The Gist: Convenience is king when it comes to online shopping, especially for parents, but it’s only one piece of the puzzle. Millennials value price far more than older generations.

We are seeing plenty of headlines out there about the ‘retail apocalypse’ that is upon us, as numerous shopping malls and brick-and-mortars close their doors.

Even though data shows that the majority of U.S. adults (59%) still tend to shop more in stores than online (which we discussed in a previous post), that’s not keeping retailers like Walmart from growing their online shopping divisions.

But unlike in Field of Dreams, “if you build it, they might come,” or they might go to Amazon or a physical store. When it comes to online storefronts, retailers are certainly faced with a host of challenges, like having enough inventory at distribution centers or competing with Amazon’s same-day delivery service, not to mention leveraging store sales with online sales.

All of this makes us wonder what makes customers want to shop online versus in stores. Is it the greater variety of products? Competitive pricing? Home delivery?

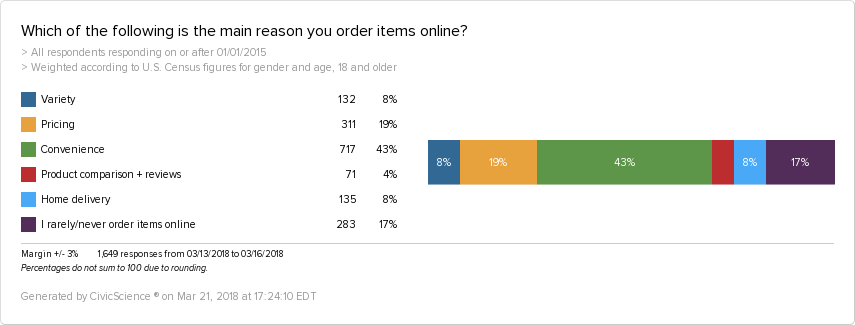

To get a better sense of what’s driving online shopping, we asked people to choose what their biggest motivator was: variety, pricing, convenience, product comparison, and reviews, or home delivery.

As it turns out, convenience is king. For many, convenience likely means not having to get into your car, drive to the store, park, contend with crowds, hope they have your items in stock, wait in checkout lines, drive home, and haul your goods back into the house.

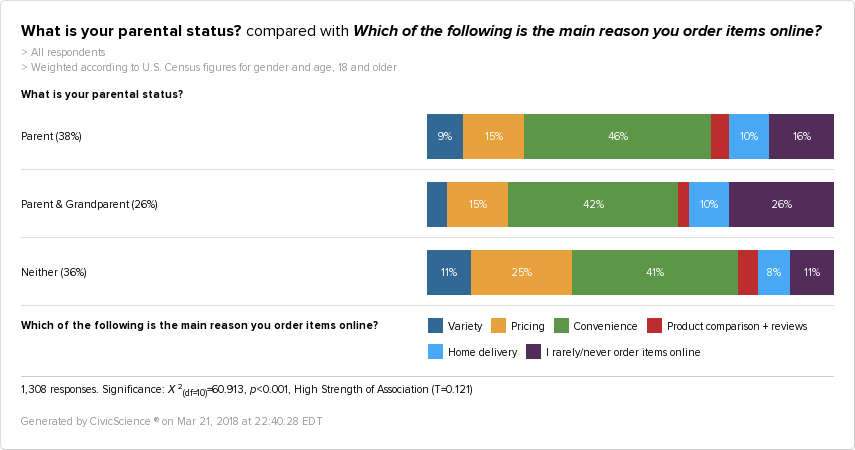

Add young kids into that mix, and being able to buy toilet paper and shampoo from your phone is nothing short of a miracle. In fact, we found that parents value convenience more than non-parents.

While you may not always save money, you save time shopping online, provided you can wait for delivery.

