The Gist: Favorability for Victoria’s Secret is up, but sales aren’t, and the body-positive ad campaigns of competitors may not be the only reason. Price, shopping habits, and Millennials could play a role.

Within the past couple of years, we’ve witnessed a growing revolution when it comes to women’s marketing and advertising.

Several leading women’s clothing retailers are embracing the body-positive movement, including Aerie, an American Eagle company choosing to feature lingerie models with a range of body types and promising not to touch up their photos.

But while Aerie and other major retailers, including Target, are shifting their marketing focus towards authenticity, the largest lingerie retailer in the U.S. isn’t budging.

Victoria’s Secret has built its brand image on fantasy, not authenticity, with its cadre of thin, statuesque runway models (‘angels’) featured in highly-retouched and often suggestive photography, in which they always appear to be vacationing on some private Caribbean island or lounging around in a penthouse.

However, a recent decline in sales, in contrast to record growth for Aerie, has some wondering if the lingerie queen is on her the way to the guillotine for no longer resonating with women.

Is Victoria’s Secret being edged out by more body-positive and alternative retailers? We looked into favorability of the brand, and what we found was rather surprising.

VS is still held in high regard by U.S. women.

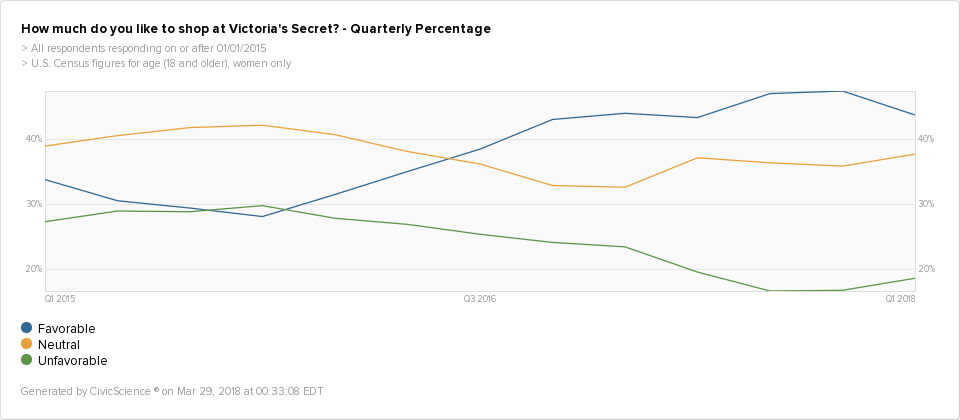

It turns out that nearly double the number of women like and love the brand than those who dislike it. About 41% of U.S. adult women polled are favorable to Victoria’s Secret, while 37% are neutral and 22% are unfavorable.

What’s really interesting is that since the last quarter of 2015, favorability has dramatically grown for the brand, peaking at the end of 2017 and declining a few percentage points since then.

Could the slight drop in favorability this year be related to negative same-store sales growth that the company saw in the last quarter of 2017?

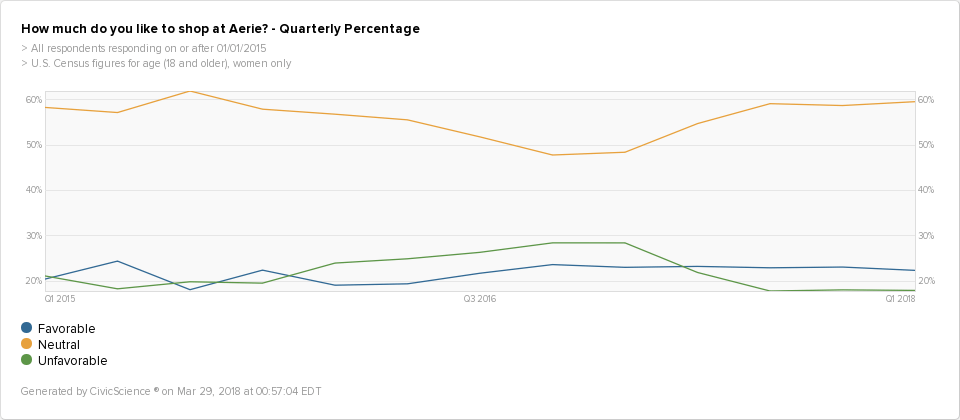

Possibly, but of course, favorability doesn’t always translate to actual sales. For example, even though Aerie has had significant sales growth in the last quarter, it favorability hasn’t seen the same growth as Victoria’s Secret.

