A year and some change since Amazon’s acquisition of Whole Foods, the food retailer has had its ups and downs when it comes to perception. From changes to inventory causing empty shelves, to offering additional discounts for Prime members, the store has had its mix of press.

The customer experience at Whole Foods has definitely changed. For one, you feel like you’re in an Amazon store—Echos, and blue Prime signage everywhere. Now, there are more to-go items, deals of course, and potentially products you bought before now discontinued.

Of course, Amazon did report significant Q1 gains, all thanks to Whole Foods.

Recent press points to Whole Foods stealing customers from other grocery chains, where they can save big thanks to Amazon’s purchase of the natural foods giant. That is if they’re Prime members.

Though this recent study shows there’s more foot traffic in a select group of stores, where does favorability around the shopping experience stand? Does more foot traffic mean higher favorability? And are people really saving that much money?

CivicScience weighs in with their research.

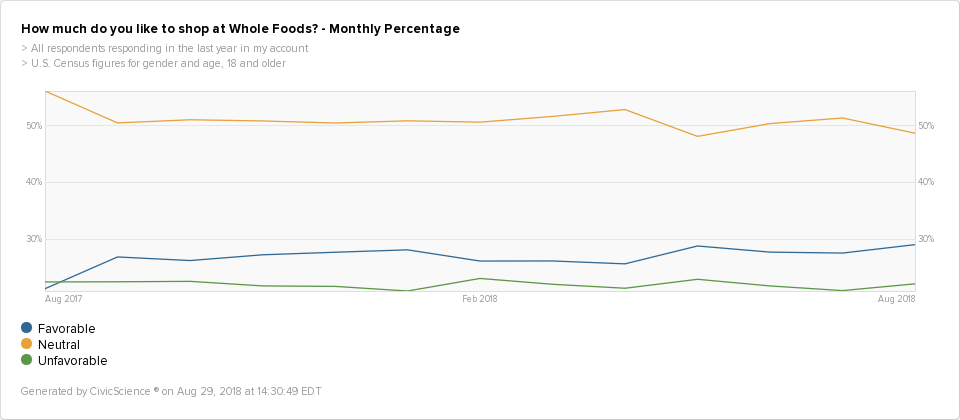

CivicScience has been tracking favorability to shopping at Whole Foods (and thousands of other retailers) with over 40,000 respondents in the past year. In January, CivicScience reported that favorability to shopping at the store hadn’t budged since Amazon swooped in. The thing is, the same goes for now:

Showing the monthly favorability index for the past year, favorability has had only small gains, most notably in the last month.

Is this to be expected? We can see that in August of last year, favorability grew likely along with the Amazon news. So, are the deals in the store really drawing in more shoppers?

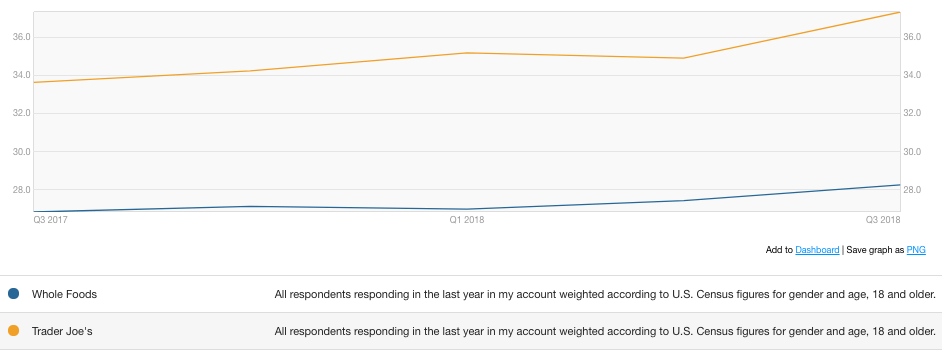

The recent research specifically named Trader Joe’s as losing customers within a mile radius due to better deals at Whole Foods, but CivicScience shows that may not be the full picture.

