CivicScience continually tracks current and anticipated consumer trends. Here are three key insights marketers should know this week. All insights are derived from the CivicScience Social | Political | Economic | Cultural (SPEC) Report, a weekly report available to clients covering the latest news and insights. Start here to learn more.

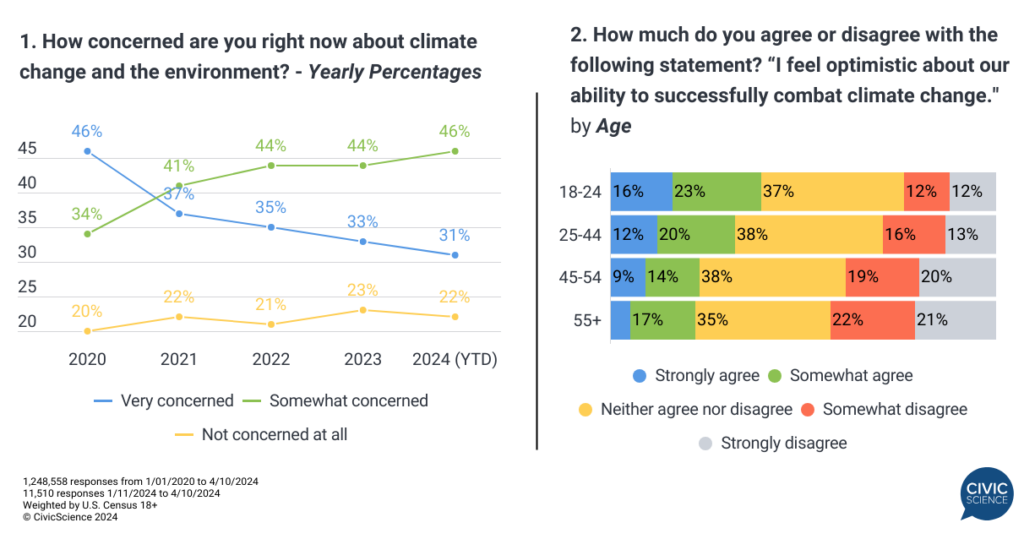

1. The majority are concerned about climate change, but younger Americans are more optimistic about combating it.

In light of Earth Day coming up next week, more than 75% of Americans say they are concerned about climate change and the environment. However, there are notable changes in how concerned people feel. Ongoing CivicScience tracking shows the percentage of those who are ‘very’ concerned has fallen precipitously over the past four years, from 46% in 2020 to 31% in 2024 (YTD).

Young Americans – especially Gen Z adults – are more likely to report recent strong feelings of eco-anxiety (extreme worry about the effects of climate change or environmental damage). Despite these anxieties, there remains a heightened sense of optimism among Gen Z and Millennials regarding humanity’s capacity to address climate change effectively, compared to older cohorts.

Weigh In: Are you concerned about climate change?

