Like many companies, Lululemon globally closed brick-and-mortar stores for at least some period of time during Q1 2020, but because of the brand’s digital strategies, it has been able to stay top-of-mind for its customers and connect with new ones.

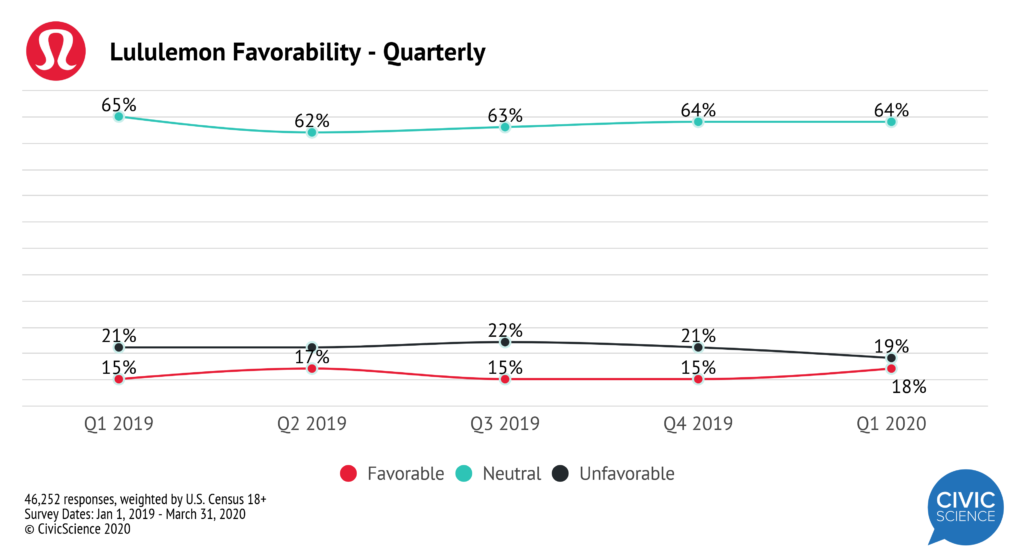

Overall brand favorability for Lululemon is currently at 18% of U.S. adults. CivicScience brand tracking year-to-date shows favorable and unfavorable ratings of the Lululemon brand in close competition. Quarterly favorability hovered between 15% and 17% just beneath unfavorable ratings that hovered between 19% and 21%.

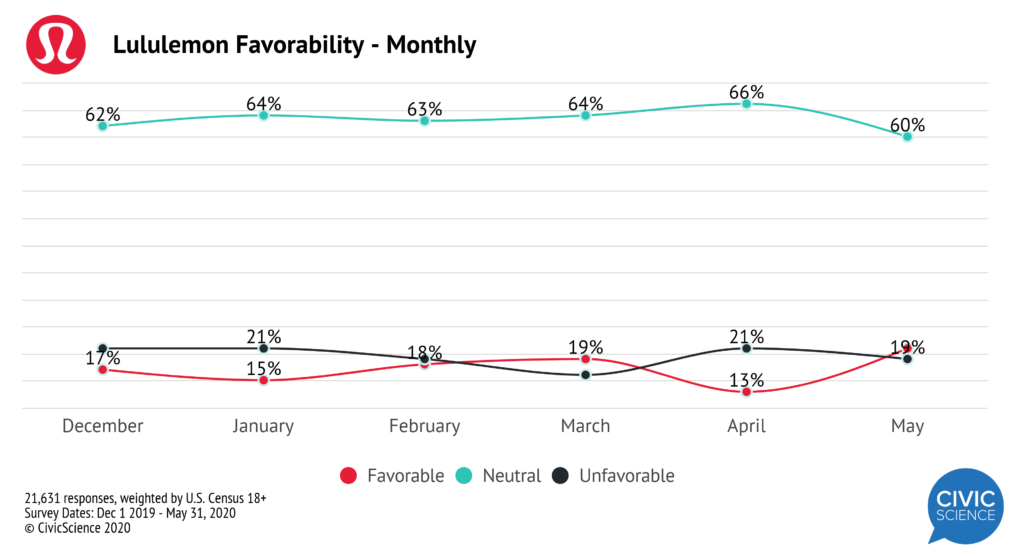

Monthly data suggests favorability might be on the rise and could potentially overtake unfavorable ratings that have been historically higher. Those who reported a favorable opinion of Lululemon increased from 17% in December to 21% in May. And, while neutrality isn’t much to boast about, it is certainly true that people who were indifferent toward the brand decreased significantly.

