It’s no secret that Americans pay some of the highest healthcare costs in the world. A study published earlier this year by the American Medical Association reports that the United States spent approximately twice as much as other high-income countries on medical care in 2016, yet not because Americans were using the healthcare system more frequently.

Costs have been on the rise for years. It’s estimated that the average annual premium for family coverage has more than tripled since the turn of the century, from around $6,000 to close to $20,000 today. Premiums excluded, total spending on health services for those with employer-sponsored insurance plans increased by an estimated 44% within the last decade or so.

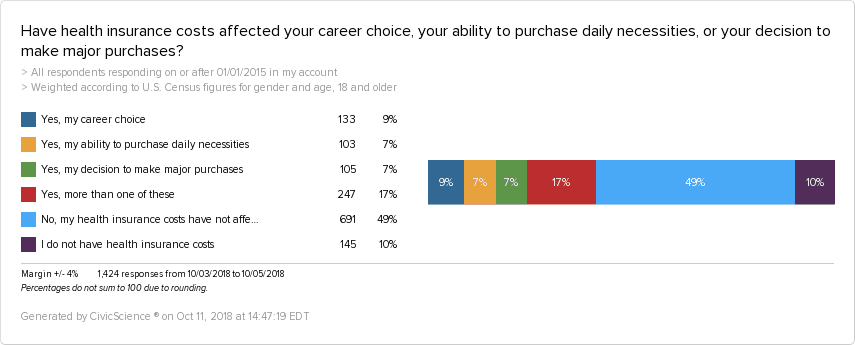

Those numbers are scary, but just how debilitating are these costs to the American people? In a survey of more than 1,400 U.S. adults, CivicScience discovered that a total of 40% of respondents say that health insurance costs have affected how they spend their money and/or what career they choose.

Whether it’s buying daily necessities, making major purchases, or choosing a career path, a little less than half (42%) of those affected report that health insurance costs have interfered with more than one of these key aspects of their lives.

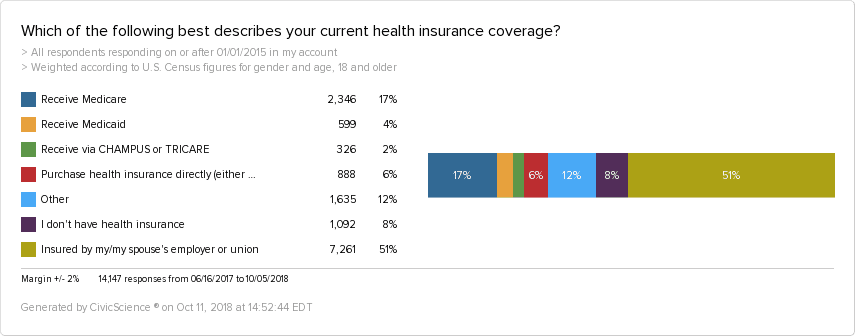

While these numbers don’t include the impact of healthcare costs on those without health insurance, bear in mind that most Americans surveyed were insured through some type of plan. According to survey results, 51% of U.S. adults were insured through an employer or union. 8% had no health insurance at all.

In other words, health insurance costs are likely taking a toll on a significant percentage of the population, and doing so in different ways. One way is through the purchase of a home.

Survey results show that those affected by health insurance costs are at a disadvantage. They are 14% less likely to be a homeowner compared to those unaffected by their health insurance costs and are more likely to rent or live with parents.

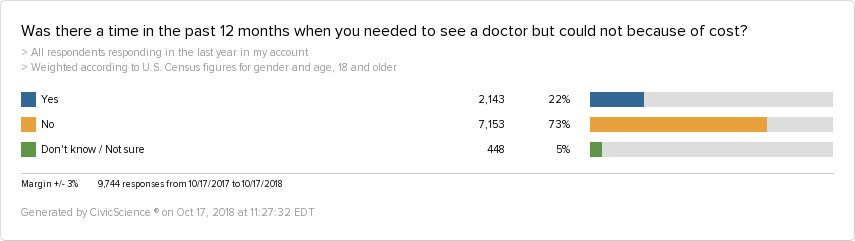

Ironically, the high costs of healthcare are also dissuading some people with health insurance from even using their insurance at all. CivicScience asked whether or not adults put off going to a doctor they needed to see in the past 12 months because of cost, finding that 22% answered “yes.”

A trip to the doctor is a source of financial dread for many, and about one in four Americans choose not to go. What’s even drearier is this trend has mostly stayed the same for the past five years that CivicScience has been tracking it, despite changes like the Affordable Care Act.

In fact, among the insured, those who purchased plans through the exchange marketplace were the hardest hit — they were the most likely to avoid going to a doctor (30%), followed by Medicaid recipients (28%). On the other hand, those with employer or union-sponsored healthcare were the least likely (16%). But overall, every type of health insurance in the survey showed some percentage of recipients who avoided a doctor’s visit because of cost.

