I very seldom interview people around here.

I’ve written about it before. I fall in love with most people after a 45-minute meeting, particularly when they’re putting their best foot forward and telling me how much they admire my company. It blinds me. So, I leave the critical assessment to others.

Instead, I make it a point to schedule 1:1 meetings with everyone we hire, no matter how senior or junior. We do it deliberately at the ~6-week mark of their tenure. It’s the ideal point at which they’ve had time to form thoughtful opinions, while still new enough to not be drunk on the Kool Aid, to remember what life was like before.

I learn a lot about them – and about the company. Those meetings are often the highlight of my day.

Every conversation starts with the same two questions. In reverse order, the second one is, “What are your goals?” This is for their benefit. They can clearly establish their expectations, putting me on notice – consciously or not – that if we don’t help them track toward those goals, they’ll be looking elsewhere…which they should. Typically, they talk about growing into management, a particular title, or – for the most candid among them – making a lot of money.

My favorite all-time answer came from a woman I met over coffee years ago. She was skittish, at first, before telling me her goals had nothing to do with her career. She was an artist, but knew she could never make a living doing it. She wanted to excel in a project role, such that the more efficient she got in her job, the more bandwidth she would have to pursue her art. She got security and flexibility, provided she held up her end of the bargain. We got someone who strived to be better every day. The expectations were crystal clear, everyone knew the deal, and it worked.

The first question I ask, after the initial pleasantries, is “What has surprised you the most?” That one has selfish motives. I learn how the reality of our business aligns with preconceived notions, how our culture and operations compare to others. Most people have multiple answers. Hardly anyone tells me something bad. In their defense, they’re only just now meeting the CEO. They don’t trust me enough yet to tell me I have an ugly baby.

I hear one answer over and over again – like, literally, 95% of the time. It’s some form of “I’ve never worked anywhere where the people were so kind and helpful.” It means the most coming from people who’ve worked at many other places, who’ve become jaded. I suppose it could be a highly coordinated ass-kissing conspiracy, but I choose to believe it.

The irony is that I can’t take any credit. Remember, I haven’t even met these people, let alone helped them. We don’t make it a requirement in our employee manual to support newbies. I can only assume that, at some point long ago, a few people were particularly kind to a new employee, that person felt obliged to pay it forward, and on it went.

It’s a much-needed reminder right now that kindness and generosity are contagious.

And, at the time of year when we take stock of our blessings and give thanks, it makes me appreciate how fortunate I am to work here, with all these wonderful people. As if I don’t already have the best family, friends, dogs, and head of hair on the planet.

How did I get so lucky?

Here’s what we’re seeing:

Consumer confidence fell again in our last reading before Christmas. Our Economic Sentiment Index has been alternating between modest ups and downs since late September, receding over the past two weeks after a notable jump after Thanksgiving. The most recent results were dragged down by two metrics in particular – optimism for the long-term U.S. economy declined over 2 points, while attitudes toward the job market fell by 1.3 points. The biweekly oscillations seem like noise, as we’ve been bouncing along the bottom for quite some time. Zooming out, the key takeaways as that consumer confidence is nearly 10 points lower than it was a year ago.

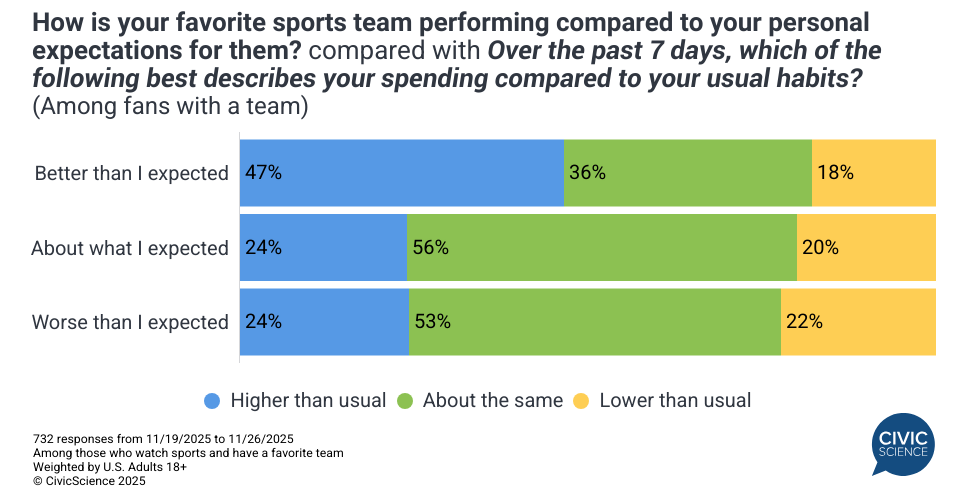

The success of our sports teams has a clear impact on our financial mood. Our 3 Things to Know this week contained one of the coolest findings I’ve seen in our data recently. In short, there is a clear and significant correlation between whether someone’s favorite sports team is exceeding their expectations and whether they have lofty economic expectations AND spending. Also, the inverse. It just goes to show how strongly our financial behaviors are influenced by our emotional state – and how powerful sports can be in our lives. We also learned that, when it comes to the school calendar, Americans increasingly prefer shorter summer breaks and more evenly distributed time off. Lastly, we looked at how people feel about the deluge of new data centers being built – they support it, but not by a lot.

