The Gist: Although 80% of American adults view homeownership as a positive investment, there is a smaller group that view it in a negative or neutral light. Those who are skeptical of the benefits that accompany home ownership tend to be younger and/or African-American.

QUICK HISTORY

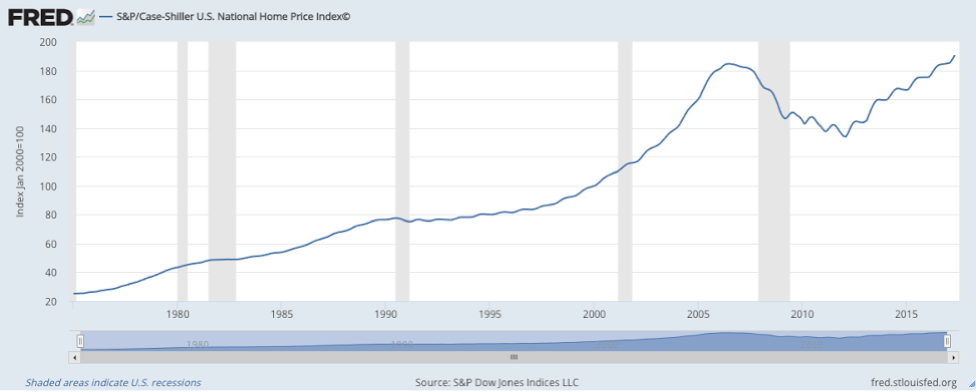

The old adage by Mark Twain says, “Buy land, they aren’t making it anymore!” Over the past 100 years or more, residential real estate has been a profitable and safe investment, despite periodic declines. Even a hedge fund manager who made billions of dollars betting on the mortgage collapse and resulting financial crisis of the Great Recession stated, “I still think buying a home is the best investment any individual can make.”

PRESENT

Despite the slew of anecdotal quotes and historical data, there seems to be a disconnect among younger generations relating to the investment value of home ownership. In particular, Millennials, who witnessed or suffered hardship during the Great Recession. Those stark memories coupled with student debt and the rising cost of living might be fostering a mentality change not seen since the Great Depression. Given the current and growing consumer buying power of Millennials, I wanted to quantify if a disconnect truly exists.

RESULTS

When analyzing the results, four demographics stood out beyond the topline results: age, education, ethnicity, and income.

OVERALL RESULTS

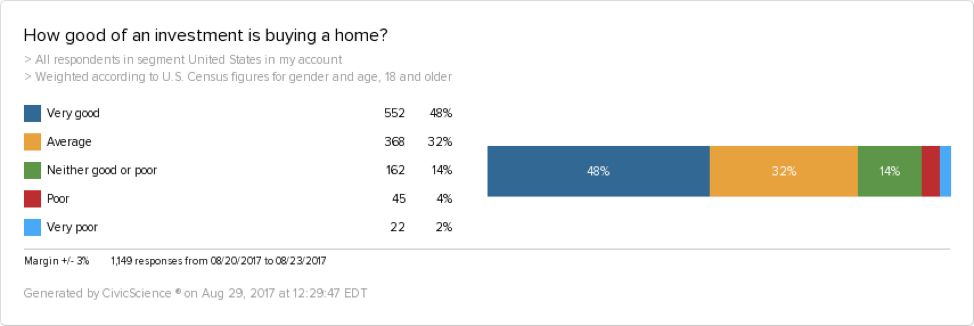

Approximately 80% of respondents still view home ownership as a positive investment.

AGE

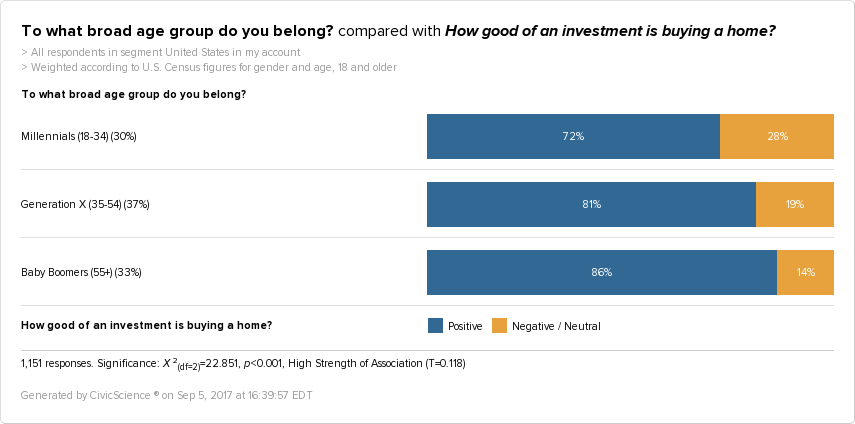

28% of Millennial respondents view home ownership as a poor or neutral investment, compared to only 19% of Gen X respondents, and 14% of Baby Boomers.