So, just because 41% of women favor Victoria’s Secret doesn’t mean that they are all shopping there or shopping there exclusively.

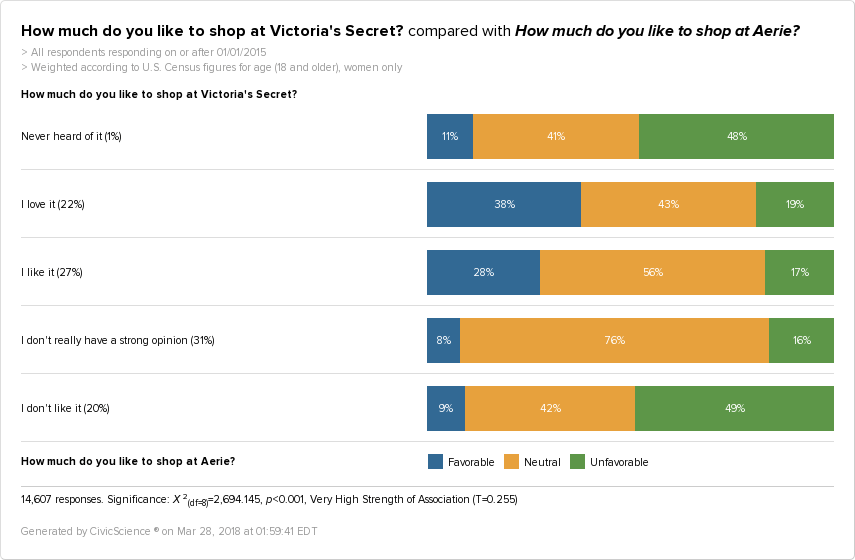

In fact, data suggests that about 34% of Victoria’s Secret shoppers are also favorable to Aerie. When paying a visit to Victoria’s Secret, they might also pop over to Aerie or a department store.

It’s clear that there is a shared customer base between these two brands; Victoria’s Secret and Aerie shoppers are not mutually exclusive. If you’re favorable to shopping at Victoria’s Secret, then you are more favorable to Aerie, and vice versa.

The same goes for many other major clothing retailers. Women who love or like to shop at Victoria’s Secret are more likely to shop at Target, Macy’s and Nordstrom than those who are neutral or dislike the brand.

The point here is that despite high favorability ratings, brand flexibility among Victoria’s Secret shoppers could account for the drop in sales growth for the company and the rise in Aerie’s sales. While it’s plausible Aerie or Target are stealing sales away from Victoria’s Secret as the result of their body-positive ads, the question is, to what extent?

Millennial trends may provide clues.

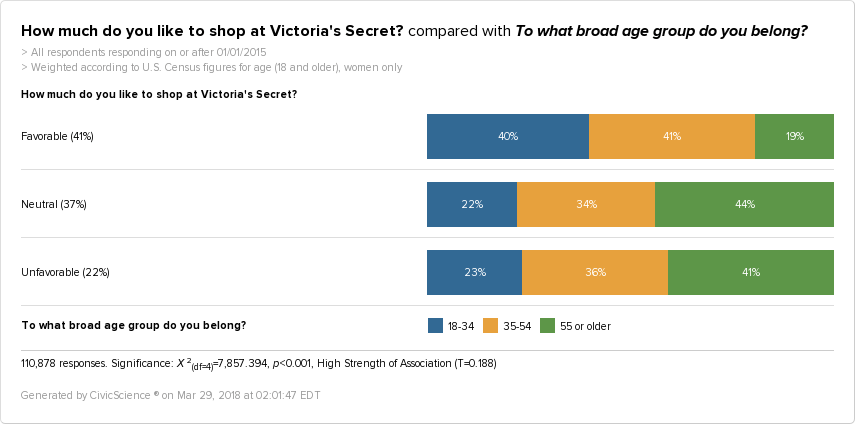

Consider that Millennials make up more than one-third of those favorable to shopping at Victoria’s Secret:

This generation has a slew of quirks that could help make sense of what’s happening with Victoria’s Secret.

