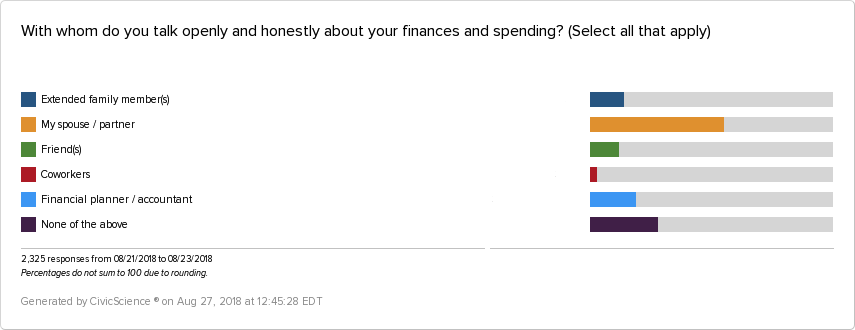

Money talks, but do U.S. adults talk money? CivicScience polled just over 1,700 respondents on the topic of who people are openly and honestly talking with about their money and spending.

In a select-all style question, the top line results are as follows:

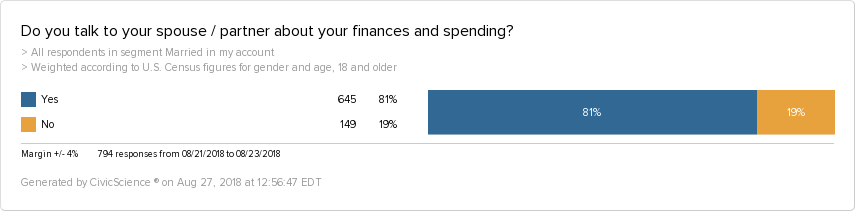

Though the top line data show the most popular answer was “My spouse / partner,” that doesn’t mean married adults are being forthcoming about money in the bank or their latest purchases.

Marriage and Money

Segmenting the poll with CivicScience’s existing marital status question, 19% of married respondents do not talk money with their spouse. You could look at this as half empty or half full:

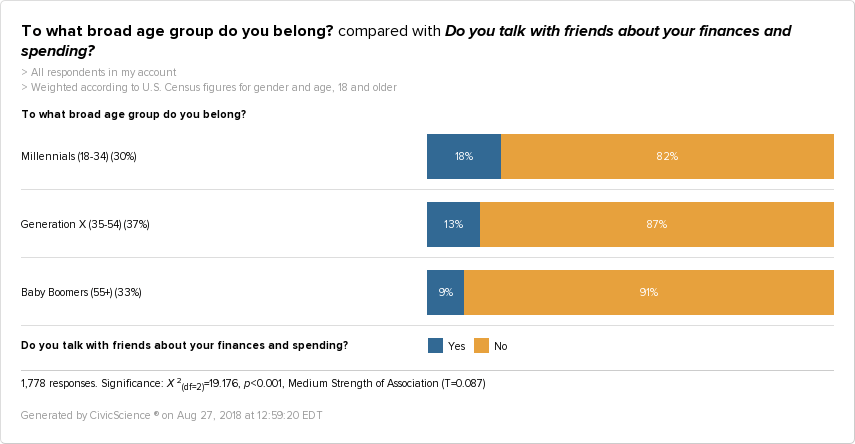

Friends and Finances

Moving on to the “Friends” option, CivicScience found that the younger a person is, the more likely he or she is to talk with friends about money, with Millennials in the lead. Of course, Millennials are less likely to be married and not to have a spouse to talk about finances with, but regardless they are broaching the topic with their peers at a higher rate than other generations.

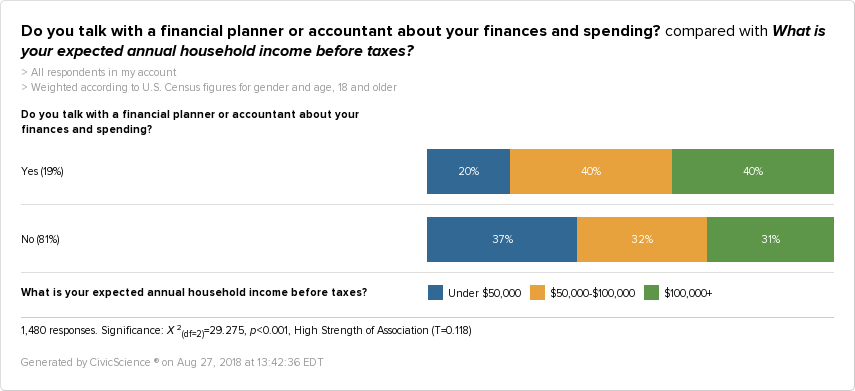

Consulting a Professional

Looking at the 18% who talk with an accountant or financial planner about their funds, it seems that those with more money are more likely to talk to professionals about it, while those who make less and may be in need of help with their finances and may not have resources to do so aren’t.

This does not come as a surprise at all, but it may be a clear indicator of why some may not talk with professionals (ie: it costs money) and could be part of the disparity, to begin with.

Going at it Alone

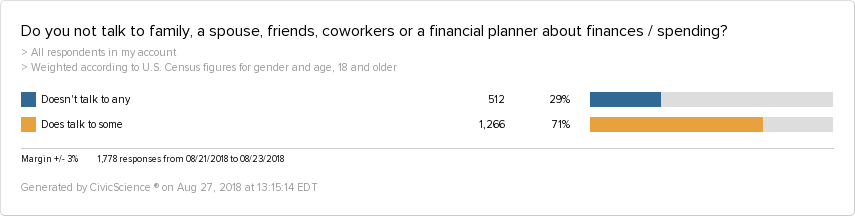

29%—a not so small portion of U.S. adults—aren’t talking to anyone about their money.

