CivicScience captures over one million survey responses daily to turn real-time consumer insights into high-performing advertising. Learn how we drive measurable impact here.

With early holiday shopping at a six-year high, Gen Z has emerged as a critical segment for brands and advertisers. They’re nearly 60% more likely than the average American to have already started holiday shopping, with 53% of Gen Z adults (ages 18-29) reporting they’ve begun – a 33% jump from this time last year, and 51% higher than the Gen Pop average. They’re also 10pp more likely than the average American to say tariff concerns drive early holiday shopping to avoid potential price increases.

Early holiday shopping among Gen Z means advertisers who wait may risk missing this momentum. CivicScience’s real-time insights reveal how brands can seize this opportunity among this valuable segment:

The Current State of Gen Z Holiday Shopping

While mid-year industry forecasts point to decreased holiday spending among Gen Z overall, a significant percentage of young adults aged 18 to 29 are still looking to open their wallets more this year.

CivicScience’s early-season tracking (August and September) reveals a more nuanced reality: younger shoppers spend differently, buy differently, and adapt to economic pressures reshaping their shopping. Looking at both value and quantity makes the shift clear:

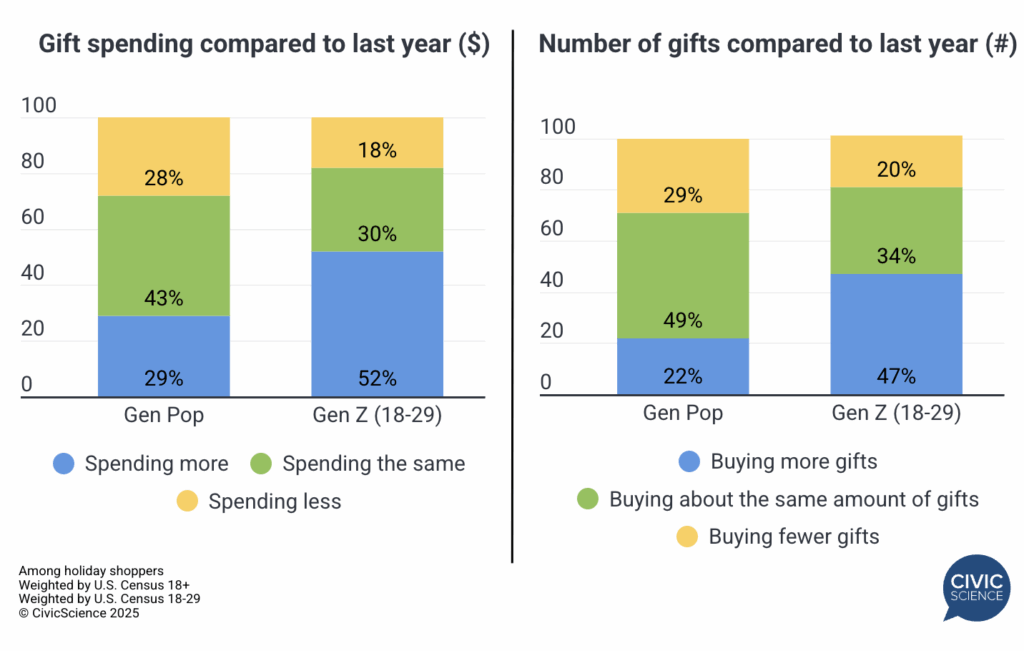

- Value: Over half (52%) of adults 18-29 expect to increase their holiday spending this year, compared to 18% who expect to spend less. Thirty percent report spending about the same amount as last year.

- Quantity: Rising prices are not the only factor driving the shift—47% of young shoppers say they’ll buy more gifts overall (over twice the rate of Gen Pop), and another 34% are buying about the same amount. Conversely, 20% of Gen Z shoppers are buying fewer gifts this year.

