The Gist: Most consumers, specifically frequent online shoppers, are aware of the Supreme Court ruling on online retailers collecting state tax.

June has been rife with major legal decisions as the Supreme Court winds down to its summer recess. Included in the many rulings is the South Dakota v. Wayfair decision in that states are now permitted to collect sales tax from orders of online retailers that don’t even have a physical presence in the state.

The ruling ensures that taxing decisions will be made on a state by state basis, meaning it’ll likely be awhile before we see how the policy plays out economically. However, it’s not too soon to speculate what this decision means for consumer behavior–will taxes change online shopping behaviors? Are they even aware of this new policy?

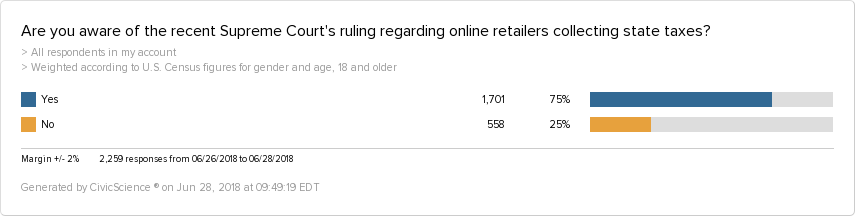

¾ of the adult US population is aware of the ruling, which is encouraging for online retailers. As policies are enacted state by state, stores don’t need to spend all their time and capital educating on the issue. Maybe it’s our rapid news cycle, but regardless, shoppers know potential change is coming.

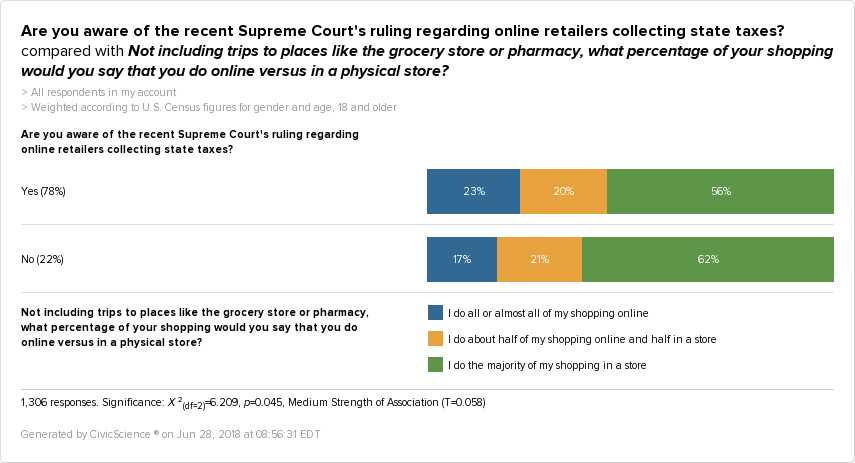

We took a deeper dive into the “aware” group, to see how much shopping they’re currently doing online.

People who do almost all of their shopping online are more likely to be aware of the recent ruling. There’s still nearly a quarter of US adults who aren’t aware of this ruling, many who shop online, so future messaging for brands will be important.

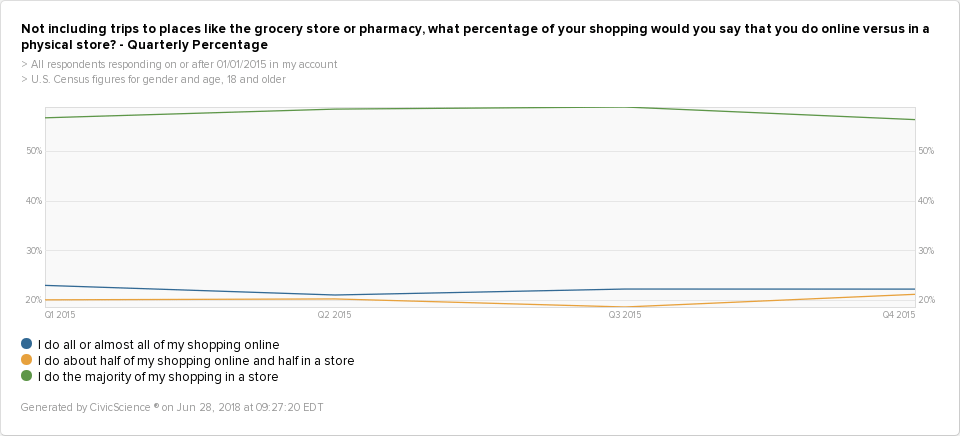

In a previous post, we highlighted that 59%, a majority of US adults, still do the majority of their shopping in stores. For the most part, this number has been steady for the past few years.

In a moment where the future of some online retailers is in flux, it’s worth noting that we’re still in the early days of shopping online. Most still shop in stores, citing convenience. An industry this young is obviously going to face changes and growing pains.