Like clockwork, the blue coupons appear in our mailboxes, beckoning us to 20% off for a single item at Bed Bath and Beyond. Devotees of the legendary promotion know it has no expiration date. The coupon is as good as gold when it comes to buying items for bed, bath or that elusive beyond.

Bed Bath and Beyond announced the end of its 20% coupon program after announcing a 17% drop in sales last quarter. In lieu of the coupon, the store plans to roll out a membership model where a $27 annual fee grants you a 20% coupon for every visit. Will the retailer be able to maintain customers after ditching a mainstay of the store experience?

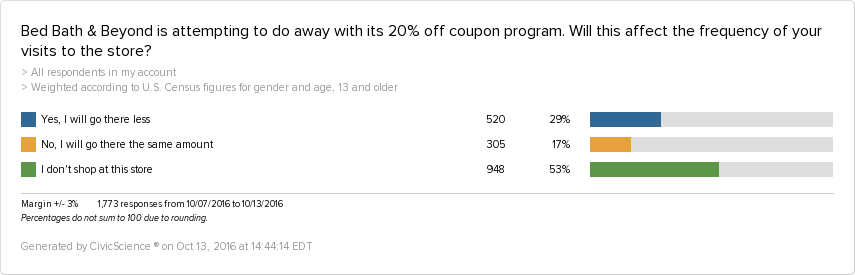

We asked customers what they think about the policy change:

While the question itself is somewhat obvious (ex: Would you pay more to shop somewhere?), it did reveal who is a Bed Bath and Beyond fan, and how the store can cultivate new customers.

Cutting Ties With Couponers

29% responded that they will go to the store less. People who selected this question are more likely to be married but less likely to pay attention to cost when shopping for electronics. Over 50% of these respondents live the suburbs.

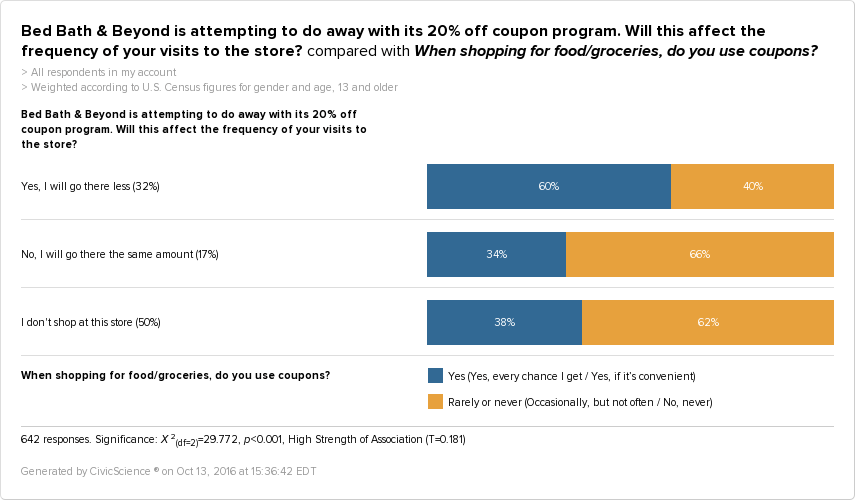

When compared with coupon use overall, this group is more likely to use coupons often or occasionally when shopping for food related items.

Focus on Favorability

Dedicated fans make up 17% of the responses. This group will continue to shop at the home goods store, sans coupons.

Women are more likely to return to Bed Bath and Beyond after the coupons disappear. In regards to age, the 55+ range is more likely to return. Bed Bath and Beyond has just celebrated its 45th year, which means this age group might’ve grown up visiting this store in its early days. Old habits die hard, perhaps the fondness of shopping here comes from memories of shopping as a young adult.

Finding the Fans

Bed Bath and Beyond’s move beyond coupons will certainly lose some patrons, but can they gain new buyers? As Bed Bath and Beyond’s new program evolves, the retailer should keep in mind the shoppers who don’t typically visit.

This group is less likely to follow cooking and food trends. They are more likely to be influenced by social media when it comes to music choices. They aren’t homeowners or typically married.

They’re also active Snapchat users who are more likely to be price conscious in general, and specifically, price conscious around electronics and food. They are less likely to consider food an important part of their lifestyle.

While this group doesn’t cook, Bed Bath and Beyond offers a range of products that simplify the cooking process. The store offers more than just kitchen supplies, and appealing to this group might involve downplaying the kitchen items.

How do you reach them? Tap into their social media habits and create simple content that can pull them in. With tools like Snapchat, Bed Bath and Beyond can leverage its expansive inventory through video content.

Creating a more convenient experience might help the uninitiated. The store should consider tools like in-store pick up to get people in the door without the intimidation factor.

That being said, Bed Bath and Beyond would be smart to address the price consciousness of the group. Perhaps the store could start offering memberships at a discounted rate, similar to Amazon Prime for students.

It’s no surprise that Bed Bath and Beyond could lose customers by getting rid of the popular coupons. But the decision also creates an opportunity to entice a whole new set of fans. By focusing on items beyond the kitchen and targeting the group through Snapchat, the store might see sales from a new demographic.