You can’t go a week without hearing about the current record-low mortgage and refinance rates amid the global coronavirus pandemic. And there’s a good chance you’ve noticed an influx of ‘For Sale’ signs around your neighborhood. CivicScience conducted surveys to understand who is taking advantage of purchasing a new home and refinancing their current one.

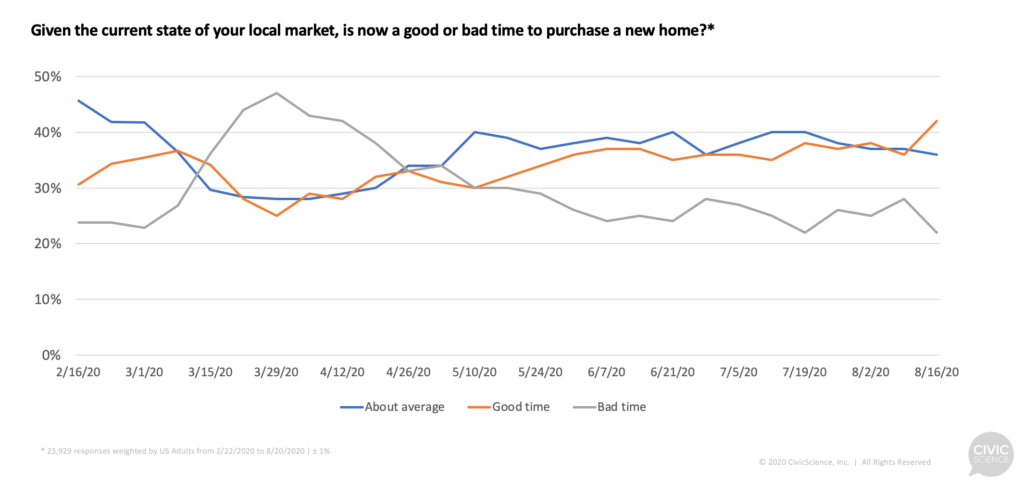

First, CivicScience has observed increasing optimism in American’s confidence in purchasing a home right now. Confidence in local housing markets has remained high over the past few months, showing greater optimism in recent weeks than seen even before the pandemic.

And, according to overall residential status data tracked by CivicScience, homeownership has gone up among U.S. adults over the last year. Though only a slight increase (63% vs. 66%) the data show that low interest rates have allowed people to become homeowners for the first time, and it’s made a notable dent in the residential status of the overall population.

Home Buying Amid the Pandemic – Seasoned and First-Time Buyers

Among those surveyed about their current status in home buying, 16% of Americans are either in the market for or have already purchased a home in recent months.

When rebased only by those who have already purchased recently or are currently in the market, we see that non-first-time home buyers are slightly more likely to have made a purchase during the pandemic or are looking now than new, first-time buyers. Still, first-time home buyers present a strong showing among the current buyers in both those who have bought a new home in recent months (15%) and those who plan to (25%).

Younger adults aged 18-44 are the most likely to have become brand new homeowners or be in the market for a house right now. The distinction between the two is that those in the older cohort –30-44 year olds– are more likely to be in the market to upgrade from their current home and buy a different house.

Due to social distancing, all of our lives have turned more towards our home lives to some extent. It makes some sense then that current remote workers are more likely than those still commuting to a job to be looking for a house.

Also quite notable is going at it alone. Among all marital statuses, single people who have never been married are reporting the highest rates of being in the market for their first home. This is an important trend, and perhaps an opening with lower interest rates, for the non-traditional home buyer. Things may be shifting, but the data did find that men are more likely than women to be looking for a new home, perhaps illuminating the gender pay gap.

Refinancing is for the Rich

An even bigger, more popular option for current homeowners right now is taking advantage of super low refinance rates. Twenty percent of surveyed homeowners have either already refinanced their home (9%) or plan to do so soon (11%).

Gen X homeowners ages 45-54 over-index as having refinanced or having plans to do so.

Current job status has interesting correlations to refinancing, too. People who are working reduced hours or with reduced pay as well as those who are working as usual or more have the highest incidence rates of already refinancing. Those who work remotely are the most likely to plan to refinance soon. Those who aren’t working and not getting paid are the least likely to refinance.

Consider that higher earners are more likely to take advantage of can’t-pass-up refinancing rates right now. Refinancing fees can be high. So while refinancing saves people a lot of money monthly, only the wealthiest American homeowners can really afford to do so.

Overall, the home buying and refinancing market is hot, and Americans have strong confidence in their local housing market. At some point, will it cool down? CivicScience will continue to report on consumer sentiment surrounding housing in the U.S.