

In September, 6% of adults said they spent more than $100 in this category and in December that number more than doubled to 15%.

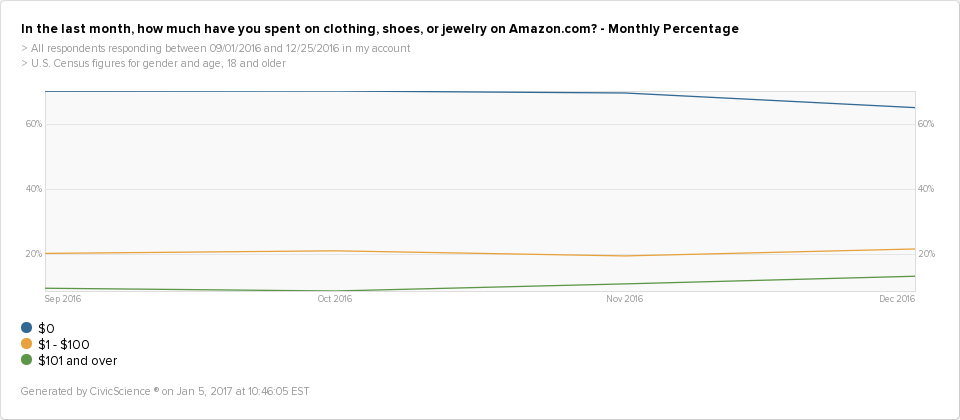

Clothing and accessories spending saw a bump in November and December. In September, 70% of adults didn’t make clothing or accessory purchases on Amazon, and in December, that number decrease slightly to 65%.

Movies, music, and games also saw a small bump in sales, as well as – going from 73% of adults not spending anything in September to 70% in December. Grocery sales remained stagnant throughout the holiday shopping season.

Amazon really made out this holiday season, especially on kids-related items. The number of adults who spent over $100 in the category more than doubled around the holidays. Clothing and accessories and personal electronics were also winning categories for the e-commerce giant. It may not be surprising that Amazon saw success this holiday, but based on the December data, it may be good news for other retailers as well.