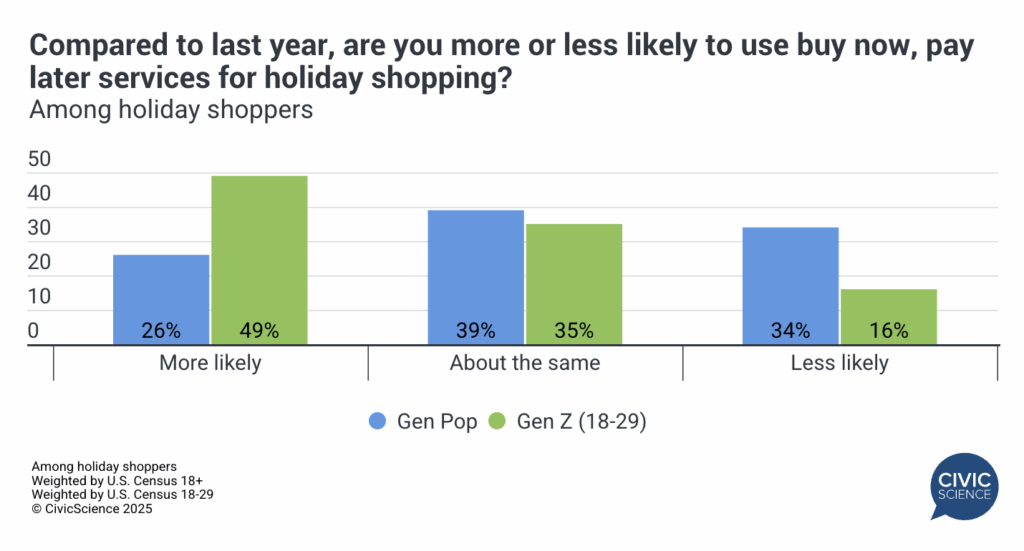

In addition to buying gifts for others, 54% of younger consumers also expect to buy a gift for themselves. However, there’s a tradeoff to their increased spend – Gen Z is 88% more likely than the average adult to say they’ll use Buy Now, Pay Later services more often than last holiday season.

Bottom Line: The early momentum among Gen Z suggests that marketers who wait risk missing out. But nuance matters: Gen Z is shopping earlier, more likely than other age groups to spend more, and buying more gifts – yet also leaning heavily on flexible payment options like Buy Now, Pay Later.

Answer our Poll: Do you typically start your holiday shopping earlier or later than most people?

Targeting Gen Z Holiday Shoppers

CivicScience data reveals not just who is shopping early (demographics) but also why they’re shopping (intent), where they prefer to shop (channels), and when they’re most receptive to messaging (timing) – insights that transform advertising effectiveness.

Gen Z shoppers spending more this holiday season have clear priorities: home goods and electronics/entertainment are tied at 26% each, followed by clothing/shoes/accessories at 21%. This differs from non-Gen Z big spenders, who prioritize apparel (-6pp) and electronics (-4pp) less than Gen Z. Understanding what they’re buying and how they prefer to shop within these categories creates more precise targeting opportunities.

