The Super Bowl in Las Vegas that will feature a 2020 rematch between the Kansas City Chiefs and San Francisco 49ers is now just days away. Here’s how CivicScience data breaks down consumer intent around the big game:

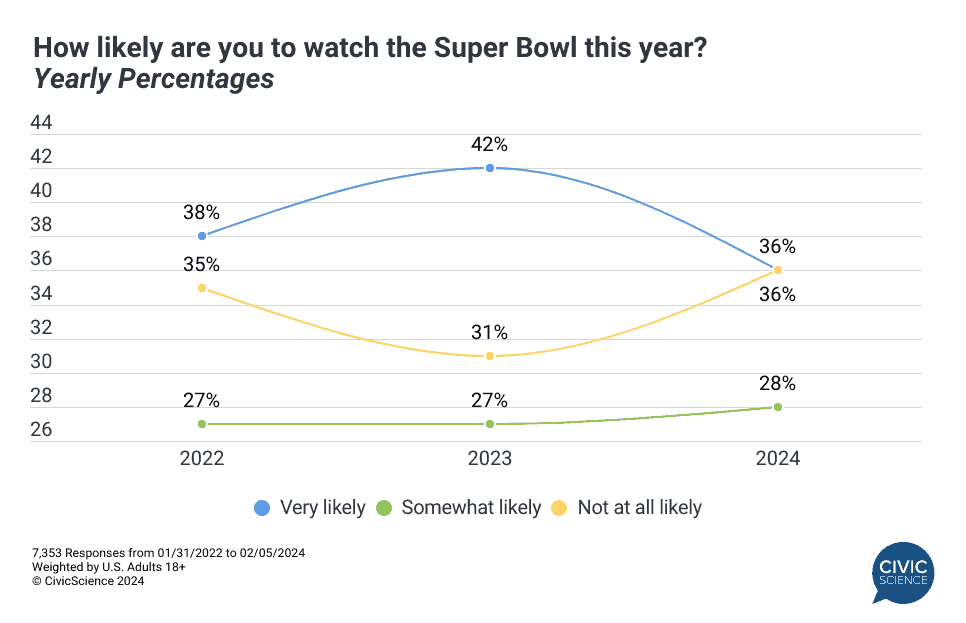

The latest data show that while the majority of U.S. adults (64%) plan on watching the game (including 36% reporting they’re ‘very’ likely to tune in), intent to watch is down from last year and looking similar to 2022 intent.

Take Our Poll: Do you expect the Kansas City Chiefs to win or lose this year’s Super Bowl?

Interest is there for Nickelodeon’s inaugural Super Bowl broadcast.

While the game will be broadcast on CBS and streamed on Paramount+, viewers have an additional place to watch the game for the first time ever: Nickelodeon. Among consumers aware of the broadcast, just under a third (32%) say they’re at least ‘somewhat’ likely to tune into the SpongeBob-themed showing of the game. Unsurprisingly, consumers who are parents (40%) are the most likely to watch the Nickelodeon broadcast. Still, as much as 32% who are neither a parent nor a grandparent are also likely to watch the game on Nickelodeon.