For one, in an earlier post, we found that Millennials (and Gen Z) are more likely than any other age groups to think that models should actually be retouched more in advertising. While only a small percentage (3%) of the U.S. population prefers more retouching, it is worth noting that younger people dominate here by a lot, especially Gen Z. Campaigns focused on limiting or eliminating photoshopping of models might have a hard sell with this group.

Millennials are more concerned about price.

Changing behaviors related to price and brand may factor into Victoria Secret’s mysterious rise in favorability but loss in sales growth.

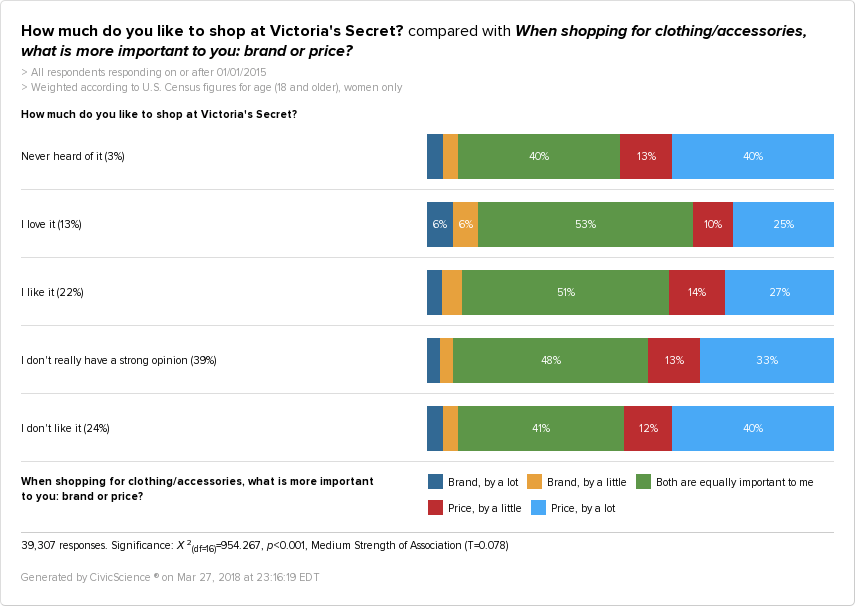

We can see here that women who favor shopping at Victoria’s Secret are the least concerned about price when shopping for clothing and accessories.

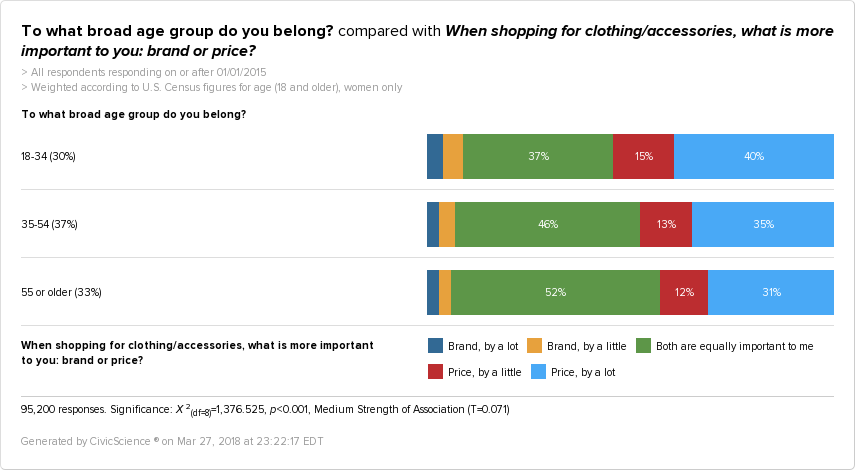

However, Millennial women, in general, are more concerned with price when shopping for clothing and accessories than older women:

Our data shows that this trend doesn’t change when it comes to Millennials who are favorable to shopping at Victoria’s Secret. Millennial women who favor shopping at VS are more likely to be concerned with price when shopping for clothing and accessories than Gen Xers or Baby Boomers who shop at VS.

