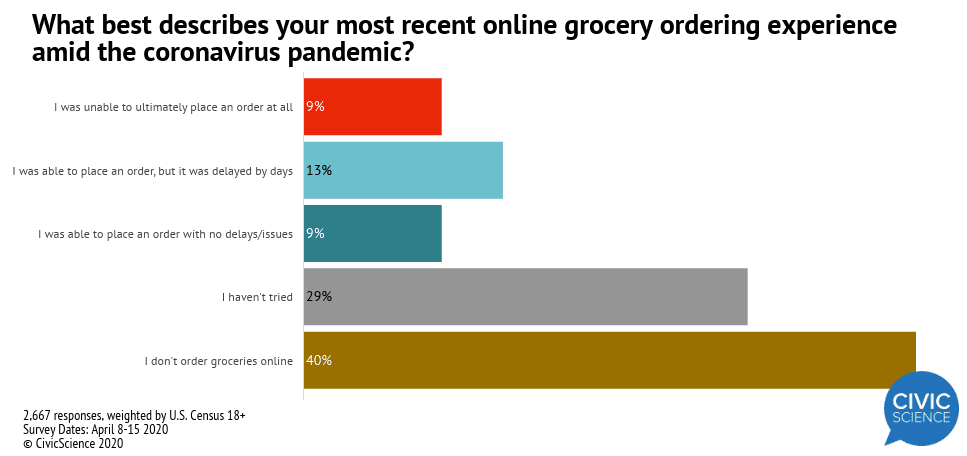

Grocery shopping online continues to prove difficult for more than 20% of the adult population, according to a CivicScience survey of 2,600 U.S. adults from the past week.

The survey, which found that 9% of the adult population says they were unable to place an order at all and 13% reporting delays, is consistent with numbers from the prior seven days.

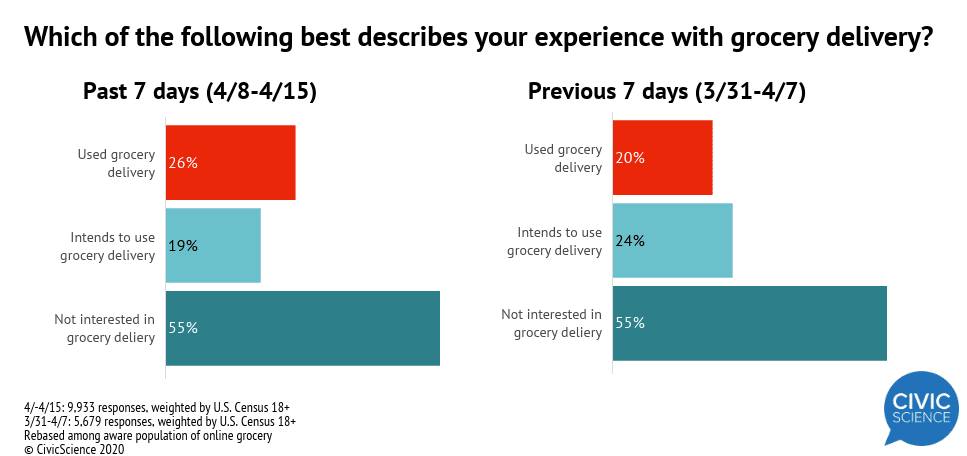

Looking at data from 9,900 respondents over the past seven days, 26% of the U.S. adult population (rebased among those aware of grocery delivery) reports having used grocery delivery, and another 19% intend to try it.

Reported use is up by six percentage points from the prior 7-day period.

What can we learn about people who have used, or intend to use, grocery delivery this week?

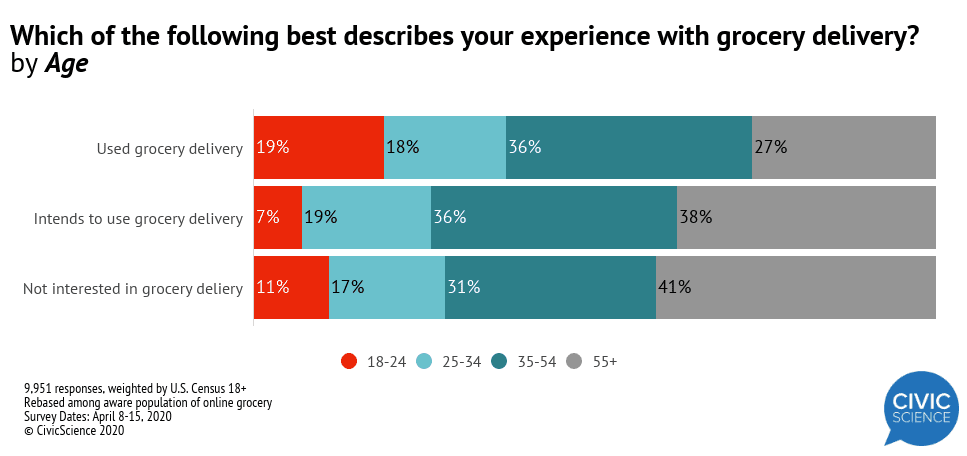

Gen Xers are most likely to report having used grocery delivery in the last 7 days. Baby Boomers and Gen Xers have the highest intent to do so as well.

