More than two months into 2024, retail consumer shopping trends have begun to take shape as shoppers consider their personal finances, plans for the year, and economic expectations. A broad look at where U.S. consumers are shopping this quarter offers insight into where consumers are spending right now, as well as what factors are influencing their purchasing decisions and their retail spending plans for the months ahead.

Big-Box Stores Lead Among Both Online and In-Store Shoppers

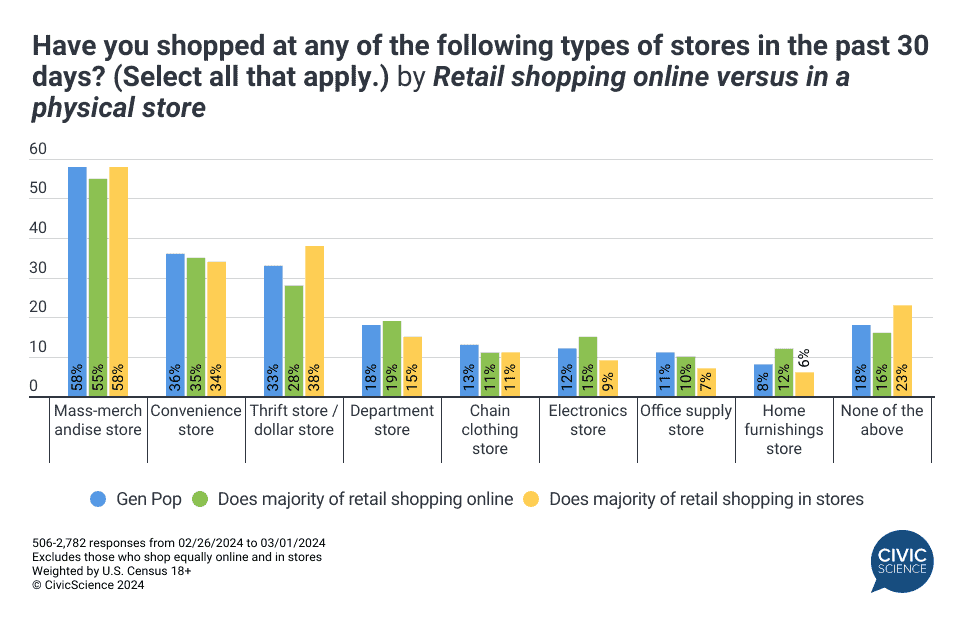

Unsurprisingly, big-box stores such as Walmart or Target were the most commonly shopped in the last 30 days, bringing in nearly 60% of the general population. That’s followed distantly by convenience stores and thrift or dollar stores such as Goodwill and Dollar Tree. People who say they do the majority of their retail shopping online were nearly just as likely as in-store shoppers to have shopped at a big-box store, likely making more of their purchases online.

However, there are key differences between where online and in-store shoppers are shopping. Online shoppers were six percentage points more likely than in-store shoppers to shop at an electronics store or a home furnishings store recently. They were also more likely to shop at a department store or office supply store. On the other hand, in-store shoppers were 10 points more likely to have visited a thrift or dollar store.

Join the Conversation: Do you prefer shopping at local or chain stores?

