The Gist: According to our data and recent industry reports, there are two major trends impacting the auto repair industry:

- Increased ownership of reliable vehicles and SUVs, which require less maintenance and repair, and

- Increased vehicle leasing, which also requires less maintenance and repair, coupled with repairs taking place at dealerships, rather than DIY or local repair shops.

Introduction

Over the past few months, we have been diving deep into the consumer retail and auto industry to tease out signals and trends that could ultimately have significant impact. To compliment that research, we decided to venture into an adjacent market to perform high-level research for the consumer auto part repair industry. We’ve looked at O’Reilly Automotive (ticker symbol: ORLY) as a reference point.

Company and Industry Background

ORLY offers replacement auto parts for vehicles which are in need of repair, and its stock is down approximately 22% year to date.

In ORLY’s last quarterly financial report, management stated that its revenue increase was due to higher prices per items on average, not overall volume. In other words, industry demand remained soft. The explanation given for decreased unit volume is that higher quality components last longer, warranting less frequent repairs, in addition to the string of milder winters.

CivicScience Data That May Offer Additional Insight

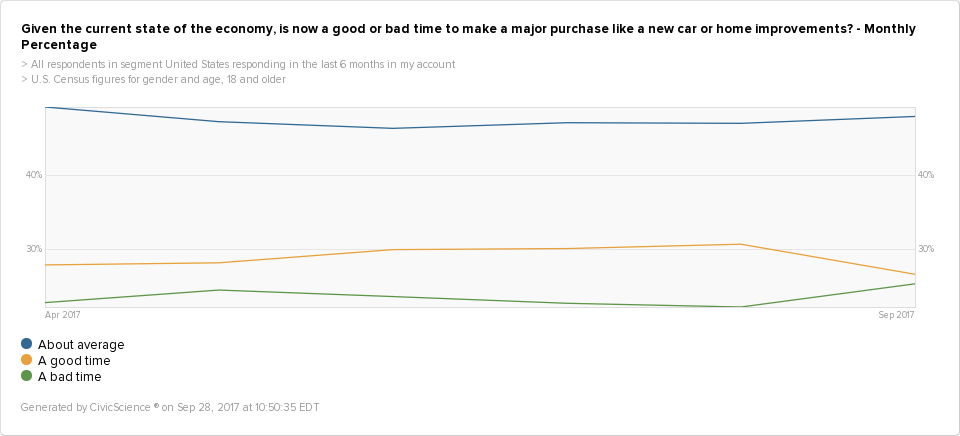

Economic Sentiment towards “Major Purchase” like a new car (Last 180 Days)

Over the past 180 days, there has been an increase in consumers who feel that it is a bad time for a major purchase like a new car, and subsequent decrease in consumers who feel it is a good time for such a purchase.

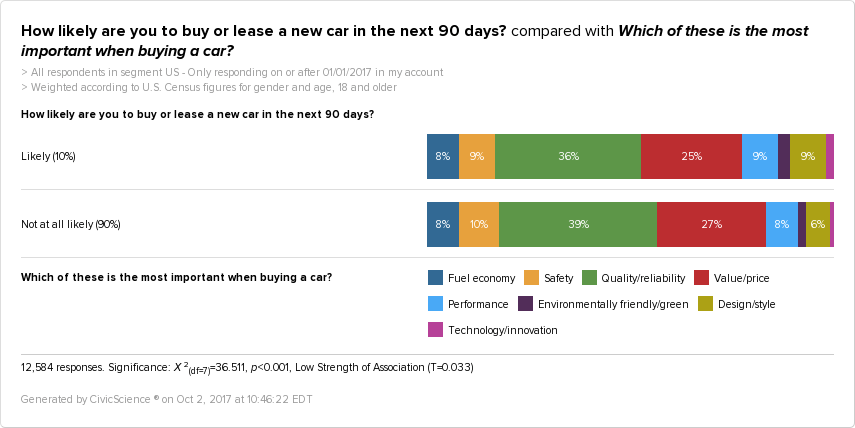

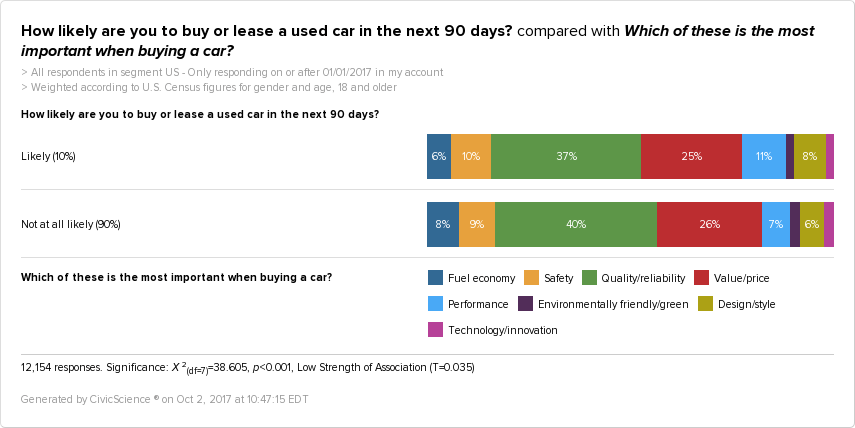

Preferred Vehicle Attributes Among Potential Buyers

The data suggest that management’s statements regarding quality of vehicles and quality of parts are true, as likely car buyers are more likely to rate quality and reliability as their preferred attributes.