As previously mentioned, the company has kept up a strong digital strategy during the pandemic. Lululemon’s methods of staying connected with its customers and attracting new ones will likely be one of the main reasons for any future rise in favorability.

Demographic Breakdown

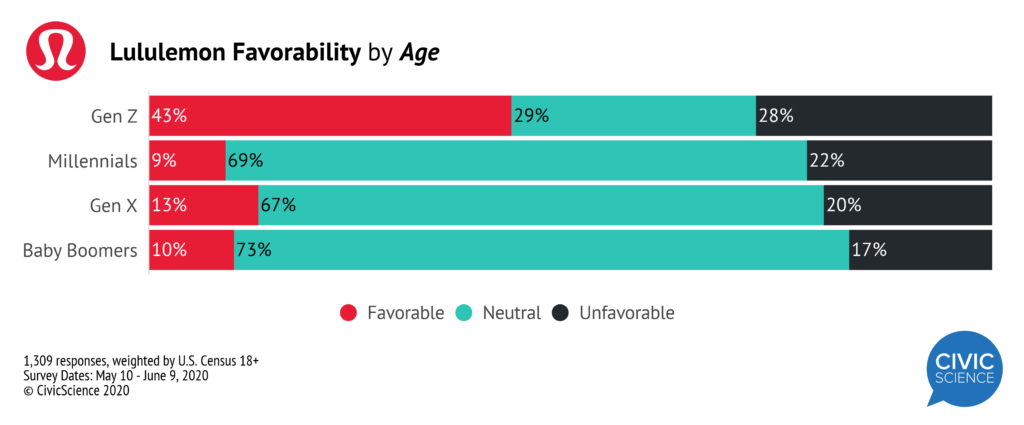

In line with CivicScience’s last reading of the Lululemon brand, Gen Z is still the generation most favorable toward Lululemon. In fact, favorability among Gen Z rose 79% since our last reading in December.

Also consistent with our last report is that high-income earners are the more likely fans of Lululemon. There are significantly more fans of Lululemon among those making over $100K each year.