Do Income and Age Matter?

Logic would dictate that the more money you make, the less likely you are to be hurt by the cost of health insurance. The study shows that is indeed true — a whopping 46% of earners who make under $50K or less annually say health insurance costs have impacted them in some way, compared to 38% of those pulling in between $100-150K.

However, it bears repeating that 38% of those who make $100-150K per year, an income well above the national average, have experienced negative effects from health insurance costs. In fact, even the highest earners surveyed weren’t exempt — nearly 30% of those earning $150K or more per year say they have been impacted by insurance costs.

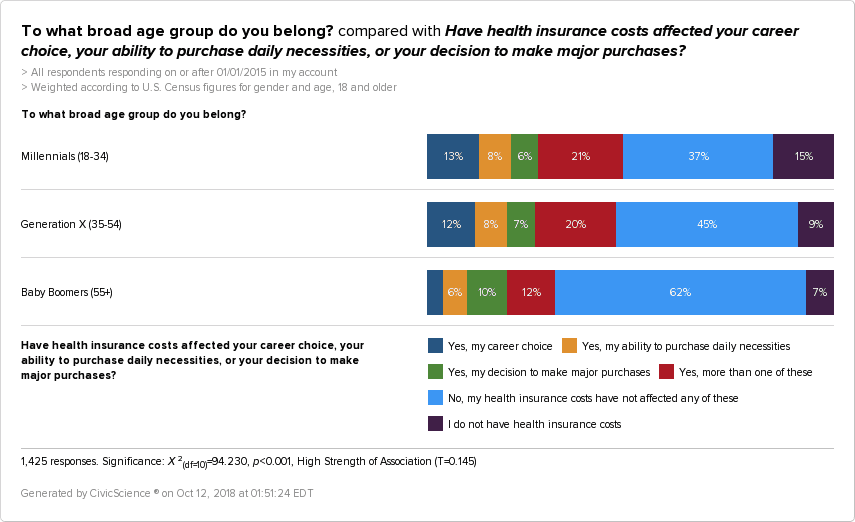

When it comes to age, both Millennials and Gen Xers are quite frankly, getting shafted. About 48% of those between the ages of 18 and 54 say that health insurance costs have affected their purchasing power and/or career choices. Yet even Baby Boomers, many of whom receive Medicare, aren’t unscathed by the high cost of insurance; 29% say they’ve been affected, mostly via spending on everyday items and major purchases.

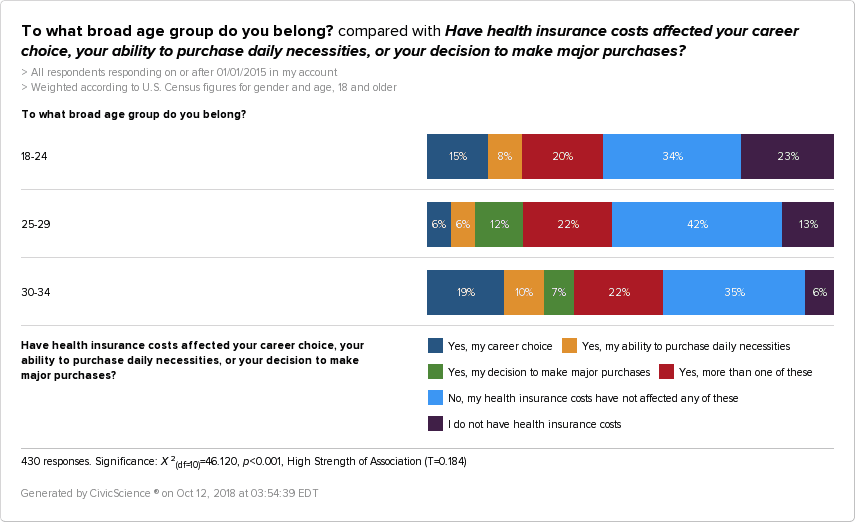

Looking a little deeper into the numbers reveals that 30-34-year-old Millenials are disproportionately affected, more so than any other age group. More than half (58%) say that health insurance costs have impacted them, and 19% say that costs have affected their career choice alone.

Health care costs are a piece of the puzzle carving out Millennials’ place in the economy. Millennial spending on healthcare increased 73.9% from what their counterparts were paying in the late 1980’s, further limiting the buying power of a generation already strapped with massive student debt.

At the end of the day, the study suggests that the cost of health insurance presents a pernicious and far-reaching problem affecting Americans across income brackets and age groups. It’s stifling spending on necessities and major purchases, screwing up career choices, and discouraging needed doctor visits.

Still, some demographics are more impacted than others, such as Millennials. If health care costs continue to rise as they have been, that impact can only be expected to get worse.