Among over 40,000 U.S. adults aware of both stores, CivicScience found that while favorability to both chains is at least growing slightly, it’s growing faster with Trader Joe’s. It also shows that Trader Joe’s is more popular with the general adult population, to begin with.

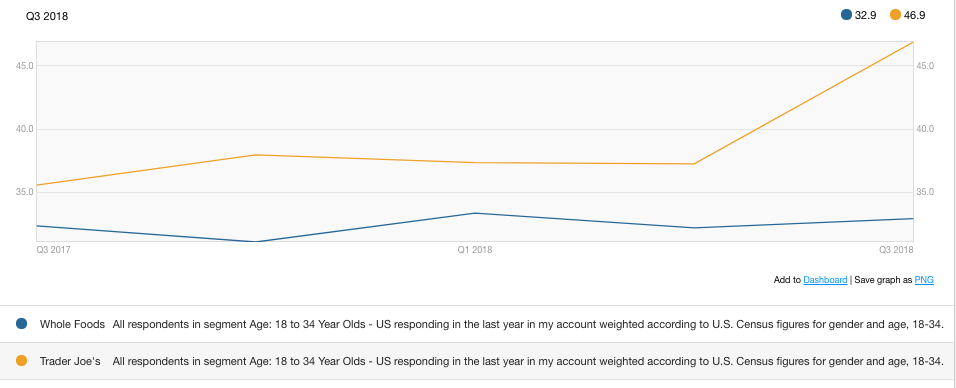

Which age group is driving it? It could be 18-34 year-olds. Among Millennials aware of both stores, Trader Joe’s favorability is outpacing Whole Foods’ with this age group (orange line). Of course, favorability isn’t shopping, but it’s important. It’s definitely worth noting that its grown more than 10 percentage points with a very influenceable (and potentially less wealthy) subset of the population, so maybe Trader Joe’s really is still a big competitor.

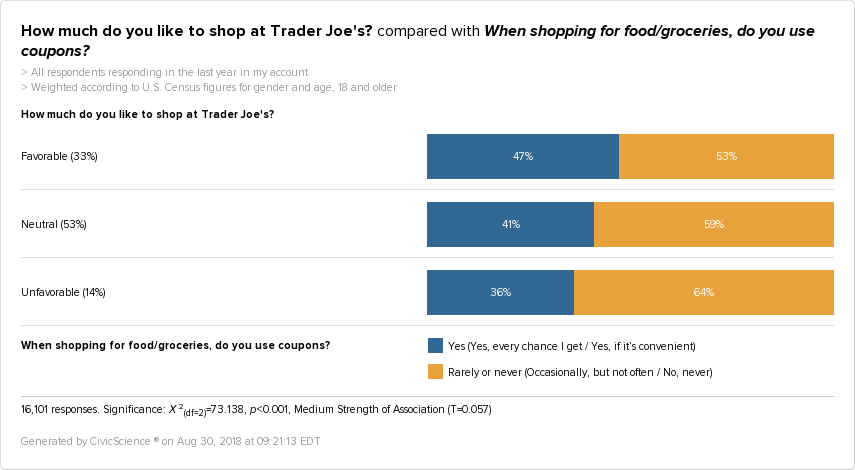

Looking at Trader Joe’s fans with shopping habits, the chart below does highlight that favorable Trader Joe’s shoppers are more price-sensitive than those unfavorable to it.

It also shows that Trader Joe’s shoppers use coupons a lot more than those who are unfavorable.

So, one, is Trader Joe’s losing favorable consumers? It appears they are gaining them. Two, the study linked to above only comprised a subset of stores in a certain radius of Trader Joe’s, and three, are the deals Whole Foods now offers really deals for those who are price-conscious?

While Amazon will likely expand and add more stores to fill the gap, and certainly have huge gains in market share, they should still keep in mind that store experience counts towards growing its consumer favorability and could eventually impact revenue. It’s a wait-and-see situation, as always