Attitudes change before behaviors do. For forward-looking insights into how your brand’s target audiences are responding to changes in the grocery and CPG space, contact CivicScience today.

Prices didn’t see much relief from inflationary pressures in February, according to the latest CPI numbers. As inflation persists, a growing number of manufacturers and retailers are responding with practices such as package downsizing (“shrinkflation”) and using dynamic pricing. Yet, CivicScience data show consumers are growing more aware of these practices. Here’s a quick look at where U.S. consumers stand today on the issue of shrinkflation and how they’re responding:

As Shrinkflation Becomes More Prevalent, Consumers Grow Less Brand Loyal

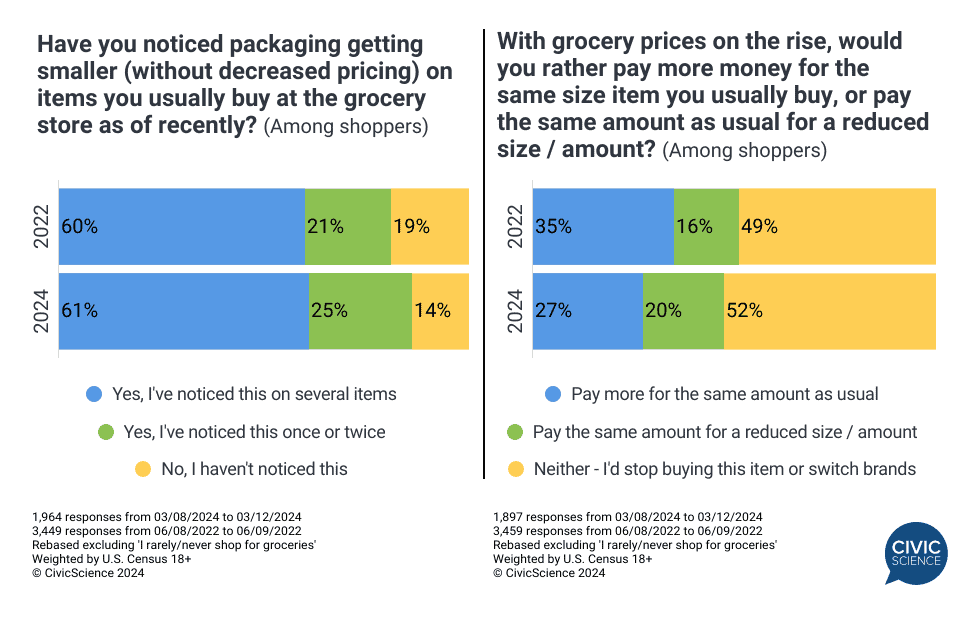

Less product for the same or higher prices? That’s the practice of “shrinkflation,” impacting many groceries, household items, and other packaged goods. More and more consumers report noticing decreased packaging on items they typically purchase at the grocery store, while the price has stayed the same or increased. Currently, 61% of shoppers have witnessed the effects of shrinkflation on several products, while an additional 25% have noticed it on a few. Those percentages have both increased since 2022, when “shrinkflation” first entered the vernacular.

How shoppers are choosing to respond to shrinking item quantities has also changed in the last two years. Interestingly, shoppers appear to be more open to certain ‘shrinkflated’ items now – 20% say they would prefer to pay the same amount for a reduced quantity of an item versus pay more for the same quantity, which has risen four points since 2022. However, the majority of consumers report they would abandon the purchase altogether when faced with this scenario, with some opting to switch brands.

Join the Discussion: Do you think shrinkflation is a major or minor issue?

