It seems that the coronavirus pandemic has not turned consumers away from all-natural cleaning products in search of a more powerful option.

Nearly 3 in 10 U.S. adults have now turned to brands like Mrs. Meyers, Seventh Generation, and Ecover for their cleaning needs, according to a CivicScience study in early May 2020. That’s up slightly from one-quarter of adults in a previous CivicScience survey in August 2019.

Interestingly, though, awareness of these products hasn’t increased much (if at all) over the past nine months.

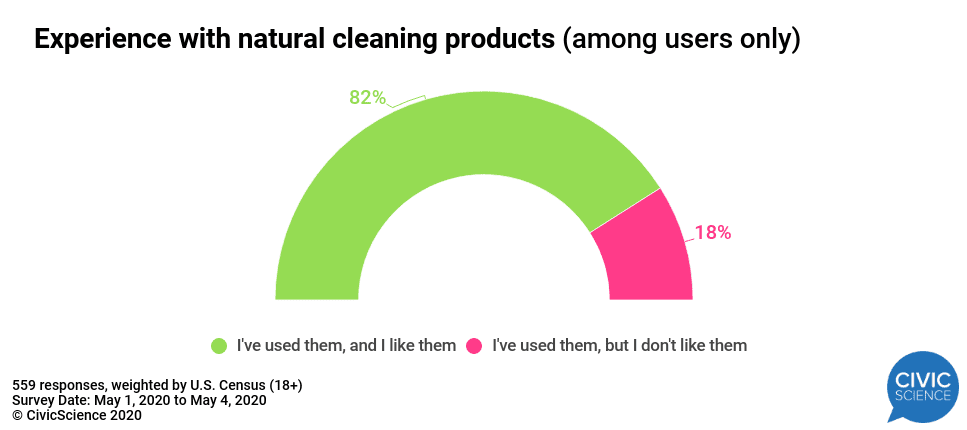

Among those who said they’ve used them in the May survey, more than 4 out of 5 said they had a good experience with natural cleaning products.

Going Au Naturel

Rarely in the CivicScience database do we see a gender comparison so eye-popping as this: Women make up an immense two-thirds (66%) of those who said they’ve used or intend to use natural cleaning products. Meanwhile, men accounted for the vast majority (63%) of those who said they’ve never heard of them.

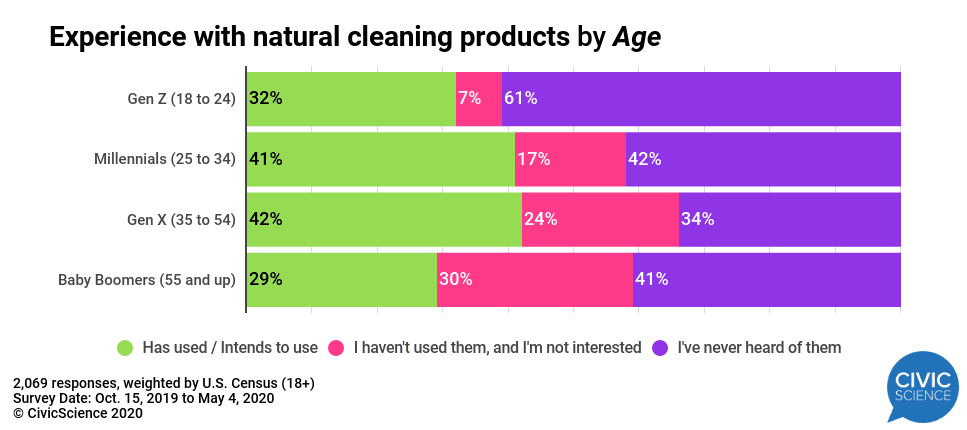

One might be tempted to assume that young people would be more likely than their elders to use these products. The data just don’t track with that theory, though: Gen X respondents (35 to 54) were just as likely as Millennials (25 to 34) to say they’ve used them.

Meanwhile, Gen Z (18 to 24) usage was more akin to that of Baby Boomers (55-plus). Perhaps that’s because many of the youngest adults haven’t fully formed their house-cleaning habits yet. Gen Z may be an untapped market, though: more than 3 in 5 of this generation hadn’t heard of these products before.

Parents are clearly a prime target market, possibly due to worries about children ingesting cleaning chemicals. Nearly half of all parents of babies and toddlers (kids age 0 to 2) say they’ve either used natural cleaning products or are interested in doing so.