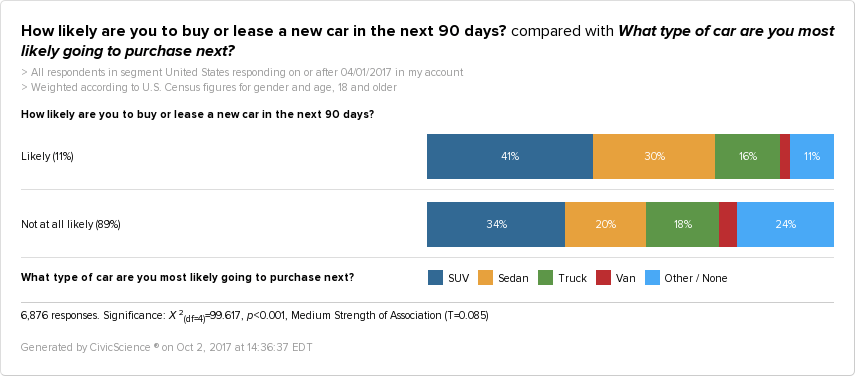

Preferred Vehicle Types Among Potential Buyers

Data show that likely car buyers are more likely to purchase SUVs, which can handle far more “wear and tear” than traditional sedans.

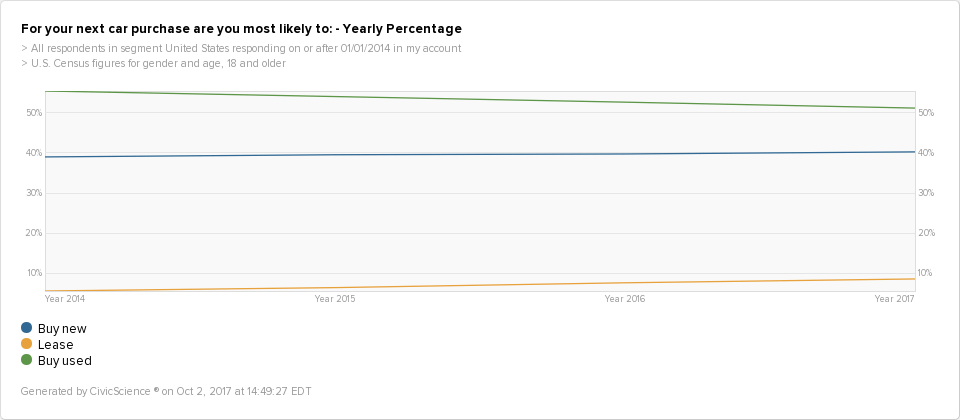

Consumers Lean Toward Leases

At the beginning of 2014, only 6% of respondents were likely to lease their next vehicle, while now, 9% of respondents are likely to lease their next vehicle. This coincides with recent industry reports that leased vehicles are at an all-time high.

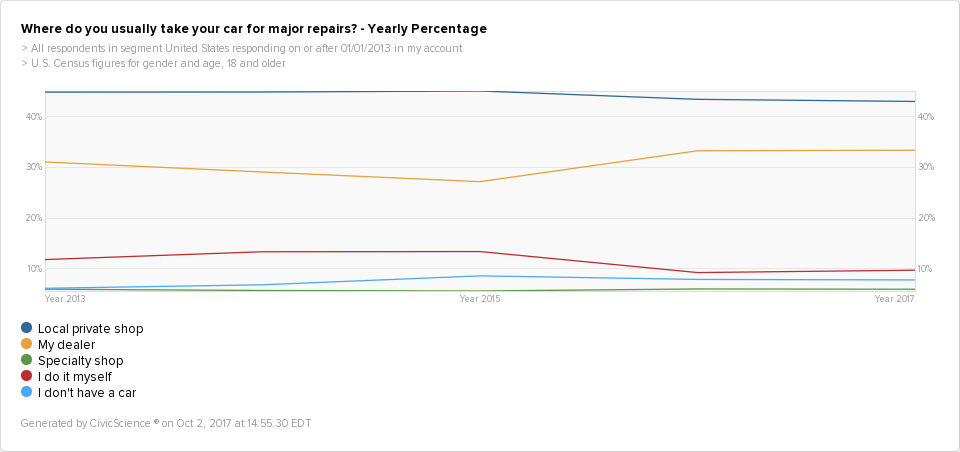

Auto Repairs

Respondents choosing local private shops for car repairs have decreased, while respondents choosing their dealer has risen steadily over the past two years, which falls in line with the growth in vehicle leases.

Conclusions

The data suggest that ORLY management’s statements are valid regarding quality cars and materials eating into their unit volume. Additionally, it appears the general sentiment among U.S. consumers is it is a bad time for a major purchase such as a new car.

Additionally, two main factors contributing to weak industry demand and affecting ORLY’s performance are:

- Increased ownership of reliable vehicles and SUVs which require less maintenance and repair.

- Increased vehicle leasing which typically requires less maintenance and repairs, coupled with repairs usually taking place at dealerships rather than DIY or local shops.

What’s Next for ORLY?

The data has illuminated several interesting consumer trends within the auto repair industry. However, we will leave the investment recommendations up to the investment professionals 😉

*This document is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation.