Good companies obsess over their customers.

The best ones ingrain that understanding far and wide. The buzzword nowadays is “democratization” – namely, the sharing of knowledge and insights about customers among every corner of the organization.

It used to be that most consumer insights teams operated in a small subset of cubicles, serving primarily as a help desk or short order cooks for marketing leaders. Data was gathered, assimilated into a PowerPoint, and handed only to the person who asked for it. Knowledge was siloed.

That’s stupid.

Some insights people liked it that way. Knowledge – and the ability to dole it out – is power. Moreover, they rationalized, the average mortal couldn’t be trusted to understand statistics or interpret findings. People might draw faulty conclusions, make bad decisions, and an entire Fortune 100 business could crumble to the ground. Heaven forbid.

But that’s changing. The best companies are setting data free.

Not long ago, whenever I was asked to speak at a client gathering, it was often barely a dozen execs or maybe a 40-person marketing organization. Two weeks ago, I spoke to over 850 people at a major retailer. Last year, over 1,000 at a restaurant behemoth.

Procter & Gamble holds its annual Signal Conference, inviting presenters like me, with thousands of employees joining in person or online. UnitedHealth Group distributes a weekly consumer insight publication to over 1,000 leaders across the company.

That’s how you do it.

I see it in this email too. Several of your companies have a readership counting in the 3-figures, some because the CEO started reading it, forwarded it to a few people, and it spread from there (everybody wants to be inside the head of the CEO).

Some of our clients have dozens of people logging into our InsightStore every month to peruse findings and explore our repository of questions. It should be 850. Or 1,000.

We made the decision a long time ago not to use “seat licenses” as a denominator in our contracts. It’s counter to our clients’ best interests. The more knowledgeable people, the merrier.

Besides, data-savvy isn’t the barrier it once was. You can’t get through college, let alone business school, without it. The tools are better too, idiot-proof even. Hell, if I can do this stuff after almost failing high school algebra, everyone in your organization can do it.

Make it happen.

Here’s what we’re seeing:

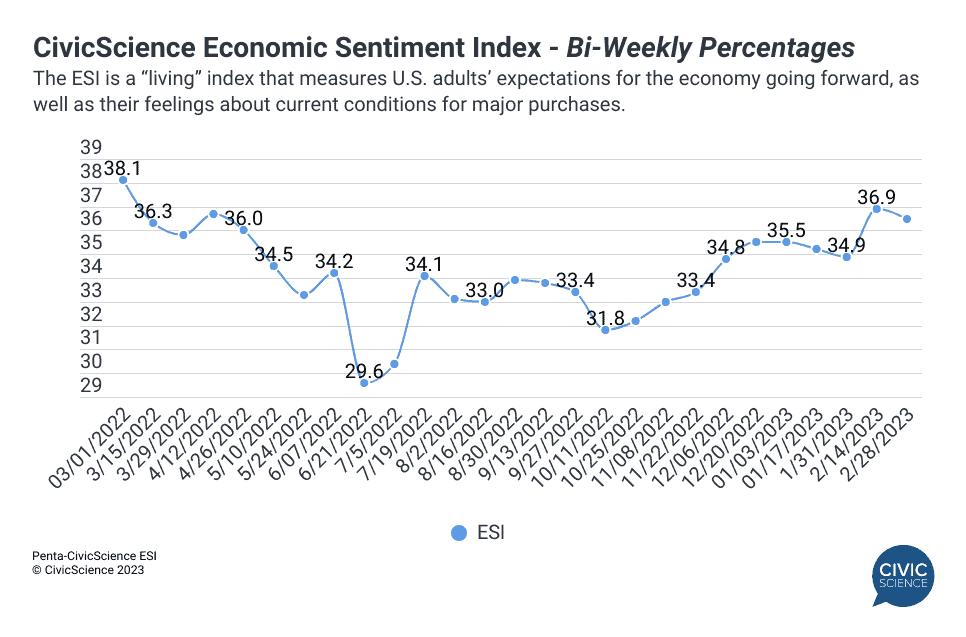

Consumer confidence fell from its lofty perch this week. After a near-record surge in its last reading, our Economic Sentiment Index backslid a bit this time around, albeit still well above anything we’ve seen since last spring. A lousy week on Wall St., surging mortgage rates, or worse-than-expected inflation numbers could all be to blame. On the brighter side, confidence in the job market had a nice uptick. The “Long Island Iced Tea of Economies” just keeps chugging along.

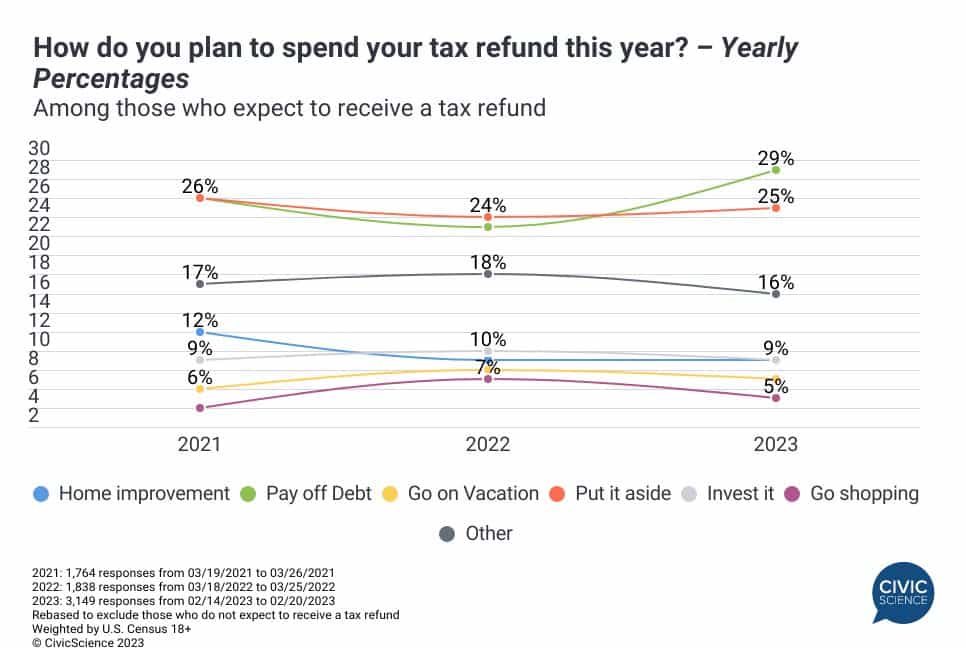

The tax man cometh for more people this year. One thing that could be denting consumer confidence right now is a growing percentage of Americans who expect to owe federal taxes come April. While a majority of people still expect a refund, the number who are bracing to cut a check to Uncle Sam has grown three percentage points since 2022. More notably, the largest group of refund-receivers expect to use their proceeds to pay down debt, up over 25% from last year. Home improvement projects have fallen the most since 2021. Also in this study, Americans have the most trust (though still net negative) in local governments to spend their tax dollars. Trust in the federal government is abysmal.

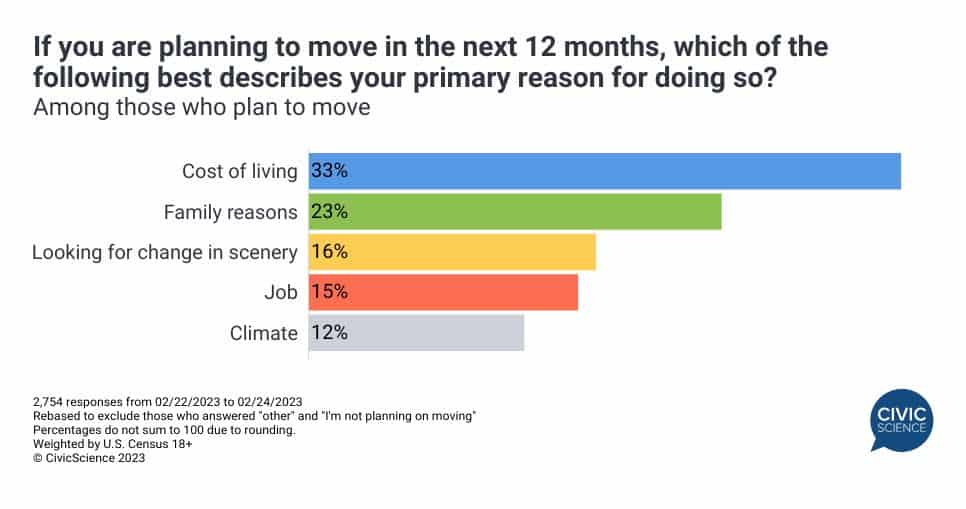

Cost of living is causing a lot of migration. In our latest data on housing and relocation, 15% of U.S. adults say they plan to move in the next 12 months. Just over half plan to buy/rent a single-family home, which is on par with the past 12 months. Thirty-nine percent plan to move into an apartment or condo (down from 41%), and 9% are looking for a townhome (up from 7%). The cost of living where they currently reside is the main reason people are looking to relocate, which bodes well for places like Pittsburgh. Among Gen Z, however, a new job or proximity to family are the bigger drivers. Speaking of drivers, U-Haul is the number one rental moving brand by far.

