Nearly two years after Ticketmaster’s limelight over its dynamic pricing of major concerts, consumers still don’t find unpredictable pricing a melodious concept. In August 2023, CivicScience data revealed the majority of consumers believed dynamic pricing to be the same as price gouging – taking advantage of demand and raising price tags to exorbitant heights.

Dynamic pricing is actually the fluctuating of prices up or down depending on demand. Despite dynamic pricing coming into the news cycle when implemented – and clarified – by popular quick-service restaurants, consumers today aren’t any more favorable to the idea of shifting prices – even if that means prices could go down at times.

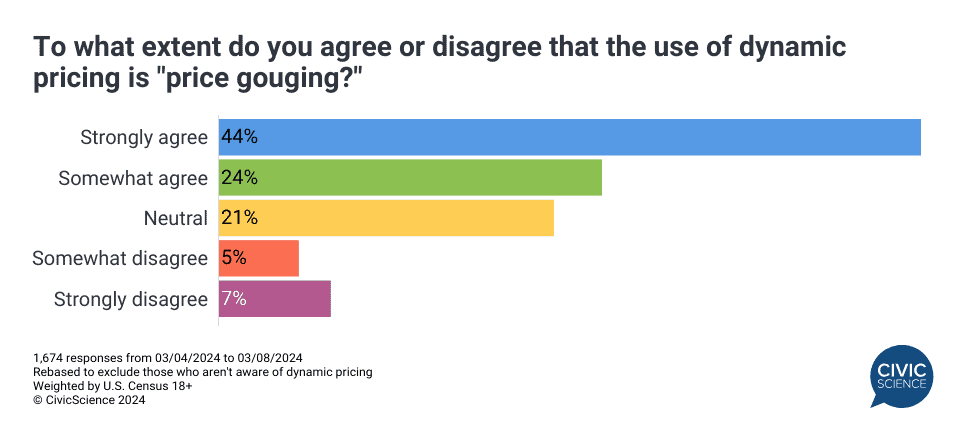

Recent CivicScience data show that consumers who strongly agree that dynamic pricing is price gouging totals 44% of U.S. adults who are aware of the pricing strategy.

Join the Discussion: To what extent do you agree or disagree that price gouging is an issue in the US?

Even if consumers are unknowingly patronizing businesses that take advantage of consumer demand by altering prices, the general consensus among shoppers is that they are significantly less likely to buy from a store implementing this kind of a pricing strategy (56%). One-quarter of consumers shared that dynamic pricing doesn’t change their decision to make a purchase and 19% said they are more likely to do so (n=1,981 responses from 3/4/2024 to 3/8/2024).

Who are the people who agree with dynamic pricing strategies and will even consider shopping at places of business who implement them?

Data suggest age has a tremendous impact on a person’s likelihood to shop at a store using dynamic pricing. Gen Z reports being more likely to frequent a business that uses these pricing strategies. While annual income makes very little difference on whether or not a person would continue to shop despite dynamic pricing, other personal finance details do. For example, the following consumer groups all reported they are more likely to frequent a business that uses dynamic pricing:

- Consumers with any form of loan or debt;

- People who do some, but not all, of their banking online;

- People who have used, or plan to use, online interest-free payment programs;

- Business owners.

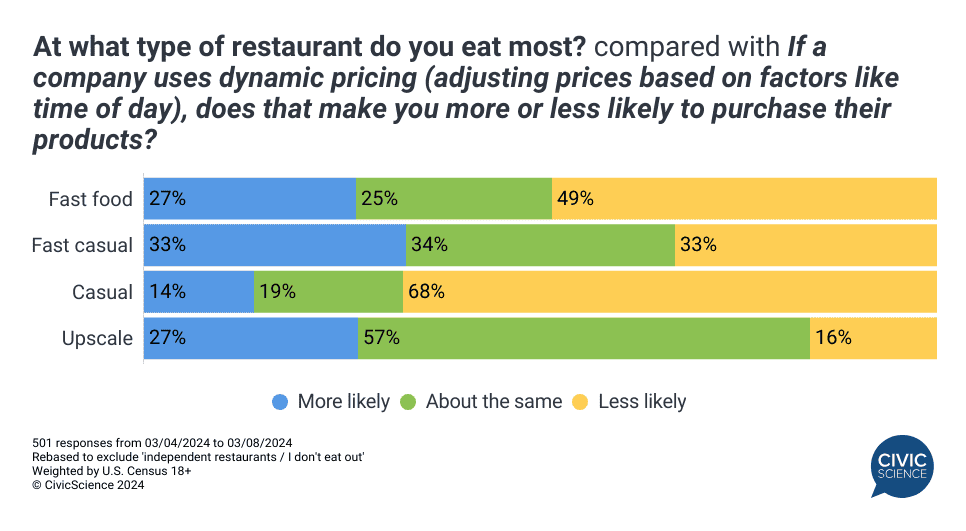

Another important correlation, considering the recent media attention around pricing at quick-service chains, is consumer spending on dining out. Of the consumers who eat out, those who primarily frequent fast-casual restaurants (such as Panera Bread) are the most amenable to dynamic pricing. Alternately, people who usually attend upscale restaurants have the greatest percentage (57%) of those who say dynamic pricing would not influence their likelihood to continue making a purchase or not.

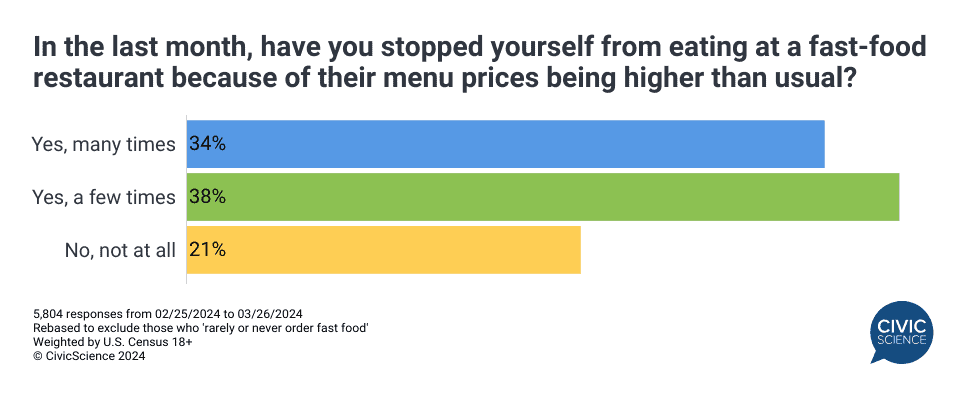

While fast-food consumers aren’t the most opposed to dynamic pricing, one-third recently said they stopped themselves ‘many times’ from eating at a fast-food establishment because menu prices were higher than usual. A slightly greater percentage indicated they too refrained from purchasing fast food for the same reason, but only ‘a few times.’

Answer our Polls: Do you think dynamic pricing in restaurants is a good or bad thing?

It isn’t always clear which businesses consistently implement dynamic pricing, but for quick-service restaurants, consumer sentiment will indicate whether or not it is a good idea for a franchise to consider it. For example, consumers favorable to Pizza Hut and Domino’s are more likely than Chick-fil-A, Dunkin’, and McDonald’s favorables to continue purchasing products from companies that use dynamic pricing.

Ultimately, the impact of fluctuating menu prices could be severe for quick-serve restaurants depending on who they call a regular patron. Brand favorables might not stick around if they can’t tolerate the unpredictable spending, or if they believe they are getting price-gouged instead of opportunities for discounts or deals.

If you’re looking for a clearer picture of your brand and how your consumer base would respond to dynamic pricing, book a meeting with us today!