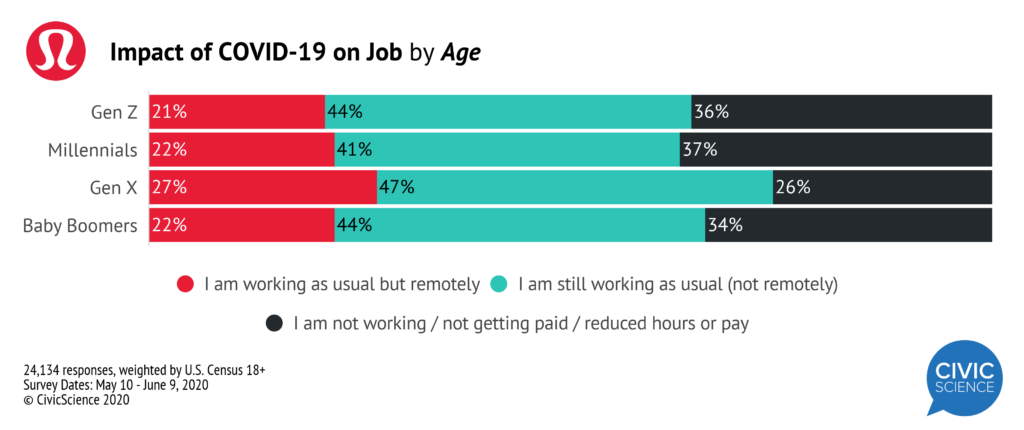

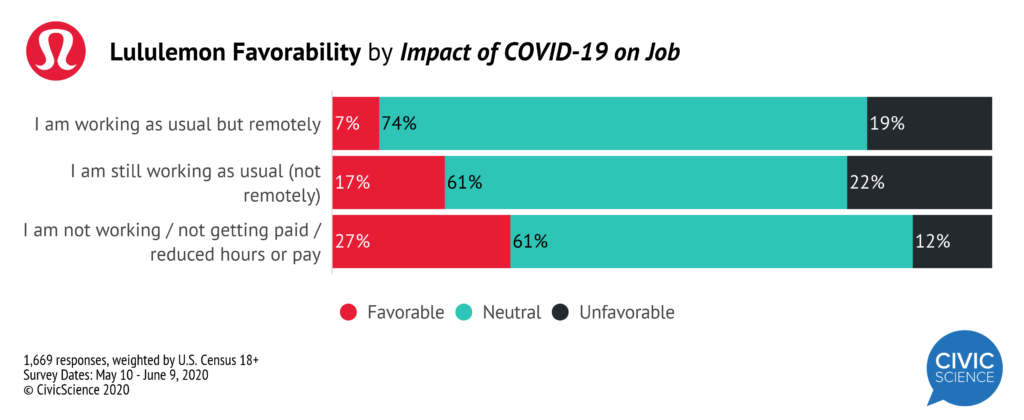

Despite income being a large determinant of a person’s love for Lululemon, recent data shows people whose jobs have been negatively affected by the pandemic are also the most favorable towards Lululemon at this time.

This is likely, in part, due to the fact that younger members of the workforce (Gen Z and Millennials) have been reporting slightly higher rates of reduced pay or unemployment during the coronavirus outbreak.

Exercise & Image

An earlier study from CivicScience found that exercise has increased among Americans during lockdowns, mostly among those who were already frequent exercisers, but also among those who would occasionally exercise.

As an athletic apparel brand, one might assume Lululemon’s favorables would be frequent exercisers and therefore spent some time looking for additional items to add to their workout wardrobe during lockdowns. Yet, just over a third of favorables exercise (at some frequency) while 62% say they almost never exercise.

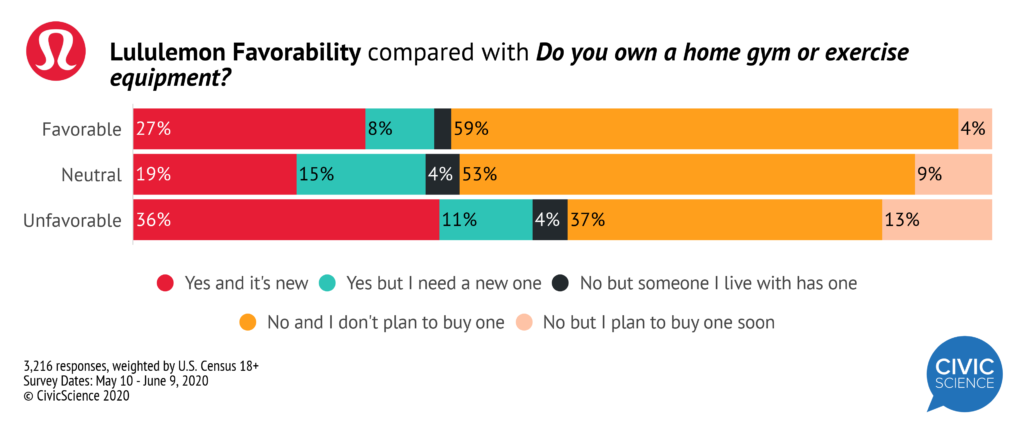

While there was a small cohort of favorables who recently invested in a home gym of some kind, the percentage of favorables who said they do not own exercise equipment and don’t plan to buy any was still the dominant answer.

The drastic difference in inclination to exercise suggests that the Lululemon brand attracts a fairly large base of customers in search of a particular lifestyle.

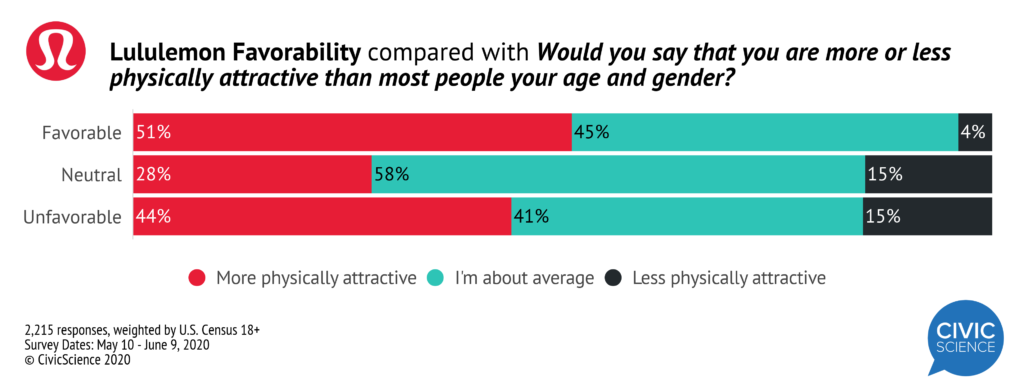

We see this notion confirmed by the percentage of Lululemon favorables (51%) who believe themselves to be more physically attractive than their peers, a 46% higher rate than the general population (32%). The significant difference suggests Lululemon favorables are more image conscious.

