The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

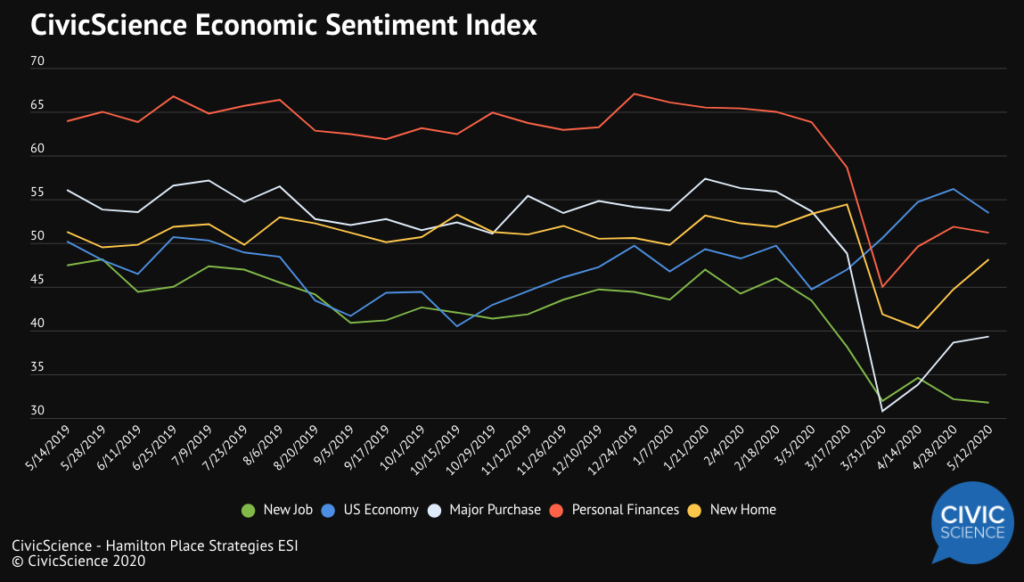

Consumer sentiment leveled out over the past two weeks following April’s uptick of confidence. The HPS-CivicScience Economic Sentiment Index (ESI) only rose 0.1 points to 44.8 during a two-week period where states and the federal government began making plans to reopen the economy. The plateau in confidence was driven by drops in three categories, including confidence in the job market, which reached a historic low days after the country’s unemployment rate jumped to 14.7%.

Though overall confidence remained steady, there was substantial movement among the ESI’s individual indicators over the past two weeks. Confidence in the housing market increased for a second-straight reading, rising 3.4 points to 48.1. Also continuing to recover was confidence in making a major purchase, which increased 0.7 points to 39.3. Weighing the ESI down were dips in three other indicators; confidence in the overall economy led the decline, falling 2.8 points to 53.4, reversing a previous eight-week rebound. Also dropping were confidence in personal finances and confidence in the job market, which fell by 0.7 and 0.4 points, respectively, to 51.2 and 31.8. Confidence in the job market is now at the lowest level since the inception of the ESI.

Changes in sentiment come as April’s jobs data saw another jump in the US unemployment rate, which now stands at 14.7%, but may in fact be much higher. Countering these numbers was some positive economic news. The S&P 500 rose 3.5% last week, and the number of new requests for government-backed forbearance has slowed. More states began to ease lockdown measures over the past two weeks, and Americans report they see less of a risk in engaging in social activities.