The digital natives are coming of age. With smartphones in hand, the last of the Millennials have made their way to college or into the workforce. Like Baby Boomers in their prime, they are on track to become the largest generation in the U.S., as early as next year. However, Millennials couldn’t be further from their Boomer parents.

Research compiled from the Bureau of Labor Statistics shows that Millennials are spending less compared to the 25-34-year-olds of the late 1980’s in many key areas, including entertainment, apparel, and homes. Instead, significantly more of their paychecks go to healthcare, rental properties, and of course, education.

A cocktail of factors, including slowed GDP, stagnating wages and trends towards minimalism and social consciousness undoubtedly feed into decreased and selective spending habits. Even so, the cold hard statistics surrounding student loan debt are impossible to ignore. Right now, student debt collectively totals $1.5 trillion and counting, which is shared in part by an estimated 37% of Millennials under the age of 30, according to the Pew Research Center.

That begs the question — to what extent is student loan debt stunting Millennial spending?

Postponing the Dream Home

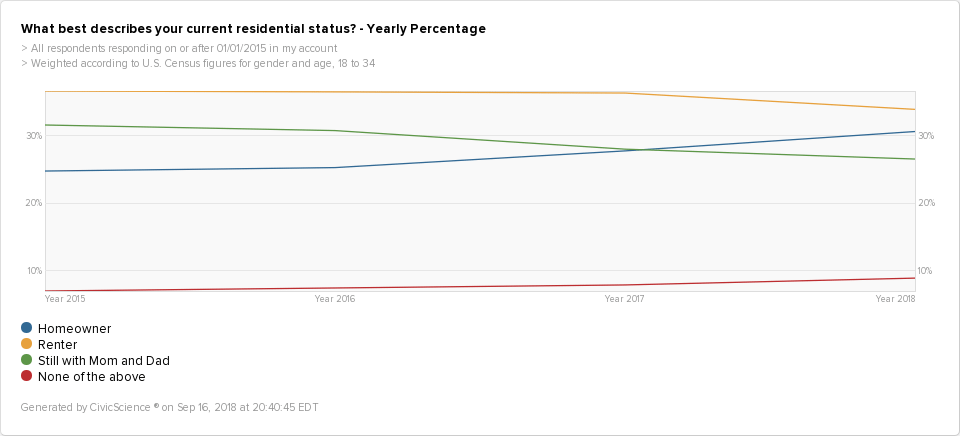

Consider one of the biggest investments that a young person will make once they’ve entered the workforce, and one that ushers them into the next stage of life — buying a home. In a survey totaling more than 220,000 respondents, CivicScience found that home buying among Millennials is on the rise, up six percentage points since 2015, while renting and living at home has fallen.

The increase is largely due to older Millennials ages 30-34, further corroborating the story that Millennials are buying homes much later in life than previous generations did. Even so, survey findings show that the majority are not homeowners; only 47% of 30-34 year-olds own homes, followed by 29% of 25-29 year-olds and 10% of 18-24 year-olds.

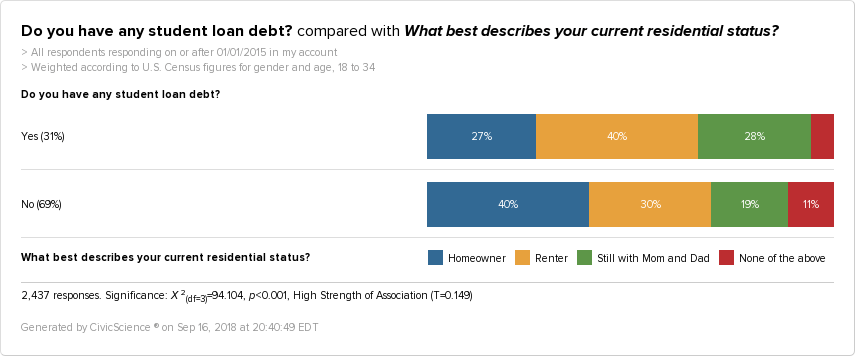

How does student debt factor in? CivicScience found that having student debt decreases the likelihood of owning a home by 32%. Only 27% of Millennials with student loan debt said they own homes, compared to 40% of those without student loan debt.

