According to new data from CivicScience, buying furniture online (without first seeing it in a store) has gained momentum in the past two years. A recent survey of more than 3,300 U.S. adults found that 23% have bought furniture online and plan to do so again.

That’s an increase of 28% since 2018. Plus, intent is high, with 15% of respondents who have not purchased furniture online saying they are interested in doing so. Those numbers bode well for online furniture retailers, like Wayfair, Overstock.com, and even Ikea’s e-commerce offerings.

The question is whether or not the growth is the result of a natural progression of online shopping trends, or if it’s been spurred by coronavirus lockdowns? Now that more brick and mortar retailers are re-opening their doors, can we expect to see these numbers trickle off?

Remote Workers are Buying More Furniture Online

When looking at how online furniture buying correlates with feelings about coronavirus concerns, CivicScience data doesn’t reveal much difference between those who have and have not bought furniture online.

Online furniture buyers are slightly more concerned about being in public spaces and also slightly more likely to say it will take 4 or more months until they feel comfortable shopping in stores.

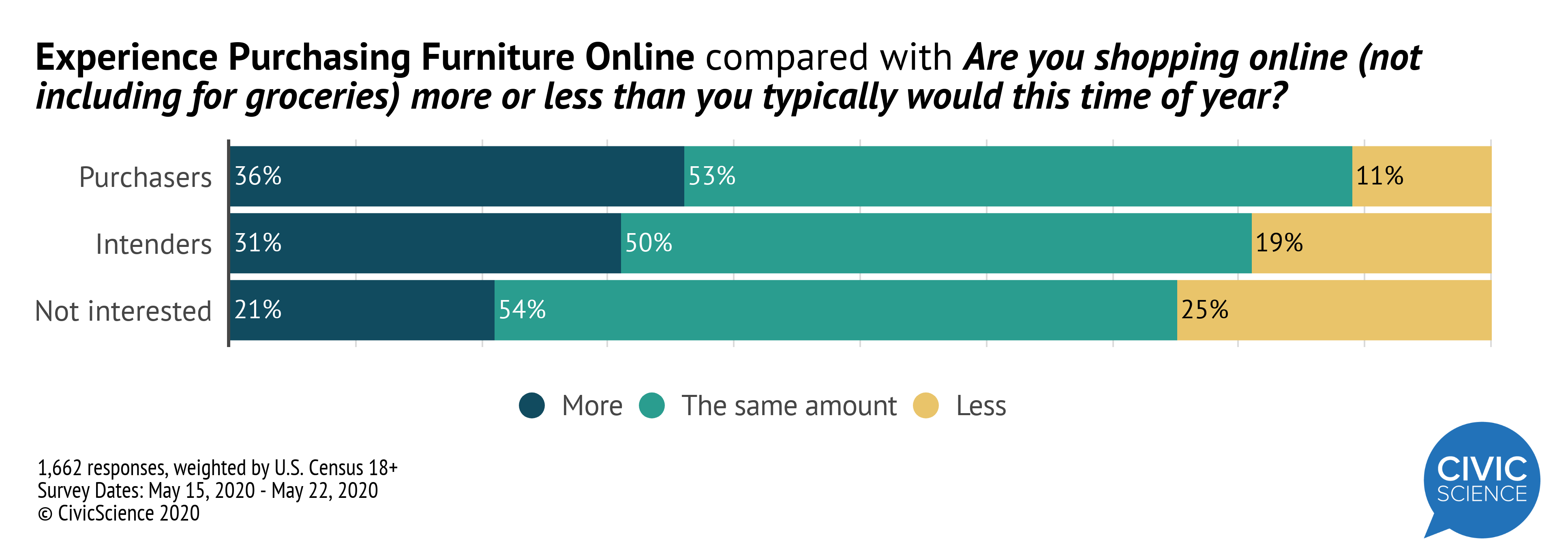

However, online furniture buyers are also more likely to say they are shopping more online (excluding groceries) than they typically would this time of year.