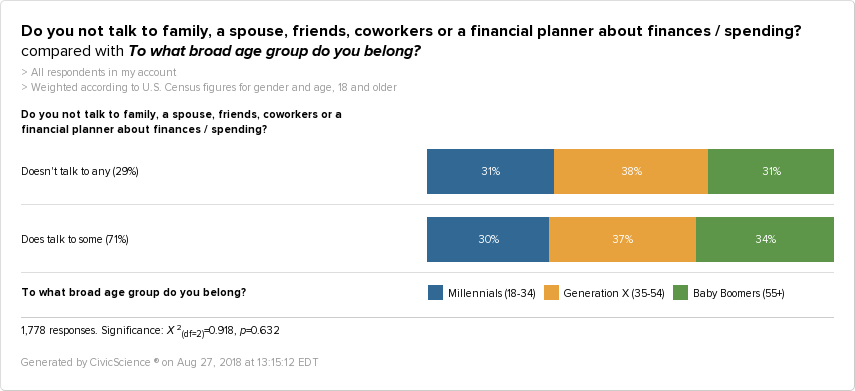

Though there’s somewhat of an even playing field among the age groups, Gen Xers make up the largest portion of those who don’t talk about finances with anyone.

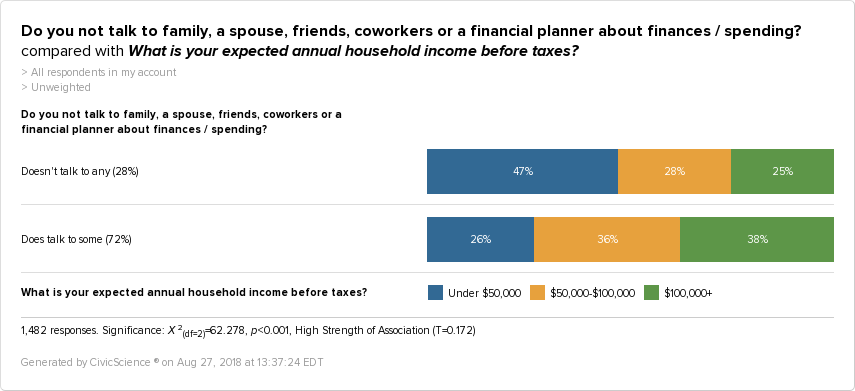

Looking at income vs. talking about money. It’s no surprise that CivicScience research found a trend.

Nearly half of those who do not talk with anyone about their personal finances make the least amount of money.

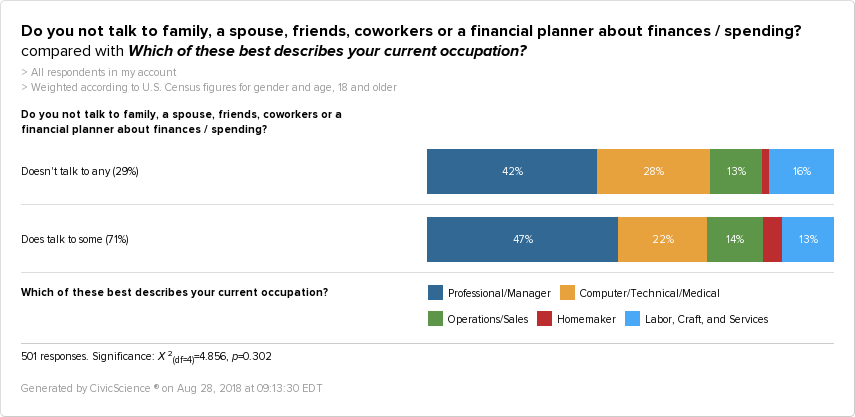

Comparing industry with this question, those in professional roles are more likely to talk to people about their finances, while those in labor, craft and service occupations, as well as computer and technical jobs, are more likely not to.

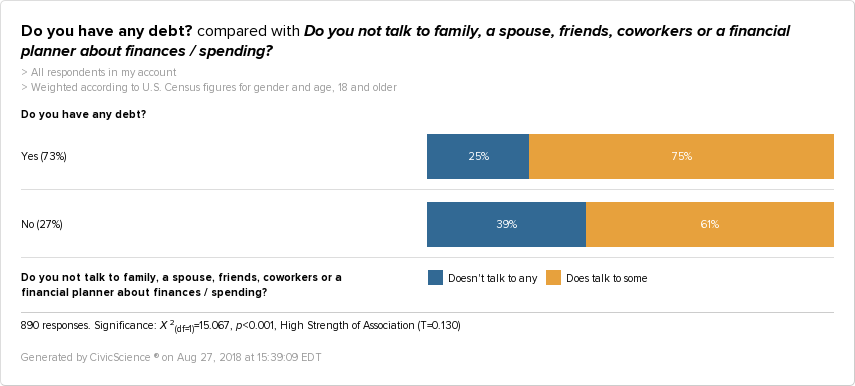

Looking at those who do not talk at all about money vs. debt, CivicScience data revealed something unexpected, highlighted in the graph below.

Those whose lips are sealed about their finances are more likely to not be in debt of any kind. Could be that those in debt are asking for advice or are trying to stick to a budget by consulting others.

Whoever adults end up talking about their finances with, it’s clear that Millennials are taking the lead of opening up the conversation with friends, which could stoke the conversation of wage transparency and equality for future generations—not to mention helping each other make smarter financial decisions. They at least may make the topic less taboo.