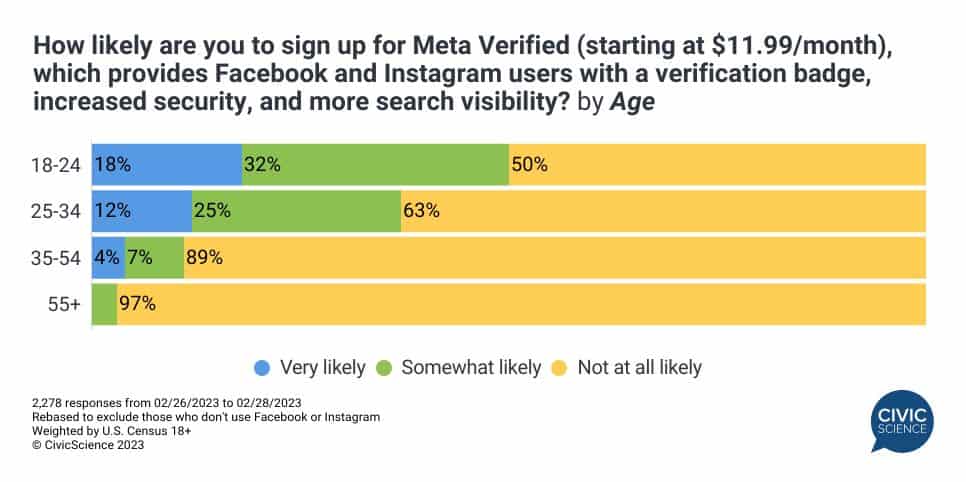

Facebook and Instagram could make a boatload of money from paid verification. Taking Elon Musk’s lead, Mark Zuckerberg recently announced plans for a paid tier for Meta platform users that will give users more security, features, and search visibility. The glass-half-empty take is that only 6% of FB or IG users say they are ‘very likely’ to sign up at the $11.99/month price point. But, considering the two platforms have over 300 Million U.S. users (with 89% of IGers and 64% of FBers using both), Meta could add over $1 Billion/year to their top line if 6% of just the dual-platform users sign up. Naturally, the most likely verifiers are younger, which creates nice customer lifetime value if the service doesn’t suck.