That said, Millennials may be less inclined to spend as much on a Victoria’s Secret trip than older shoppers. It’s possible they’d be more likely to go where the price is better or reduce how much they shop at Victoria’s Secret.

While Millennials may be impacting the company right now, they could spell even bigger problems down the road. If you look at again at Victoria’s Secret favorability and age range, you’ll see that Baby Boomers make up the smallest age group of those who are favorable, which could imply that the company appeals more to younger women.

If Gen X shoppers follow that trend as they age, then that would leave the more price-conscious Millennials to take their place as Victoria’s Secret customers, which could really shake things up for the company.

Online shopping could be cutting into sales.

And of course, there’s online shopping, which is disrupting traditional brick-and-mortar sales. Victoria’s Secret has had an online presence for years, but most women would agree that buying a bra or swimsuit online can be a hassle.

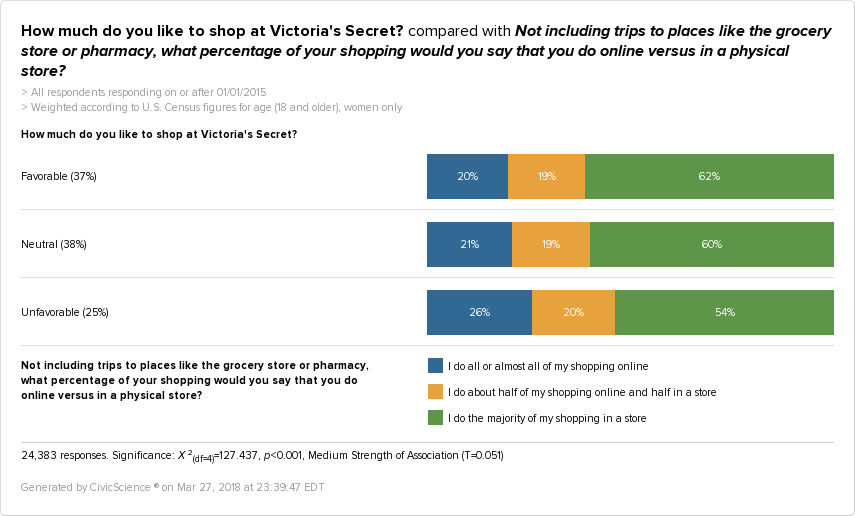

The good news for the brand is that those who like or love to shop there are more likely to shop in stores than online, when compared to those who dislike the brand.

The bad news for the brand is that we’re seeing the emergence of companies offering innovative ways to get the perfect fit without having to set foot in a store, like Third Love.

Couple that with data that shows Millennials are more likely to shop online over in-store and are more concerned with price when shopping online than older age groups, and things just got a whole lot more complicated for Victoria’s Secret.

It’s complicated.

At the end of the day, we still have an unexplained growth in favorability for the brand, making it difficult to discern whether taking a more body-positive approach to its advertising would be helpful to Victoria’s Secret in the long run. Despite other companies’ best efforts to challenge what some view as an unhealthy advertising paradigm set by the company, some women may be attracted to the fantasy and image Victoria’s Secret represents. Or, perhaps they simply like the products.

Whatever the reasons, that favorability has not translated to increased sales, and it may be the result of a combination of things: the ad campaigns of competitors and the emergence of many new lingerie companies, competitive pricing, online shopping habits, brand flexibility of shoppers, and Millennial trends.

We’ll be watching to see whether or not favorability continues to decline as the year progresses.