How Marketers Can Reach Natural Cleaning Users / Intenders

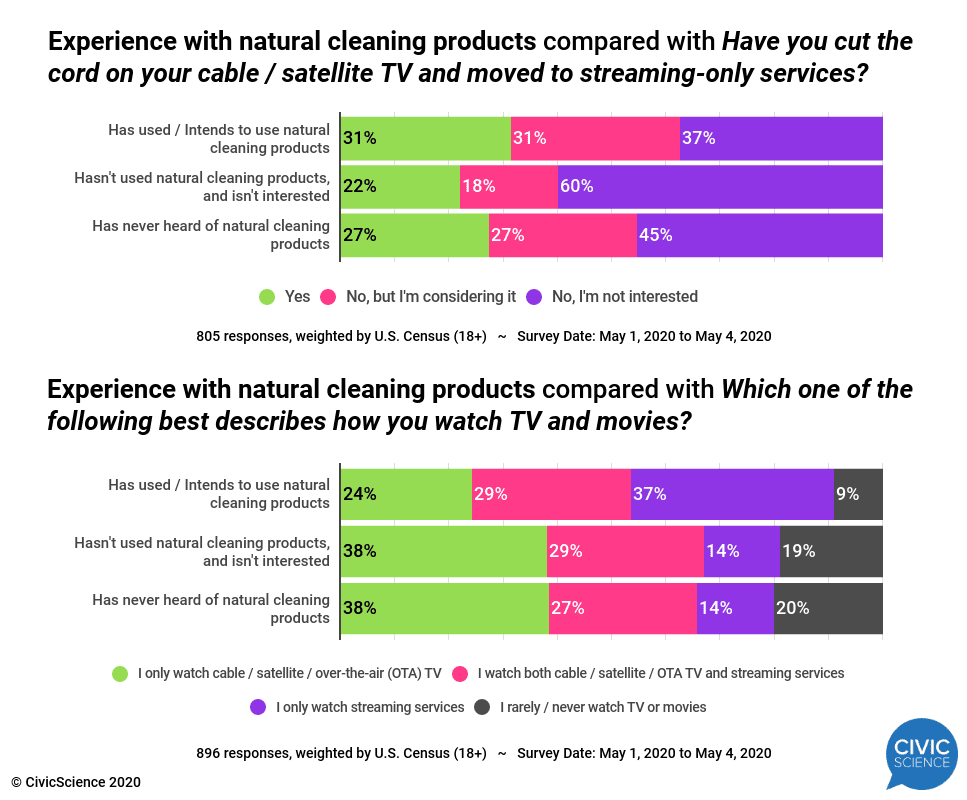

Natural cleaning product users / intenders are more likely to have ‘cut the cord’ with cable / satellite TV services — and are more likely to be considering it — than others. Naturally, this leads to this group being far more likely to say they only watch OTT / streaming services (and not traditional TV).

The natural cleaning product user / intender is also much more likely than others to say their social media contacts influence the products they buy. What’s more, they’re simply using social media more often than others. They’re also more likely than others to buy products directly from social media marketplaces.

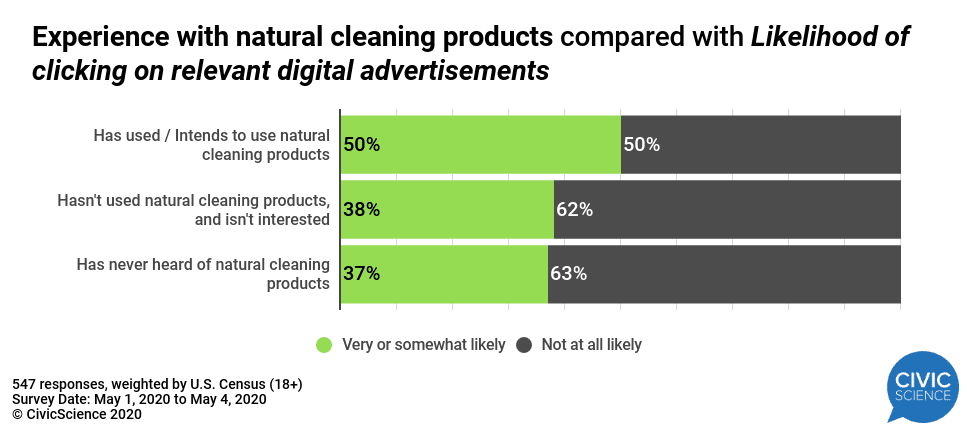

A full 50% of natural cleaning product users / intenders say they would be ‘very likely’ or ‘somewhat likely’ to click on a digital ad if it was ‘relevant to [their] interests’ — much higher than the rates for non-users.

It’s clear that marketers for these products would be best served to focus on social media and digital advertisements rather than traditional TV routes, despite the prime age range of their consumer base being a wide-ranging 25 to 54.

Some final ‘quick hits’ about natural cleaning product users / intenders compared with other survey respondents:

- They’re more likely to have used or to intend to use telemedicine

- They’re much more likely to enjoy cooking (and much less likely to actively dislike it)

- They’re far more likely to have either cancelled or chosen not to make travel plans due to coronavirus

It appears that not even a pandemic could derail the growth of natural cleaning products over the past nine months. Look for this sector to continue its expansion over the coming year — and don’t be surprised to see advertisements on social media and online.