We’re holding our annual Client Advisory Board meeting in Pittsburgh next week. Every year, the gathering spawns entirely new directions for our work. In fact, this little email was a brain-child of an attendee at our San Francisco summit last year. Expect to see all sorts of new research topics in the weeks ahead.

Incidentally, I’m super excited to show off Pittsburgh to our out-of-town guests, like our fleet of driverless Ubers, the one-of-a-kind Andy Warhol Museum, and the best new restaurant scene in America. If you’re not hip to the industrial renaissance happening in the City of Champions right now, the NY Times did a good job of explaining it last week. Get with it.

Aside from how awesome Pittsburgh is, here are a few other things we’re seeing right now:

Economic sentiment showed modest gains over the past two weeks. At some point, you might start tuning out when I write about this – which is probably when it will make significant moves. For now, every reading feels like a non-event because the top-line number barely budges. But there are interesting subplots to keep an eye on. Confidence in personal finances has reached its highest point since March. Optimism about the job market climbed after a month of downward movement. Overall, we’re still way ahead of where the numbers were a year ago.

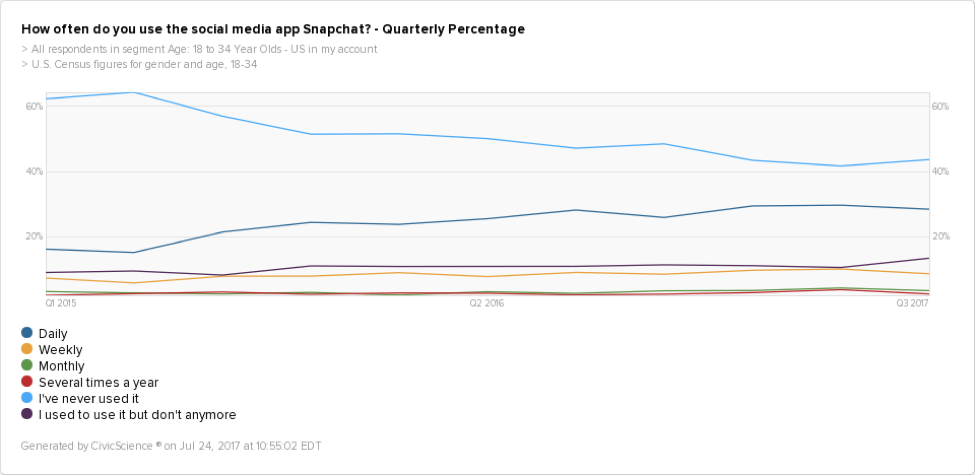

I’m not optimistic about Snapchat, to say the least. Even before its stock took a beating this week, we had a bad feeling based on some new discoveries in our data. Take a look at the chart below, showing Snapchat usage among Millennials over the past 30 months. It’s bad enough that the number of daily users (the dark blue line) leveled off beginning in Q1 of this year. What really concerns me is the recent jump we see in the purple line – people who say they used to use Snapchat but no longer do. No bueno.

Not to kick Chipotle when they’re down…but I think it’s an important cautionary tale for my consumer brand execs out there. After noticing the downward trend in our Chipotle data last week, we spent some time digging and found it even more troubling. Why? Because of WHO is fleeing the brand. When we compared the composition of Chipotle’s fans in 2015 to the composition today, it’s clear that they are losing a distinct and valuable group of consumers –namely middle to upper-middle class, Millennial and Gen X moms, who live in and around urban centers of the U.S. Not only does this cohort have the fastest-growing spending capacity in the country, they also have huge influence over their friends on social media. Oh, and they’re not taking their kids to Chipotle, perhaps tainting an entire next generation of diners.

McDonalds, on the other hand, is killing it. We told you this would happen 2 ½ months ago. I hope you listened. Here’s the funny thing. Imagine if, two years ago, someone told you that on June 25th of 2017, McDonald’s and Chipotle would both report earnings and one company would be booming while the other was floundering. Which company would you have bet on?

Shifting gears, making a hard left turn, or [Insert Car Metaphor Here], the era of the do-it-yourself auto repairer is rapidly dying. Since January of 2014, the percentage of U.S. adults who say they handle auto repairs themselves has fallen from 13% to less than 9%. Local private shops have seen declines as well. The beneficiary? Auto dealerships, who have grown as the repair option of choice from 27% to 33% of Americans in the past two years.

Random Stats of the Week

- 46% of U.S. adults had an allowance when they were a kid. 48% did not.

- Men were more likely than women to get an allowance, which is messed up.

- Allowance-getters are far more likely to have achieved advanced degrees, but…

- There is no clear correlation between childhood allowance and current income.

Hoping you’re well.

JD