Shrinkflation Has a Greater Impact on In-Store Shoppers

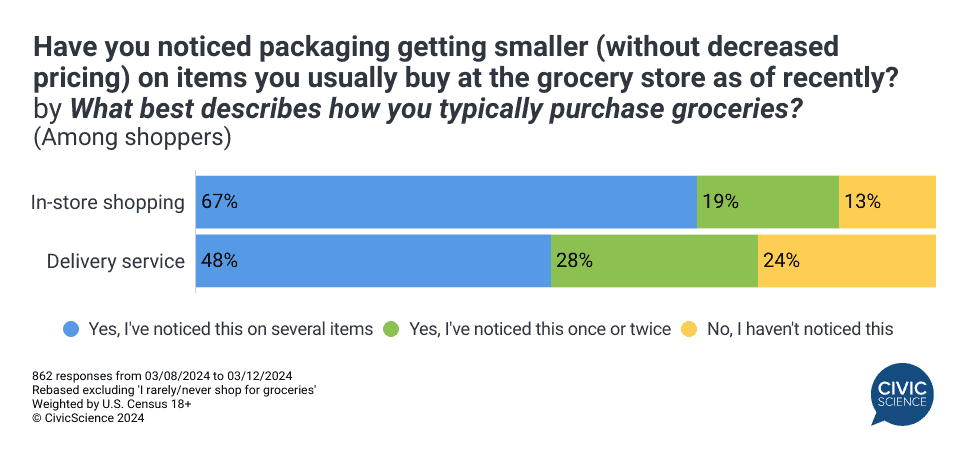

Shrinkflation is more likely to impact in-person grocery shoppers and how they shop. Data show people who typically shop for groceries in stores are far more likely to come across shrinkflation compared to people who typically use grocery delivery services. A total of 67% of in-store shoppers say they’ve noticed the effect of shrinkflation on multiple items they usually buy, compared to just 48% who use grocery delivery.

This suggests grocery delivery users may be less likely to alter their buying patterns than in-store shoppers, something retailers should anticipate.

Additionally, consumers who shop primarily at large regional grocery chains are also the most likely to say they’ve noticed shrinkflation, although it’s membership club shoppers (e.g., Costco, Sam’s Club shoppers) who are the most likely to abandon the purchase of a grocery item due to shrinkflation and/or rising prices.

Take Our Poll: In general, do you prefer shopping at a large chain supermarket or a smaller, specialty store?

Most Consumers Say ‘Yay’ to the Shrinkflation Prevention Act

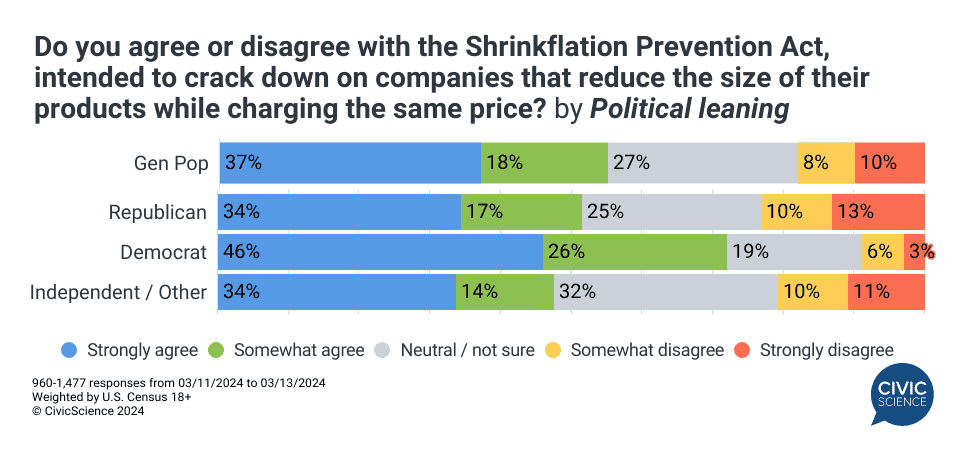

The issue of shrinkflation has moved into the spotlight as the Biden administration recently called to stop the practice and lawmakers introduced the Shrinkflation Prevention Act of 2024. The bill would identify shrinkflation as an unfair or deceptive practice, giving the FTC authority to “crack down” on companies shrinking household products without cutting prices, including adding warning labels to products that have been downsized.

A total of 55% of U.S. adults agree with the legislation, while 18% disagree and 27% are neutral or unsure of their stance. Republican-leaning consumers are more likely than Democrat-leaning consumers to not be in favor, but a majority (51%) ‘somewhat’ or ‘strongly’ agree with the bill.

The bipartisan call for some sort of action to be taken further highlights that consumers are feeling impacted by the practice of shrinkflation; in fact, Republican-leaning shoppers are the most likely to have noticed shrinkflation at the grocery store. Recent data has shown the volatility of the grocery space when it comes to consumer behavior, affecting brands, retailers, and consumers. For example, although Gen Z consumers may remain more brand loyal than older shoppers, they are more willing to shop around to multiple stores, likely in search of a better deal.

For even deeper insights, get in touch to learn how your brand can benefit from the 4+ million daily survey responses available in the InsightStore™