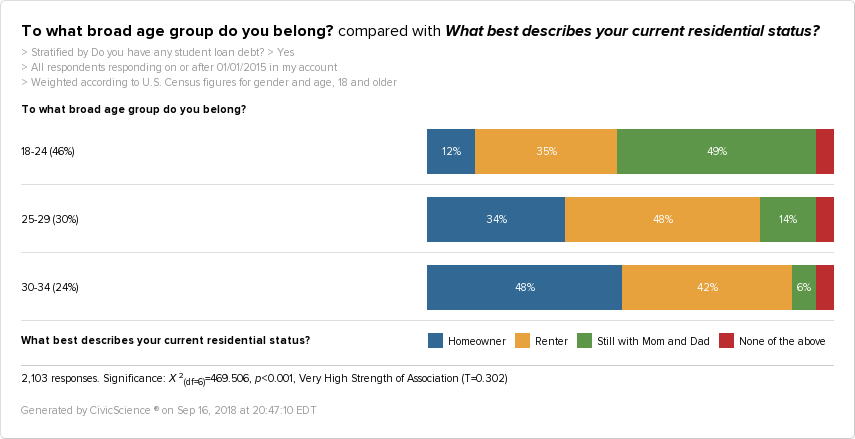

It’s reasonable to assume that this difference could be exacerbated by young Millennials in college — they have more student debt and aren’t likely to buy homes. That’s true to an extent. Student debt becomes less of a factor among 30-34-year-olds, but the decision of 25-29-year-olds to buy homes may be more heavily impacted by having student debt.

Millennials with No Student Loan Debt

Millennials with Student Loan Debt

Of course, student loan debt isn’t the only type of debt squeezing Millennials. 33% of Millennials say they have credit card debt, and those with credit card debt were more likely to also have student loan debt than those without it, and vice versa. However, credit card debt alone doesn’t have the same relationship to home buying that student loan debt has. Survey results show that Millennials with credit card debt are more likely to own homes than those without it.

Student loan debt plays a more significant role in a Millennial’s ability to invest in a home, as well as restrict other purchases and make life-altering decisions. In a related survey of 1,470 U.S. adults, 42% of Millennials report that student debt has affected decisions related to making major purchases, buying daily necessities or making career choices. More Millennials (16%) say that student debt has affected more than one of these, while 14% say it’s mainly affected major purchases.

Expecting that older generations are further along in their student debt repayment, it’s not surprising to see that Gen Xers and Baby Boomers aren’t as impacted. The annual cost of a public 4-year college has increased 250% since 1977, leaving the average student graduating with $37,000 in loan debt (according to some sources). Affected Millennials are hard-pressed to become the discretionary spenders their Boomer parents dreamed for them to be.

Don’t Sweat the Little Things

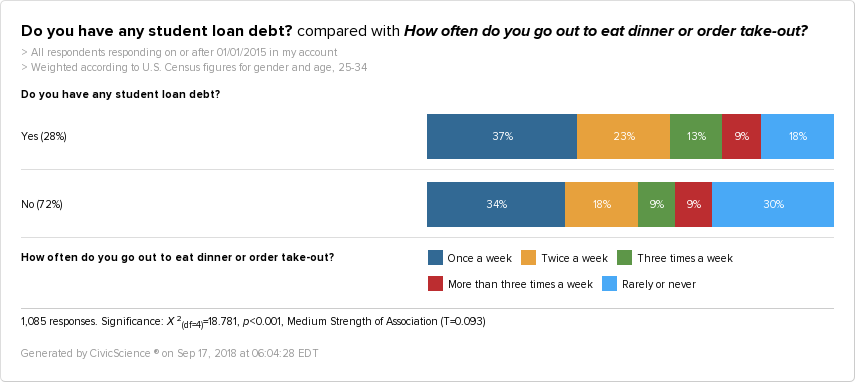

That said, there are some things that Millennials aren’t skimping on. They may be lagging in home ownership and spending less on apparel than older generations, but not so when it comes to Netflix subscriptions, going to the movies, and eating out or ordering takeout. Among 25-34-year-olds, who are more likely to be graduated and in the workforce, 37% say they go out to eat or order take-out once a week, which is on par with older cohorts. Those with student debt are slightly more likely than those without student debt to eat out/order takeout, despite data showing they make less money in general.

Perhaps poor money management skills are involved. Millennials with student debt are nearly twice as likely to claim they are bad with managing their money than those without student debt. But when it comes to money in the bank, savings, and investments, they aren’t necessarily doing as bad as they might think.

Findings indicate 14% of Millennials in debt have $25-$100K stored as liquid assets, and 55% have $25K or less, while 26% have none. Even though young people without student debt most likely have a higher combined wealth, they are still also more likely to have no liquid assets at all compared to those in debt.

There is evidence to suggest that Millennials are actually better savers than Gen Xers and Baby Boomers. But even if they gain traction with their debt load, will they still cling to more risk-averse spending habits as they age? Further complicating matters are statistics showing the traditional paradigm of higher education is changing. Research citing the National Center for Education Statistics estimates that 1 in 5 college students is at least 30 years old, which could further disrupt economic expectations.

Student loan debt is one piece of the puzzle when it comes to understanding Millennial spending and the shape of things to come, but it’s one that has the ability to affect major purchases like homes.