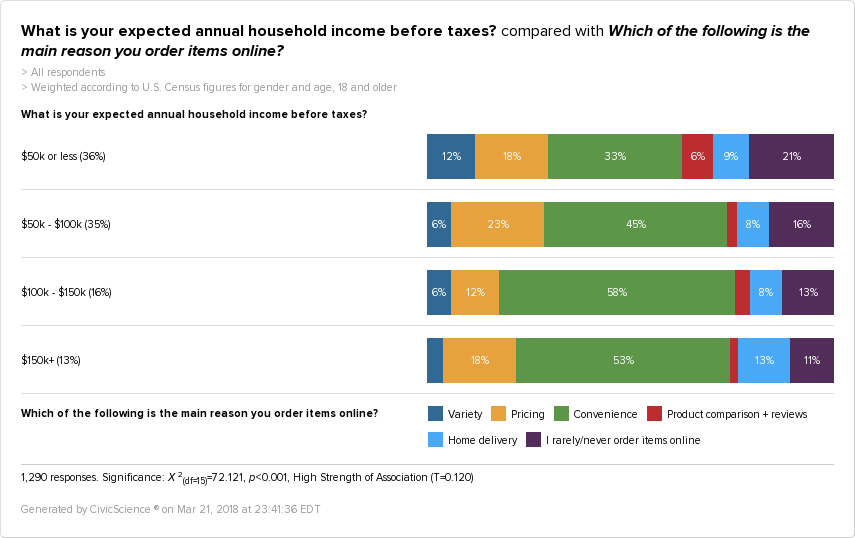

Even when breaking it down by age, gender, location, and income, convenience still ranks on top. However, there are nuances buried here that are worth mentioning. We’ll look at a couple.

Price is still important, depending on where you live.

Convenience is more important for those living in suburbs than it is for those living in cities. We found city dwellers tend to value price more than suburban or rural dwellers.

This makes sense when considering that more people make $50K or less per year in cities than in other areas. However, oddly, people who earn between $50-100K are most likely to be concerned with pricing when shopping online!

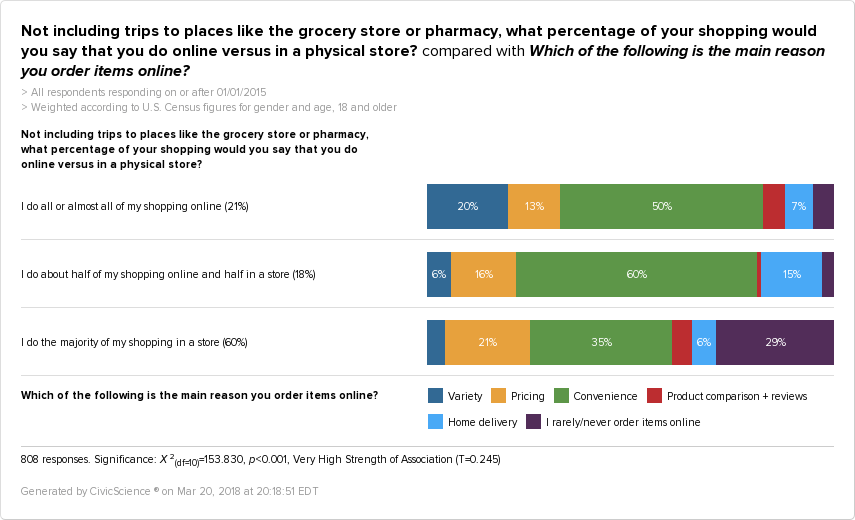

Also surprisingly, city dwellers are more likely to shop more in stores than suburbanites. In general, people who shop more in stores than online tend to be considerably more concerned with price, as you can see here:

So, a picture begins to emerge of a more price-conscious urban middle class that is more likely to buy goods in-store, and a suburban middle class less worried about costs and more willing to buy online in the name of convenience.

Price is most important to Millennials.

Interestingly, even though our data shows that 38% of Millennials live in urban areas, compared to 30% of Gen Xers, Millennials as a whole actually tend to shop more online than older generations.

When it comes to reasons why, price is considerably more important to Millennials than it is to any other generation, ranking up there with convenience.

This is in line with our unfolding narrative that Millennials are showing to be financially savvy, having more in savings and less in debt than Gen Xers, which we’ve looked at in previous posts.

It’s also worth noting that Twitter and Facebook users, Netflix subscribers, streaming music listeners, and frequent customers of fast food restaurants are all more likely to be concerned with pricing when shopping online than anything else.

No one-size-fits-all approach.

As retailers work to reinvent themselves online and in stores during the ‘retail apocalypse,’ it’s clear that there is no one-size-fits-all approach to why customers shop online. Location, income, age, gender, and even technology usage all factor into a person’s online shopping habits and expectations, which may be different from how they shop in stores.

We’ll keep building on these findings and scope out in-store shopping behaviors in a future post.