Gift-Buying for Events Is Driving Retail Shopping

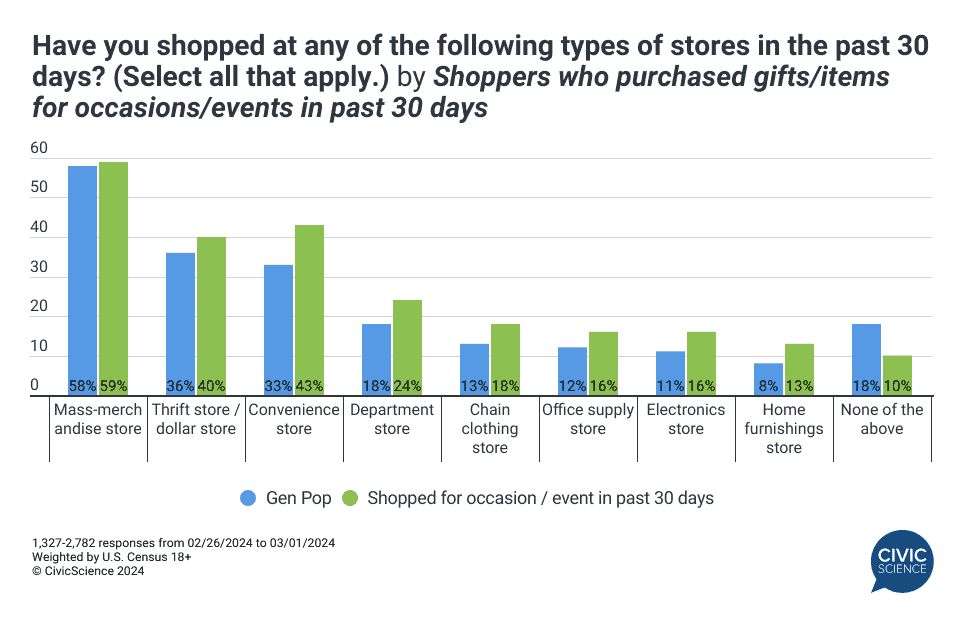

To what extent is shopping for special occasions, such as birthday parties, baby showers, and weddings, driving retail spending right now? Recent data find that 51% of U.S. adults say they have purchased gifts or other items for special occasions in the past 30 days, with birthday parties being the most common type of event to shop for. Consumers who have purchased items for a recent occasion or event are more likely to say they have shopped at all the following store types in the past 30 days.

Take Our Poll: Do you typically wait until the last minute to buy birthday gifts? 🎁

Nearly 4 in 10 Gen Z Consumers Expect to Spend More on Clothing

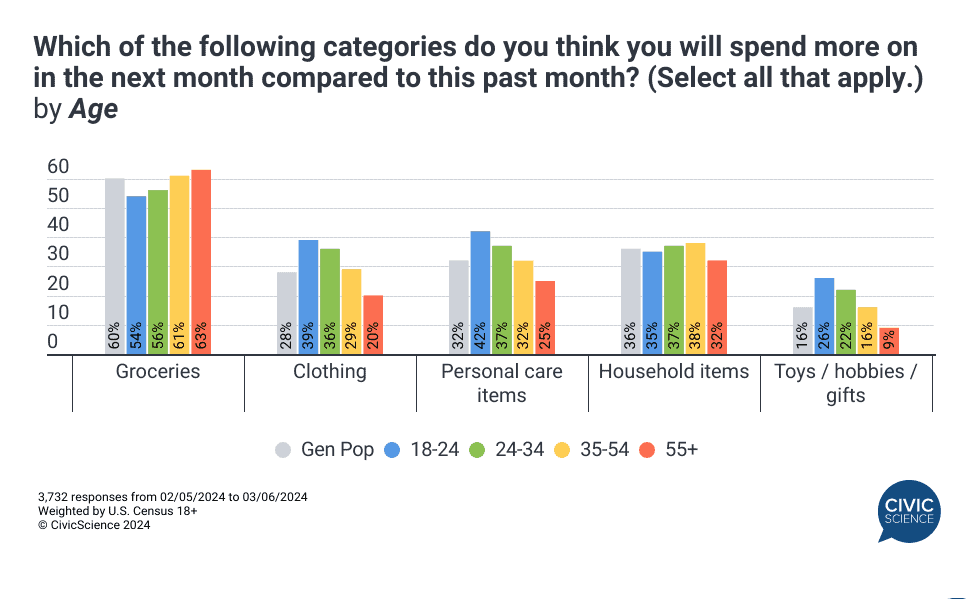

At the start of the year, Apparel was the leading category that consumers expected to spend less on in 2024, while Travel and Home Improvement were the top categories for anticipated increased spending. Consumer-reported data from Circana reveal a pullback in spending on apparel throughout 2023, which has continued into the first month of 2024.

As we head into the spring season, CivicScience consumer data show 54% of consumers expect to reduce spending on clothing, outweighing the 28% who say they will spend more on clothing in the next month. However, Gen Z adults and Millennials are making more room for apparel and anticipate spending more on clothing than older adults, as well as on personal care items and gifts.

Want to know how these trends impact your customers? Contact us now to see these trends through the lens of your customers.

CivicScience partners with a range of retailers to:

+ Detect unanticipated trends before they happen

+ React quickly to breaking news

+ Predict business and market performance

+ Pinpoint and conquest persuadable consumers

+ Activate and measure high-yield marketing strategies

Our range of clients:

“CivicScience surfaced the one game-changing insight that our army of analysts, consultants, and agencies couldn’t find.” David Feick, VP of Insights, T-Mobile