EDUCATION

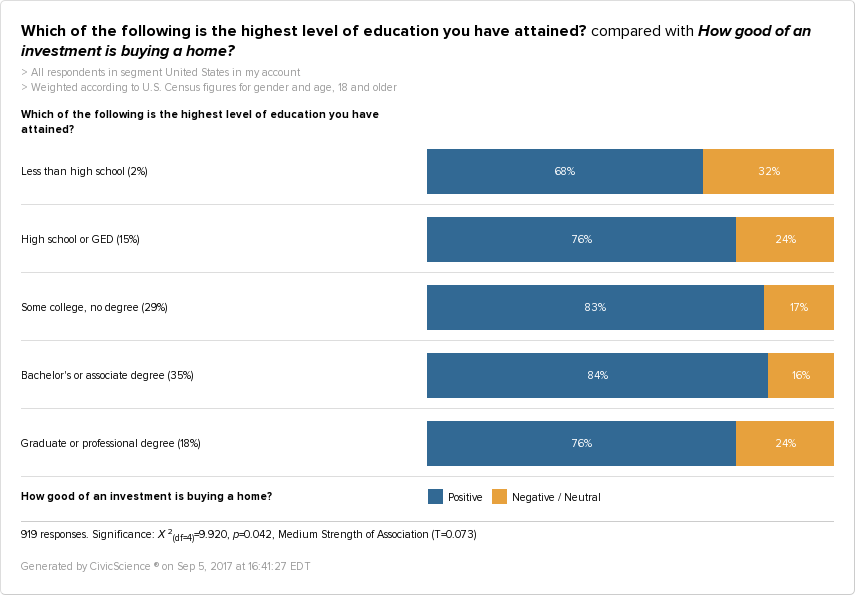

The Education segmentation is not overly prescriptive, but what I did find interesting is that respondents with a high school diploma or GED, those with less than a high school diploma, or those with a Graduate / Professional level education, were more likely to view home ownership negatively or indifferently.

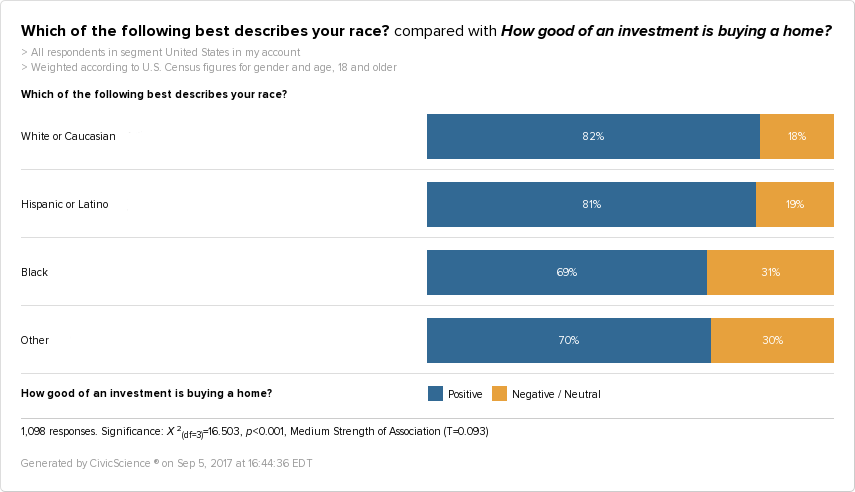

ETHNICITY

When the data is broken down by ethnicity, we find that African-Americans are more likely to view home ownership negatively or indifferently, as well as those identifying as other than African-American, Caucasian or Hispanic.

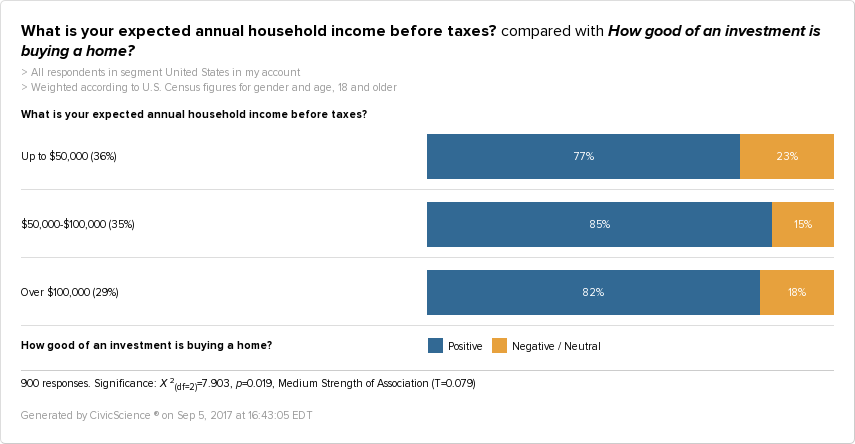

INCOME

The data broken down by income shows that those who earn less than $50,000 are more likely to view home ownership as a negative or neutral investment.

CONCLUSION

The good news for those concerned with declining rates of home ownership is the aggregate data shows that the majority of Americans still view home ownership as a positive investment. However, when you break down the results into certain segments, you notice a different story emerging. In particular, Millennials and African-Americans are far more likely to view home ownership as a negative or neutral investment. Additionally, when you view the segments of education and income (potential proxies for each other), they tell a similar story as well.

SO, WHAT?

In a time when the status and size of minorities are changing each year, where Millennial buying power grows daily, and where individuals increasingly pursue higher degrees or are priced out of higher education completely, banks and FinTech firms should take notice of this changing landscape.