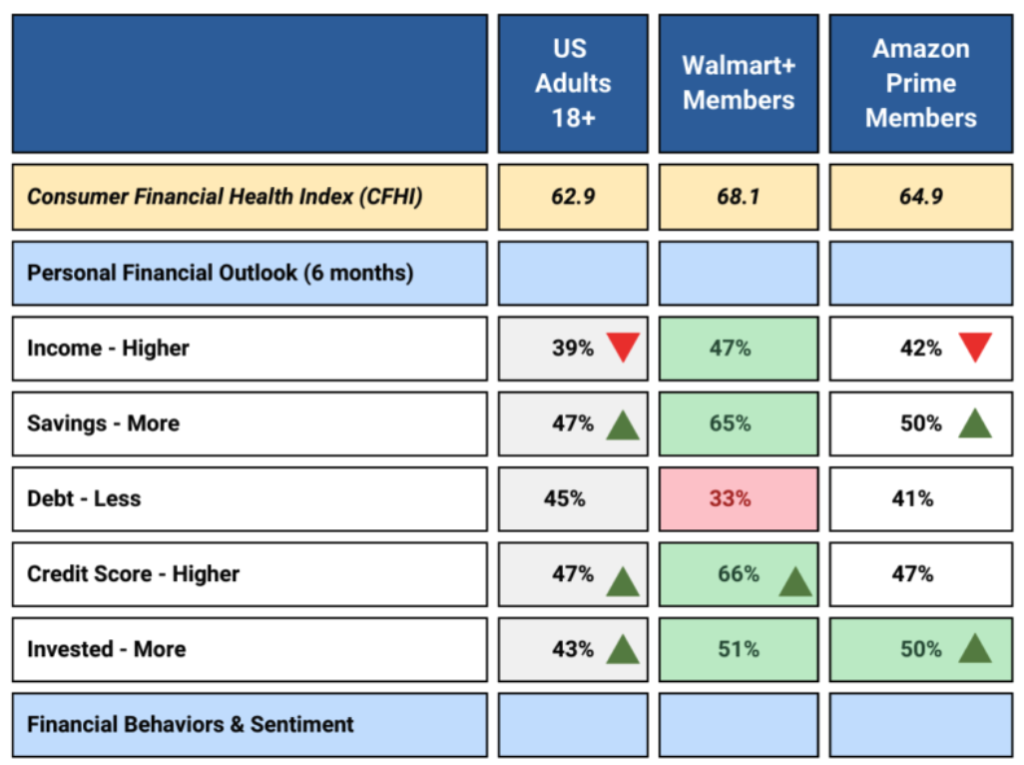

Walmart+ members are much more valuable consumers than Amazon Prime members right now. We published a free 360 Report this week, looking at customers of the two biggest retail membership programs and the differences were way more dramatic than I expected. Walmart+ members are significantly more likely to report better financial health and outlook, stronger affinity for brands across most categories, and a greater likelihood to spend more across most retail or service categories. They’re also far more likely to be concerned about nearly every social or political issue we track – which means they’re far more likely to be following media on those issues. Who knew? (To see this report for your customers and competitors, just ask for it here.)

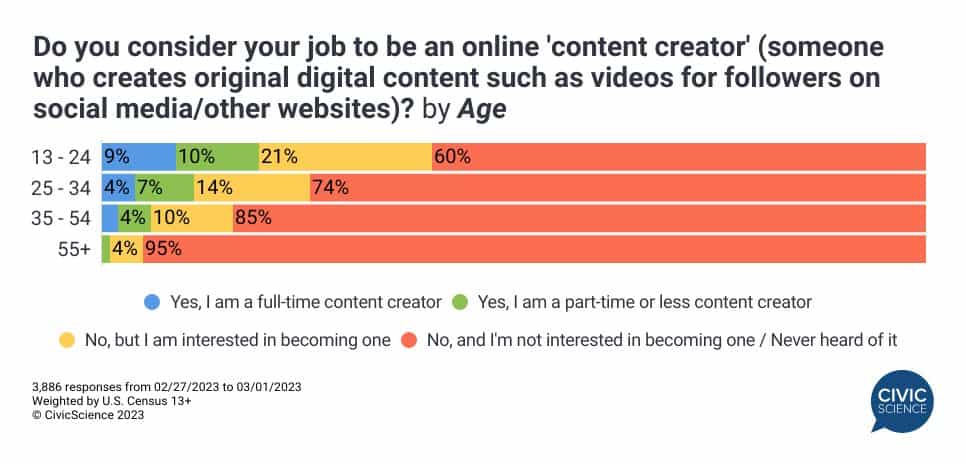

While TikTok is a freight train, YouTube is still king for content creators. Although the numbers vary by age, the percentage of all Americans who say they follow content creators on YouTube is more than double that of TikTok (and 12X that of Only Fans, for what it’s worth). Educational and “how to” content is tied with food and cooking as the most popular creator-created content across these platforms, followed by entertainment and gaming – although the largest group says ‘other.’ In related news, 40% of teens and Gen Z adults either already consider themselves to be a creator or aspire to be one. Does sharing my daily Wordle results on Facebook count?

More awesomeness from our InsightStore this week:

- In our 3 Things to Know, the majority of Americans support a 4-day workweek, and 1 in 4 people report not seeing a doctor recently due to financial strains;

- Potential newlyweds are cutting back on their wedding budgets this year;

- The majority of Americans believe the “lab leak” COVID origin hypothesis is plausible, while 2/3rds of Republicans believe it’s definitive;

- Interest in “clean” beauty products is rising, especially among department store shoppers;

- Dial-up internet service doesn’t even register in our data anymore, while younger people rely increasingly on cellular data and mobile devices;

- People who intend to try augmented reality shopping apps spend a lot of time in their cars – and a few other interesting factoids.

The most popular questions this week:

- How would you feel if you woke up with a permanent foreign accent?

- Do you support or oppose fines imposed on professional athletes who refuse to speak to the media?

- Do you typically scrub your social media profiles before starting a new job?

- How adventurous are you with trying new foods?

- How often do you work at night so the following workday can be more relaxing?

Answer Key: Probably still tired; Depends on what their contract says; I’ve never started a new job in the social media era; Very; I work most nights, but it never makes the next day more relaxing.

Hoping you’re well.

JD