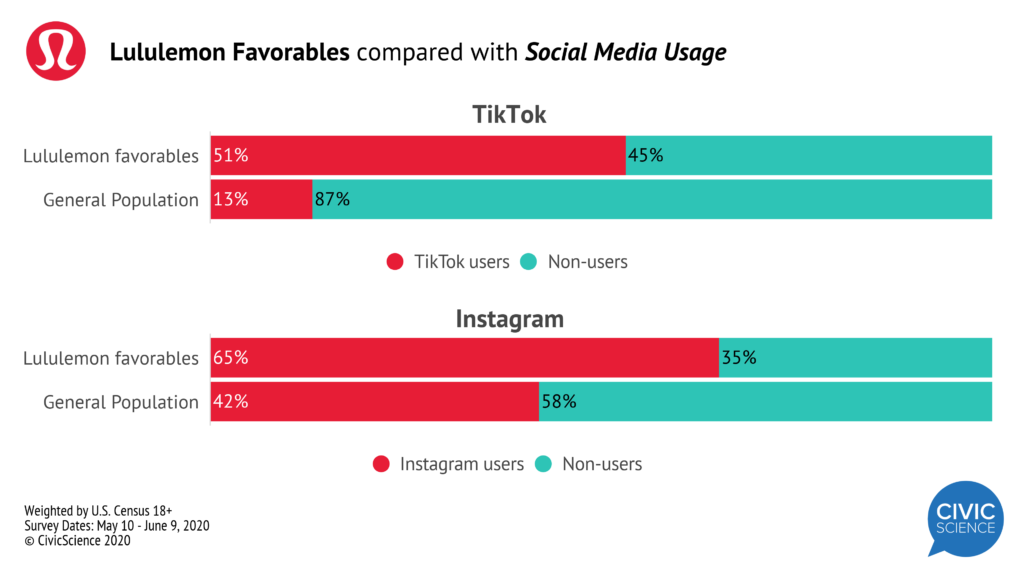

Digging into social media usage reveals a similar correlation between the brand and a concern for image. Lululemon favorables are extremely likely to be heavy users of both Instagram and TikTok, two social platforms that are extremely image-focused, in addition to being dominated by younger generations.

Returning to Stores

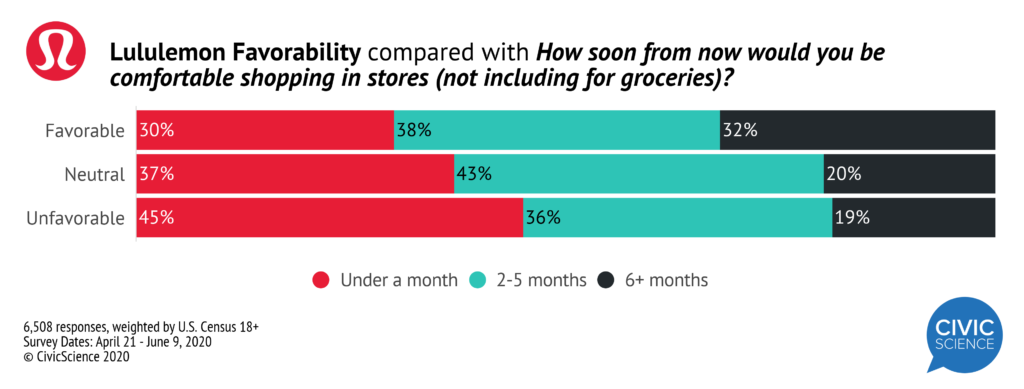

At this point in the coronavirus saga, Lululemon favorables are evenly divided about their comfort levels returning to in-store shopping. As stores reopen across the country, Lululemon customers will gradually return to the retail location to shop, however it’s likely the brand will encounter new faces as well.

Lululemon’s dynamic digital efforts set in motion at the start of the pandemic were undeniably strategic considering what we know about their customers. It’s clear the brand was able to stay connected to its customers and pull in new ones in the process, positioning the company to transition easily out of the global crisis. As things progress, social media will be the channel to watch with this brand, which is hands-down more about lifestyle than exercise.

Our clients have access to always-on data about their brand prior to earnings calls. Interested? Let’s talk.