The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

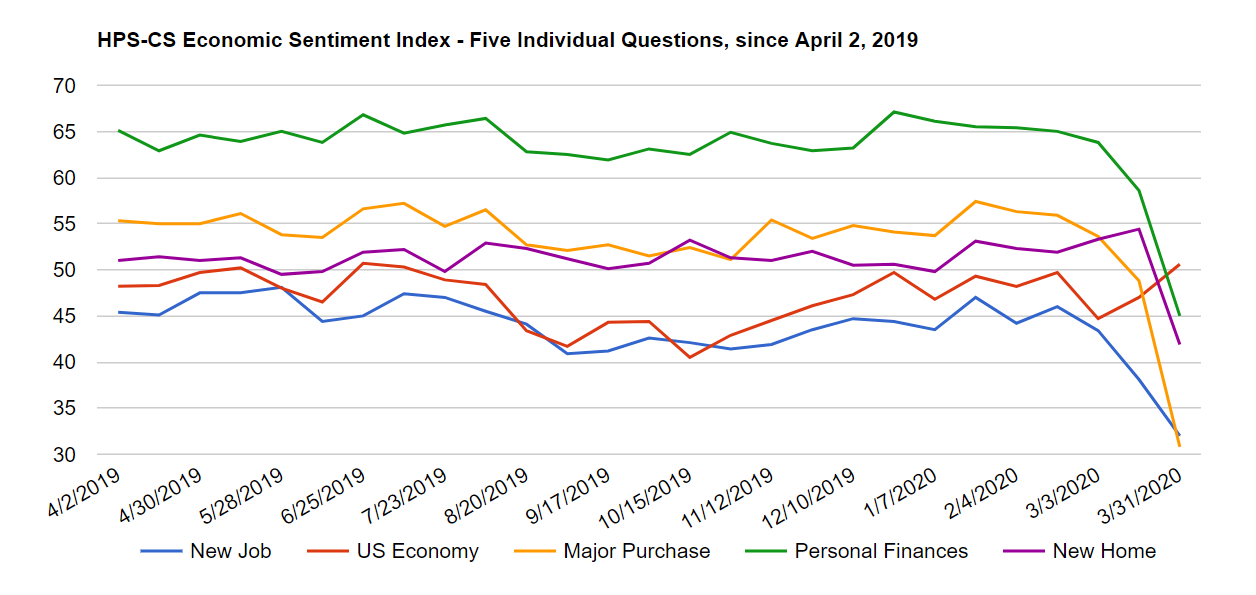

Amid record stock swings, unemployment claims, and increasing state-mandated stay-at-home orders, the HPS-CivicScience Economic Sentiment Index (ESI) plummeted 9.3 points over the past two weeks to 40.1. This is both the largest-ever two-week drop and the lowest-ever recording in the ESI’s history. The decline was led by staggering drops in confidence towards making a major purchase and personal finances, with both hitting record lows.

Four of the ESI’s five indicators fell over the past two weeks. Confidence in making a major purchase fell by 18.0 points to 30.8, the sharpest decline and lowest level in the history of the ESI. Confidence in personal finances also fell at a staggering rate, dropping by 13.6 points to 45.0, both record lows. Confidence in the housing market ended its month-long rise, falling 12.5 points to 41.9. Following record-high jobless claims, confidence in the job market also experienced a dip, falling 6.1 points to 32.0. Confidence in the U.S. economy was the sole indicator to rise, increasing on the heels of the passage of the $2 trillion CARES Act.

The massive decline follows a month of slumping confidence and comes amid new data revealing the economic fallout of the COVID-19 pandemic. Wall Street had its worst quarter since 2008, and Main Street is also struggling as states across the country continue to implement stay-at-home orders , closing all non-essential businesses. To help alleviate these economic impacts, the U.S. government has pledged to inject nearly $6 trillion into the economy through the CARES Act and Federal Reserve action.

Check out the full reading.