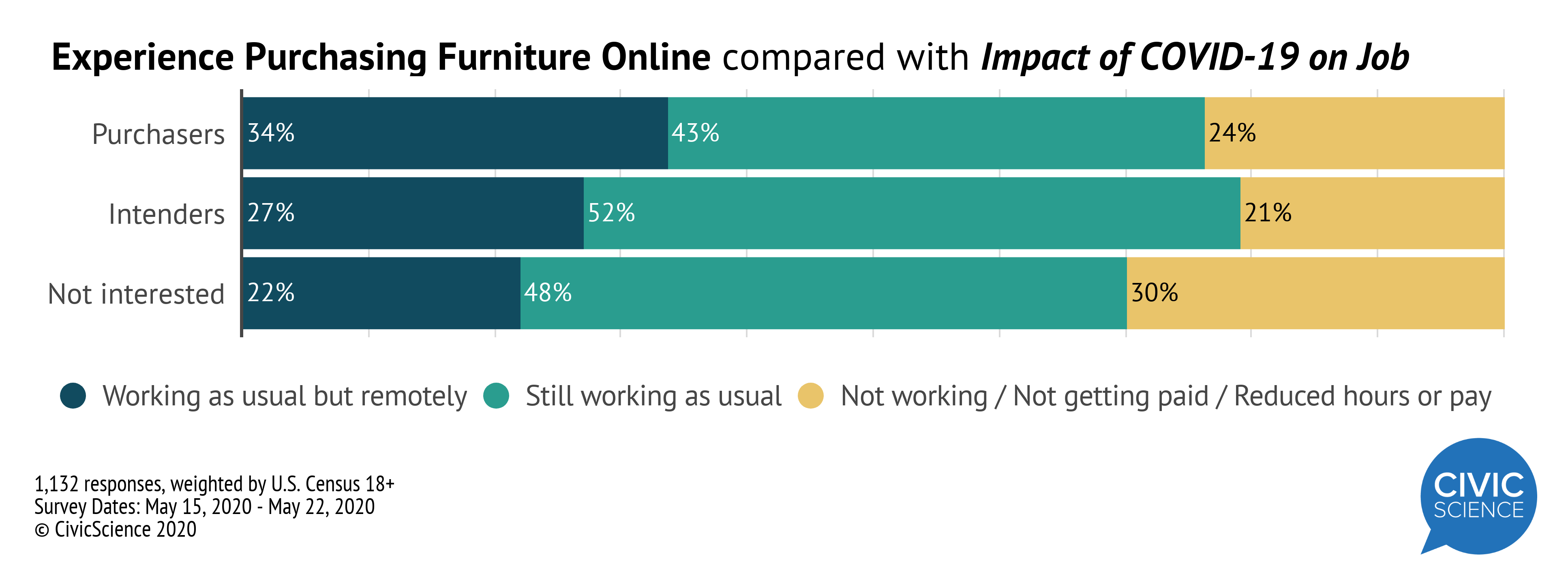

The most compelling insight comes from looking at how the coronavirus pandemic has affected job status. Over one-third of online furniture buyers have transitioned to working remotely. That’s significantly more remote workers than those who have never dabbled in online furniture buying and have no intention to.

Maybe remote workers needed to quickly furnish a home office or make changes to ambiance and organization, considering they would be spending most of their time in their personal space. Buying online has been for many the only option.

Millennials are Buying More Furniture Online

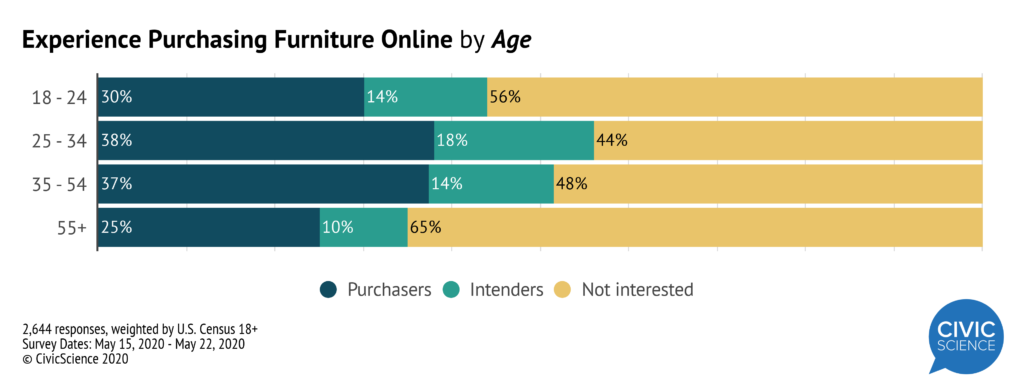

Age also plays a significant role. Online furniture buying has the greatest appeal among Millennial and Gen X age groups. In fact, Millennials have latched onto buying furniture online more than any other age group; those who bought furniture online and plan to do so again rose 31% from levels in 2018.