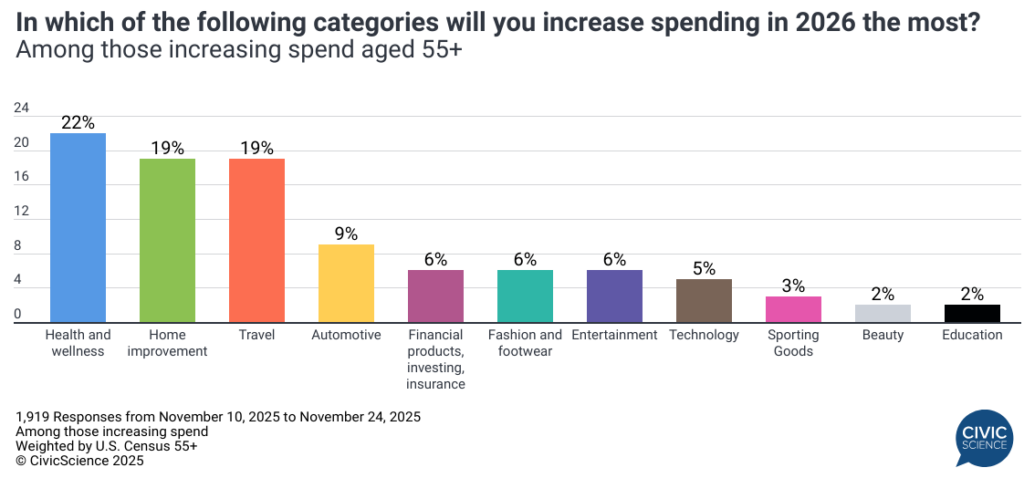

The debt bug is starting to hit older Americans. In partnership with our friends at ROAR Forward this week, we took a closer look at the financial health and outlook of U.S. adults age 55 and older, finding an eroding picture. Economic sentiment among these Boomers has remained steadily below the population average, while their overall current financial health is mixed. Their debt outlook, while considerably better than average, has been sliding precipitously over the past two months. Looking ahead, these gray-hairs expect to have less disposable income next year, while channeling more of their spending toward health and wellness.

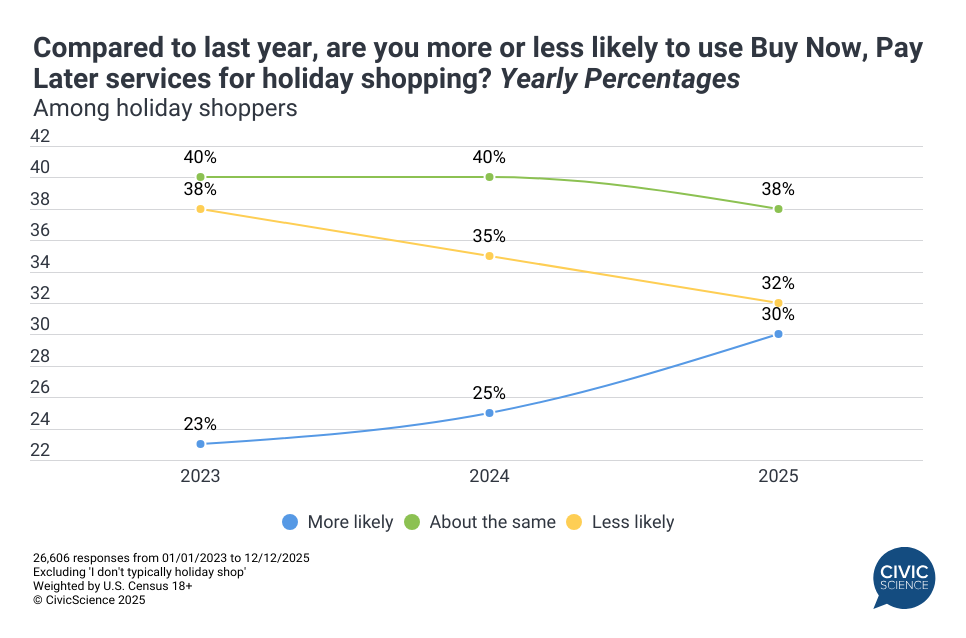

Buy Now, Pay Later will be one of the biggest stories of the 2025 holiday retail season. I feel like I’m beating a dead horse on this topic, but, in this week’s Holiday Shopping Insights we confirmed that U.S. shoppers are turning to BNPL at record levels, with those who intend to (or already did) increase their “layaway” debt increasing by over 20% YoY. We also learned that stressed-out holiday shoppers are more likely to buy some kind of subscription gift for a loved one and that last-minute gift buyers have appreciably different retailer preferences than non-procrastinators.

Speaking of last-minute holiday shoppers, there are a lot of us. As of Tuesday, only 52% of U.S. adults had completed even half of their holiday gift-buying, meaning there will be a ton of activity this weekend and into next week (myself included). Also, like me, these procrastinators heavily skew male, but, unlike me, they over-index as single, non-parents. Naturally, they’re more likely to shop in-store because they’ve missed the window for timely and reliable delivery. Affirming the common correlation between procrastination and optimism, these last-minute shoppers are twice as likely as early shoppers to anticipate significant improvements in their financial situation in the next six months.

More awesomeness from the InsightStore™ this week:

- CivicScience Wrapped: Five big things from 2025;

- Cooler Things to Know: The key differences between Igloo and Yeti buyers;

- Everything advertisers need to know about Whataburger customers;

- I’ll be joining a star-studded panel on the future of streaming at CES in Vegas after the holidays. Let me know if you’ll be in town. I’d love to see you in person.

The most popular questions this week:

Do you think there should be a legally defined maximum age for driving a car?

Do you think there should be more or fewer federal holidays in the US?

Have you ever had to confront a boss or coworker about an uncomfortable workplace issue?

Do you generally have a positive or negative opinion of dive bars?

Answer Key: No, just for being President; Yes, Election Day and the Monday after the Super Bowl; Terrible; More times than I care to recall; There are few things I love more.

This will be my last dispatch until January. In the meantime, the entire Dick family wishes you and yours the most wonderful and restful of holidays and the happiest New Year.

JD