The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

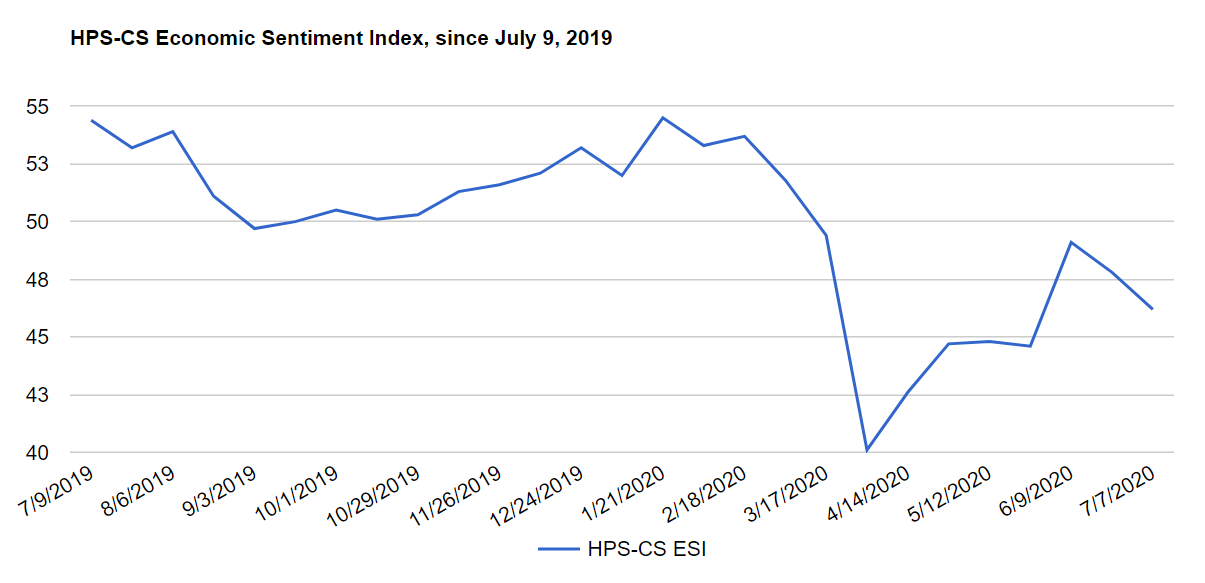

The HPS-CivicScience Economic Sentiment Index (ESI) continued last reading’s decline, dropping 1.6 points to 46.2. The four week-long decline follows on the heels of a massive increase of confidence at the beginning of June as the economy began to fully reopen. Since then, there have been large spikes in new cases in states across the country, and confidence in the U.S. economy has plummeted 8.0 points from its June peak, its largest decline during the pandemic.

Four of the five ESI indicators declined over the past two weeks. Confidence in the broader U.S. economy tanked by 5.5 points down to 48.2 as some states and localities impose new restrictions on economic activity. Confidence in personal finances also had a significant drop off, falling 1.8 points to 52.3, its lowest level since May. Confidence toward the job market and the housing market also experienced slight declines, falling 0.8 and 0.2 points, respectively. Consumers’ confidence in making a major purchase was the sole indicator to rise, increasing 0.1 points to 44.8.

The recent surge in cases is impacting the economy as states and localities weigh halting economic reopenings. The surge also seems to be impacting consumer behavior as new cellphone data reveals that fewer consumers are patronizing businesses in states that are seeing a rising COVID case load. Many experts are now reconsidering the country’s growth trajectory for the rest of the year, with Goldman Sachs reducing its third-quarter GDP outlook by eight percentage points due to concerns of the increasing virus cases. The uncertainty around economic reopening has put a shadow on last week’s positive jobs report in which the economy added 4.8 million jobs and the unemployment rate fell to 11.1%, marking the second-consecutive month of growth.