Other findings show that women, renters, and suburban and urban dwellers are also more likely to buy furniture online, as well as high-income earners.

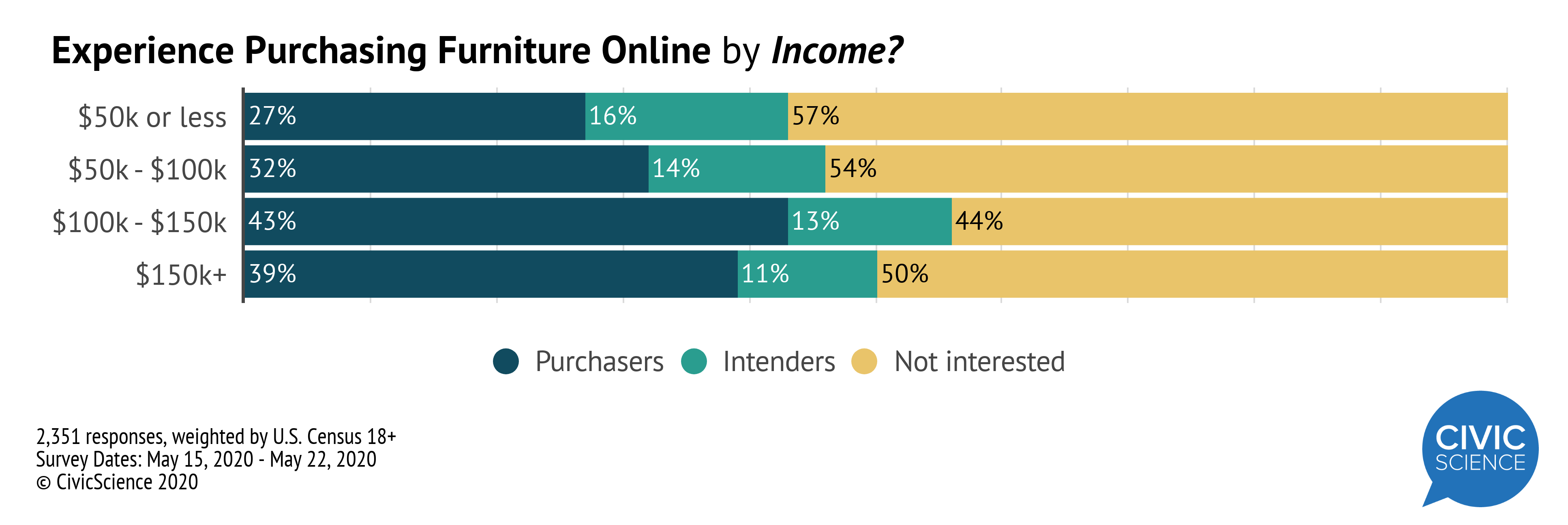

Buying furniture in general can be a costly endeavor, so it’s not surprising that higher earners are engaging the most with buying furniture online. The $100-150k income level seems to be the sweet spot for online furniture buying — 43% have bought furniture online, compared to 32% of $50-100k earners and just 27% of those earning below $50k per year.

How Brands Stack Up

When looking at a few of the most popular brands that sell furniture online — Overstock.com and Ikea — CivicScience tracking doesn’t show any change in brand favorability over the past two years.

However, the survey does show that Ikea has captured more of the market in terms of favorability among online furniture buyers, with 34% favorable to Ikea compared to 24% favorable to Overstock.