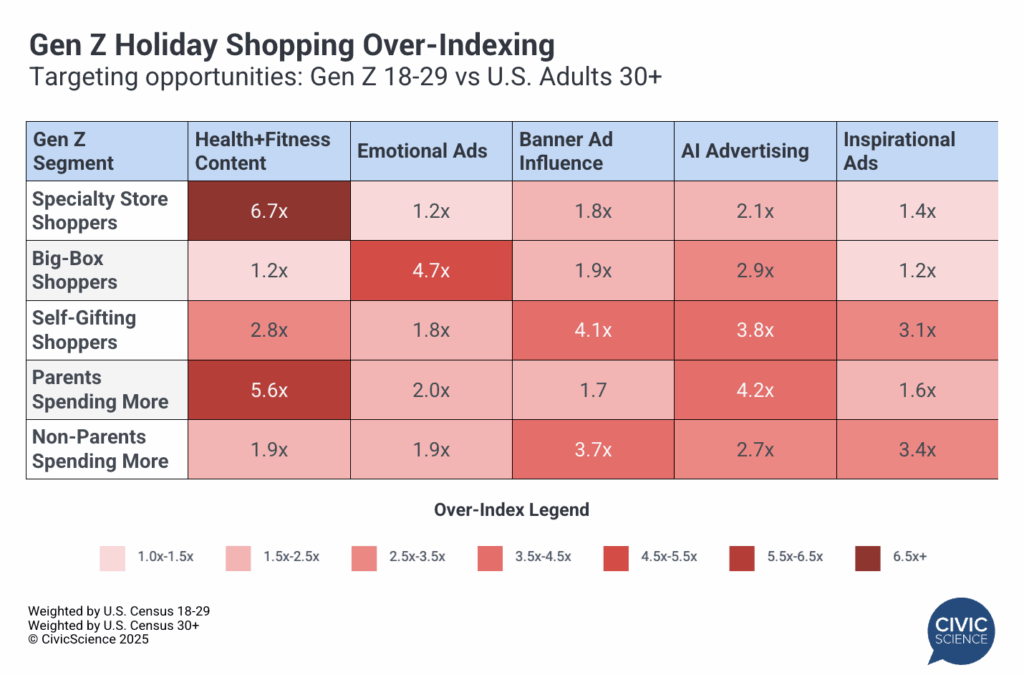

Here’s a glimpse of how CivicScience uses millions of self-reported consumer intent data points to build high-performing ad campaigns. (Note: The following compares Gen Z holiday shopper segments aged 18-29 to non-Gen Z Americans aged 30+.)

Digital Content Subscriptions

Shopping channel preferences reveal striking differences in paid digital content behavior. Gen Z specialty/chain store shoppers are 6.7x more likely than adults 30+ to pay for health/fitness content subscriptions (36% vs 5%). In contrast, big-box shoppers are 2x more likely to pay for entertainment content, and parents planning to spend more are 3.5x more likely to have entertainment subscriptions. Gen Z shoppers planning to spend more this holiday season show distinct preferences for online health and fitness content. Deep discount store shoppers over-index on local news content, while online-heavy shoppers (those doing 50%+ of shopping online) show distinct business content preferences.

Streaming Platform Preferences

Ad-tier preferences reveal targeting goldmines within platforms. Gen Z specialty store shoppers are 1.7x more likely to use Hulu with ads, while self-gifting shoppers overindex 1.6x for Peacock with ads. CivicScience can take an even more granular look at who’s using ads vs. ad-free versions across platforms, allowing advertisers to target with precision.

Advertising Receptivity Patterns

The most valuable segments show clear ad preference signals across shopping behaviors. Gen Z Big-box shoppers are nearly 5x more likely to say emotional ads resonate with them, while self-gifting shoppers are over 4x more influenced by banner ads online.

Gen Z parents self-reporting they’ll be spending more are over 4x more positive about brands using AI in advertising, while Gen Z non-parents spending more show different patterns – they’re nearly 4x more influenced by banner ads and over 3x more likely to find inspirational ads resonant compared to adults 30+.

The CivicScience Gen Z Shopping Advantage

While traditional data providers rely on broad demographic categories, CivicScience creates precise Gen Z audience segments based on actual shopping behaviors, spending intentions, and category preferences. Our platform identifies high-value Gen Z shoppers across their preferred shopping categories:

Gen Z Audience Segments Available for Targeting with CivicScience:

- Gen Z Home Goods Spenders: 26% category preference among big spenders

- Gen Z Electronics/Entertainment Spenders: 26% category preference among big spenders

- Gen Z Apparel Enthusiasts: 21% category preference among big spenders

- Gen Z Specialty Store Loyalists: Health/fitness content subscribers, Hulu ad-tier users

- Gen Z Big-Box Shoppers: Entertainment content subscribers, emotionally-driven ad response

- Gen Z Self-Gifting Shoppers: High participation rate, Peacock ad-tier preference, banner ad influenced

- Gen Z Parents Spending More: AI-positive in advertising, entertainment subscription holders

The Bottom Line for Holiday Marketers

Gen Z holiday shoppers aren’t a monolith – they segment into distinct behavioral patterns that create precise targeting opportunities. While some segments prioritize health and wellness content, others respond strongly to emotional advertising or digital banner influence. The data reveals that successful Gen Z holiday campaigns require moving beyond broad demographic assumptions to reach the right audiences with the right messages.

Answer our Poll: Do you do most of your holiday shopping online or in person?

Start Your Next Campaign With CivicScience

CivicScience’s self-reported data reveals exactly which Gen Z segments over-index for your category, when they’re most receptive to messaging, and which platforms they prefer. Using direct responses to our always-on survey, we identify, target, and measure custom audiences with the highest propensity to respond to your ads and buy your products.