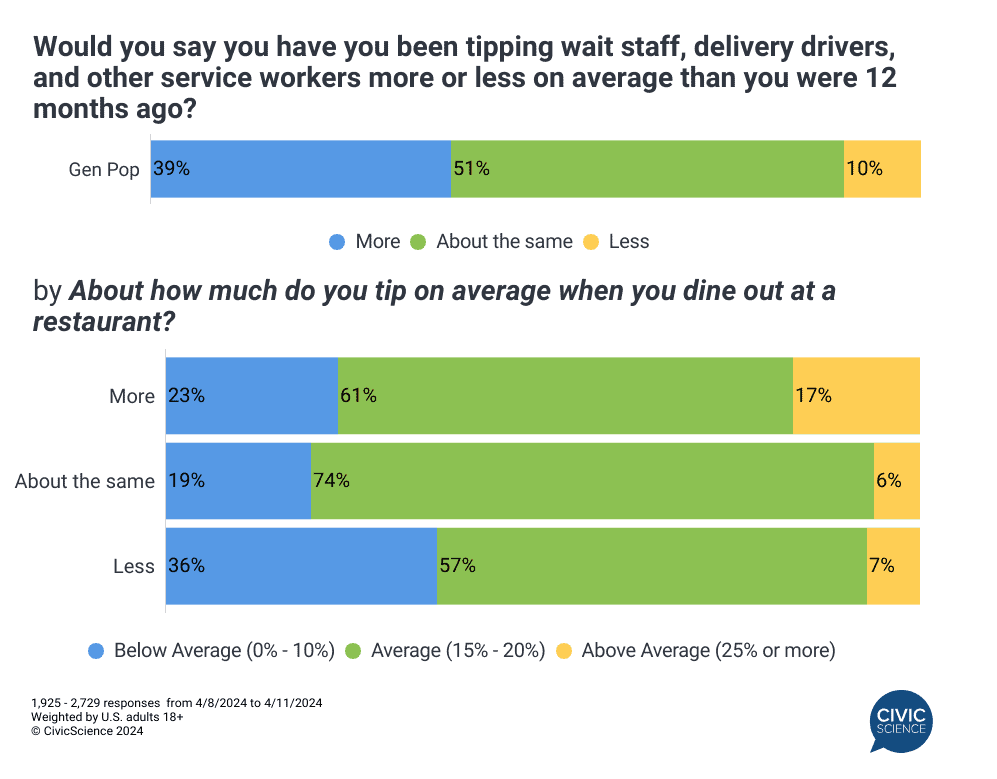

2. Roughly 2 in 5 consumers report they’re tipping more today than they were a year ago.

Tipping remains a hot topic in the United States and data show shifting trends in consumer behavior. Thirty-nine percent of consumers claim to be tipping more than they did a year ago, while only 1-in-10 are tipping less. Interestingly, even among those tipping less than they were last year, a majority are still tipping at an average rate of 15% to 20%.

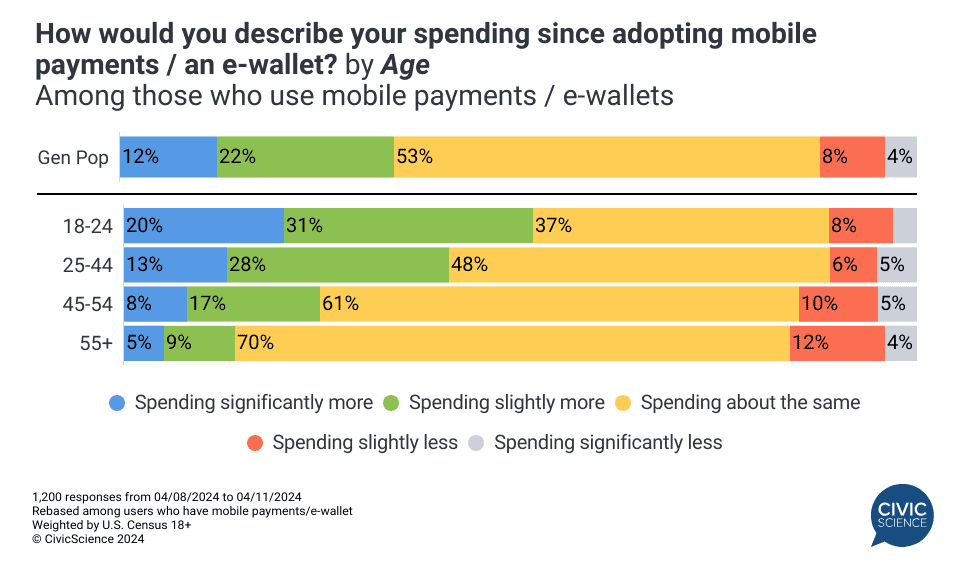

3. Over a third of consumers who use mobile payments say they’re spending has increased since they’ve begun using them.

With the rising popularity of mobile payments/e-wallets, such as Apple Pay, shopping has become increasingly convenient; it is likely leading shoppers to spend more, too. New CivicScience data reveal that one-third of users report spending more since adopting these methods, with 12% noting a significant increase. Slightly over half of Gen Z adults aged 18-24 using mobile payments report higher spending, marking a 17-point jump over the Gen Pop.

Join the Conversation: Do you think mobile payment services have made people better or worse at handling their finances?

Clients receive the SPEC Report in full, plus access to real-time insights driven by our database of over 500K questions. Contact us now to see it in action.