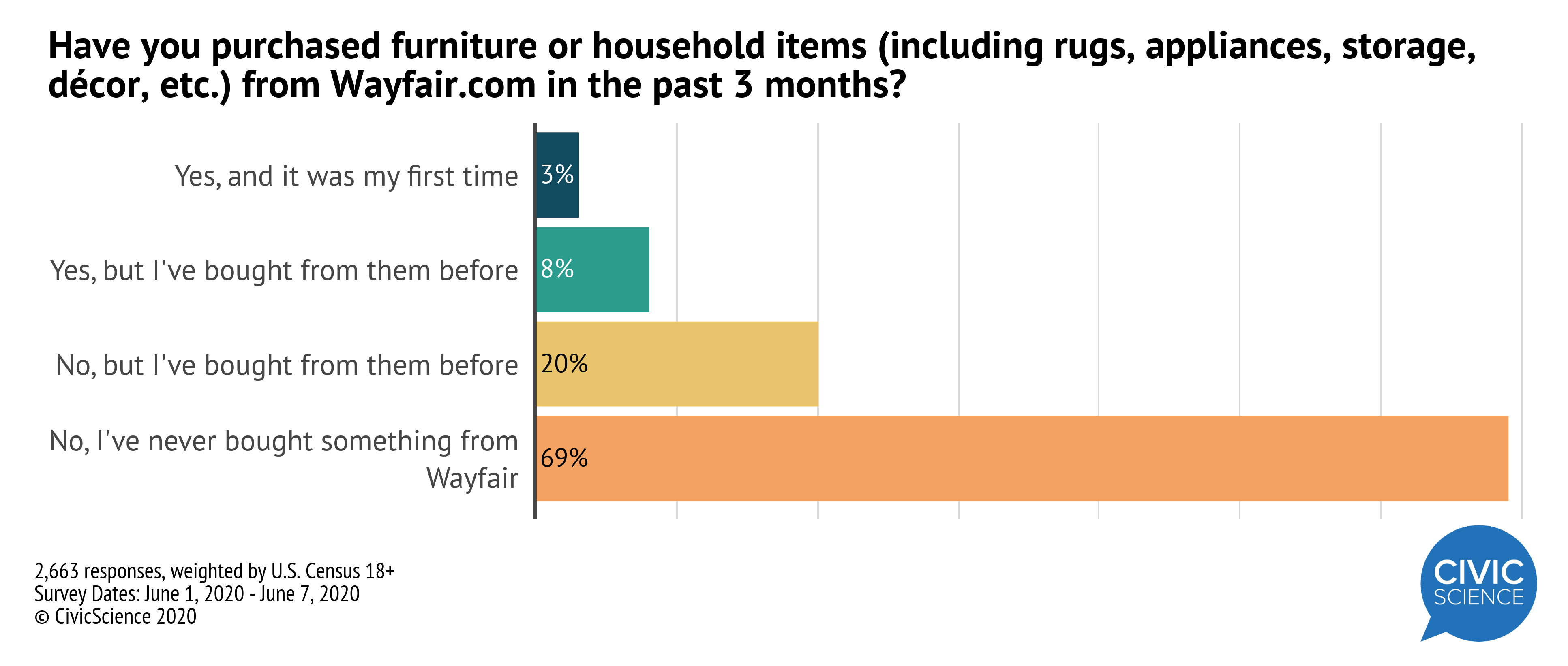

What about Wayfair, a popular online furniture re-seller which seems to be having a great ride at the moment? In the last three months, more than 10% of respondents made a purchase from Wayfair, of which 3% were first-time purchasers.

Augmented reality apps, such as Amazon AR View and IKEA Place, intend to make it easier to purchase furniture online by letting you virtually place a couch in your living room, for example. Interestingly, data show these apps haven’t seen an increase in usage over the past two years, indicating the online furniture buying trend may continue to grow regardless of the apps.

Augmented reality apps, such as Amazon AR View and IKEA Place, intend to make it easier to purchase furniture online by letting you virtually place a couch in your living room, for example. Interestingly, data show these apps haven’t seen an increase in usage over the past two years, indicating the online furniture buying trend may continue to grow regardless of the apps.

While we may have seen a jump in furniture buying as the result of the pandemic and people transitioning to working remotely, overall the survey results suggest that buying furniture online is poised to continue growing and Millennials are the age group to watch.