Well, it was certainly a less chaotic week on the business news front – and we aren’t going to touch the President’s Twitter follies with a ten-foot poll (get it?). But we never stop doing research. So here are a few of the noteworthy things we are seeing this week:

Economic sentiment toward the labor market and personal financial outlook took a dive over the past two weeks. Overall consumer confidence fell less than a point, largely because positive attitudes toward the housing market and major purchases kept things afloat. Ironically, on the same day we released our index, Bloomberg published their Consumer Confidence Index (CCI) for June, touting an “unexpected rise” in confidence due to a “buoyant” job market. Why the stark difference from our numbers? Because the CCI is based on a 4-week rolling average. Our aggregate numbers for June were very similar to the CCI; however, all of the gains came in the first two weeks of the month, with a steady (and continuing) decline in the past 10 days. I’ll say it again: These traditional survey-based economic indices cannot keep up with today’s hyper-sensitive consumer.

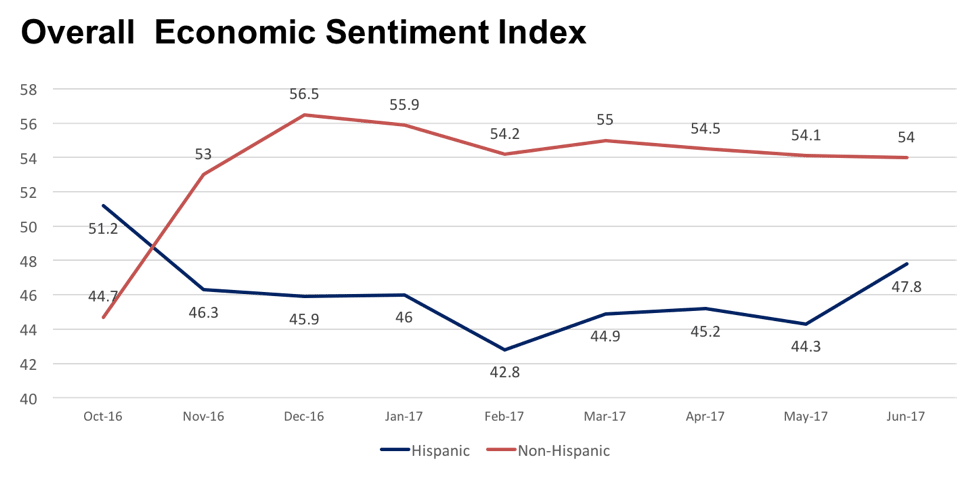

But consumer confidence among Hispanics is showing a remarkable rebound. It should come as no shock that economic sentiment among Hispanic Americans plummeted after the November election, bottoming out a month into the Trump Administration. This trend manifested itself in the form of depressed Hispanic consumer spending in the first quarter, particularly in areas like retail and restaurant. But, as you can see in the chart below, the numbers are improving at a remarkable pace. Expect this to be a harbinger of increased spending in the summer months. (Hat tip to our friends at Univision for helping us crunch these numbers).

The youngest U.S. consumers are reading the newspaper more. How’s that for a surprise? We’ve been doing deep-dive research into so-called GenZ (13-17y/o) consumers and came across this uplifting discovery. The number of GenZ consumers who say they habitually read a traditional newspaper in print or online every day has increased by 38% since 2015, the largest gains of any age cohort we study. As someone who has a soft-spot in his heart for newspaper journalism, this put a smile on my face.

The youngest U.S. consumers are reading the newspaper more. How’s that for a surprise? We’ve been doing deep-dive research into so-called GenZ (13-17y/o) consumers and came across this uplifting discovery. The number of GenZ consumers who say they habitually read a traditional newspaper in print or online every day has increased by 38% since 2015, the largest gains of any age cohort we study. As someone who has a soft-spot in his heart for newspaper journalism, this put a smile on my face.

Even if they bolster newspapers, GenZ is going to shake up the banking industry. Over 25% of GenZ consumers now say that they place greater trust in digital solutions like Apple Pay or PayPal than in traditional banks. That’s a full 25% higher than even the next youngest Millennial cohort. With the torrid pace of innovation in areas like payments and cryptocurrency, expect those percentages among GenZ consumers to accelerate before they slow down.

There are two kinds of people in this world: People who will let their auto insurers spy on them to save money and those who won’t. We’ve been studying the advent of ‘safe-driver’ devices, embedded in cars by insurance companies to evaluate driver safety, in return for lower insurance rates. The majority of Americans (53%) are creeped out enough by it to say no, regardless of the potential savings. 38% are willing to at least consider it, which is still a large number. Count me in the majority on this one.

Have a great, safe, and fireworks-filled holiday weekend.

JD