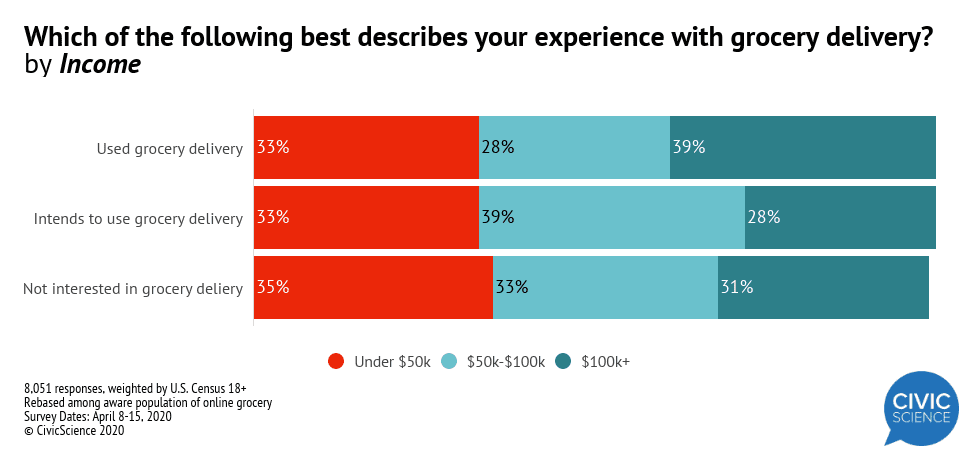

Use of grocery delivery is not heavily skewed by income bracket. While those who have used it in the last week are more likely to have an annual household income of $100k+, there is still substantial use from the other two income segments shown (33% from under $50k and 28% in $50k-$100k).

In the group of people who intend to use grocery delivery, we see the largest percentage coming from the middle income group ($50k-$100k). Money is not the driving factor for grocery delivery amid a crisis. We all need groceries.

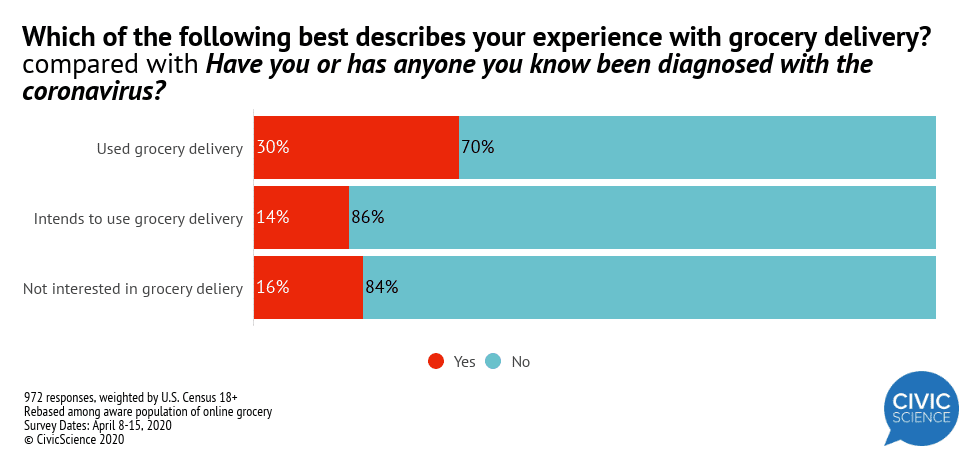

People who have used grocery delivery in the last week over-index considerably in knowing someone who has been diagnosed with the coronavirus. We have also found that younger people, as well as Facebook users, over-index in knowing someone or having been diagnosed themselves. The grocery delivery correlation makes sense, too.

Grocery delivery intenders are busy letting the next episode play. Grocery delivery intenders are the most likely to view TV programs via online streaming, while users of it are split. Those not interested in it, likely as they skew older, are more likely to tune into live TV primarily.

Grocery delivery is not going away, and in fact will likely become the new normal for some as the pandemic plays out, and even afterwards. CivicScience will provide reoccurring insight on this increasingly important category in the market.