The PNC-CivicScience Investor Sentiment Index (“ISI”) is a “living,” survey-based measurement of U.S. adults’ current attitudes and expectations related to the U.S. financial markets, investment climate, and market outlook. The primary goal of the ISI is to monitor changes in consumer and investor attitudes, to better anticipate investment trends, market movements, and overall U.S. economic health.

A Snippet of Our Latest Reading:

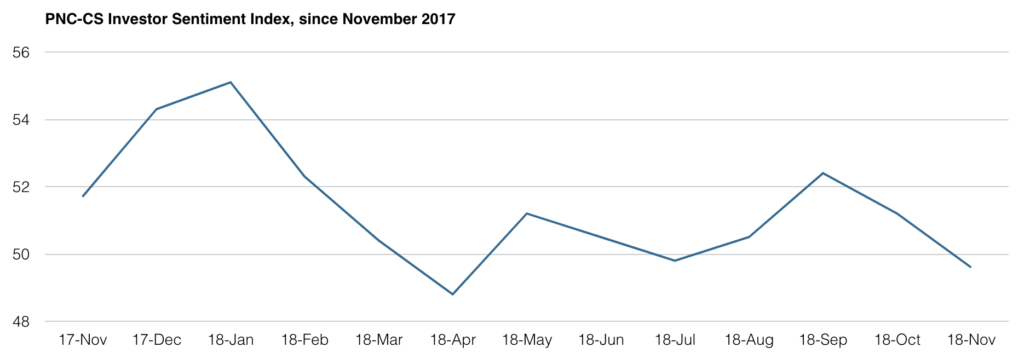

The PNC-CivicScience Investor Sentiment Index (PNC-CS ISI) ticked lower for the second straight month in November. Investor optimism, as measured by the poll, is only slightly above the 2018 low reached in April, and has been trending lower since making a year-to-date peak in September.

The November 2018 results reflect renewed concerns regarding the market and the economy, combined persistent uncertainty surrounding global trade, Brexit, the Chinese economy, and falling oil prices. These concerns have been reflected in financial markets.

In mid-November, the S&P 500® fell into correction territory (defined as being down 10% or more from a prior peak) for the second time this year. Not having experienced a correction since 2015, the market appears to be moving out of its multiyear volatility lull. With more than half of the S&P 500® constituents trading below their respective 200-day moving averages, the damage done during this correction has been far greater than what was experienced earlier in the year. During the January/February correction, approximately two-thirds of the S&P 500® stocks remained above their 200-day moving averages, giving the market far more support in its recovery.

Third-quarter earnings season is nearly complete. The S&P 500® saw a growth rate of nearly 26%. This marks the fourth consecutive quarter of accelerating earnings growth, and every sector generated positive results. Under the new Global Industry Classification Standard format, the Communication Services sector was a significant contributor to both earnings and revenue growth; however, the revenue upside surprise was among the lowest of any sector. Highlighting the recent challenges in internet-based stock prices, third-quarter earnings marked the first time Alphabet Inc. (GOOG), Amazon.com, Inc. (AMZN), and Facebook, Inc. (FB) all missed sales estimates in the same quarter since Facebook went public in 2012.