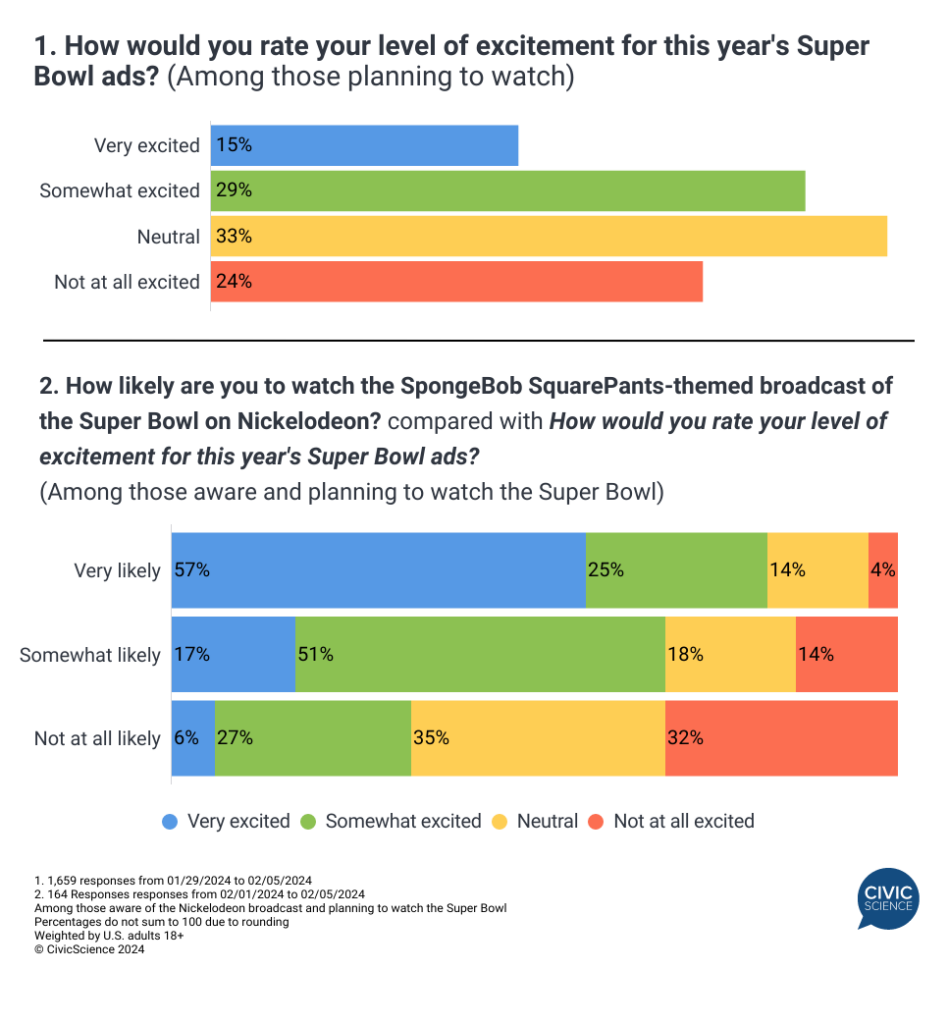

Excitement for Super Bowl ads is up this year, especially among Nickelodeon’s broadcast intenders.

Super Bowl advertisements during the game often steal the show, and new CivicScience data show 44% of those planning to watch the game say they’re excited to see this year’s slate of advertising during the game – marking a 14 percentage point upswing in excitement from last year. Nickelodeon broadcast intenders are far more likely to be excited about the ads, possibly thanks to the now-viral Paramount+ ad featuring “Hey Arnold!”

The high level of excitement on the Nickelodeon side of things could be music to advertisers’ ears, as Paramount announced its ad inventory on its Nickelodeon broadcast has also sold out, in addition to its traditional CBS broadcast ad inventory.

NFL fans are more likely to prefer these Super Bowl advertisers:

Speaking of advertising, the field of this year’s advertisers has largely been announced, with many putting out teasers of their ads. A deeper dive into the data finds that NFL fans have differing affinity for some of the most well-known advertisers who will be running ads during this year’s game. For example, NFL fans (aged 21+) are 15 and 12 percentage points more likely than U.S. adults aged 21+ to be favorable toward beer titans, Budweiser and Coors light respectively. But differences don’t stop with beer – other 2024 advertisers, Kia (+8pp), United Airlines (+8pp), and Doritos (+6pp) also enjoy higher favorability among NFL fans.

Super Bowl betting intent is up, but many bettors are worried about paying their holiday debt.

Betting has become heavily intertwined with sports ever since the 2018 Supreme Court case that cleared the path toward legalization in the U.S., and the Super Bowl is no exception, with last year’s record amount of betting. While the NFL says there will be fewer sports betting ads during the broadcast this year, betting intent ahead of the game has ticked up from last year – the latest CivicScience polling of U.S. adults aged 21 or older, nearly 1-in-5 say they plan on betting on the Super Bowl this year.

Still, experts are increasingly concerned over the prevalence of sports betting. Potentially even more concerning, though, is that a whopping 66% of likely Super Bowl bettors say they’re at least ‘somewhat’ concerned about paying off 2023 holiday debt. They’re also more than three times as likely to be ‘very’ concerned.

With the decline in watch intent, the NFL and its advertisers are sure to love any residual viewership bump a potential Taylor Swift appearance can provide, but the Nickelodeon broadcast is likely to make strides among its youngest viewers regardless. Can they capitalize on the dual broadcasts and close some of the brand favorability gaps between NFL fans and the Gen Pop? Will the reduced presence of sports betting advertising have any impact?

Join the Discussion: Do you personally believe sports betting should be legal or illegal?

This is only a preview of the insights available to CivicScience clients thanks to our database of more than 500K ongoing polling questions. Want to gain a competitive edge using insights like these? Start here.