The Gist: When it comes to purchasing skincare and makeup products, U.S. Women of all ages and income levels seek top quality options.

These days, the skincare and makeup industries are having a moment. With a variety of all-natural, high-quality-ingredient-focused products appearing on shelves, we couldn’t help but wonder what was driving this boom. Could the self-care trend be the cause? And when you get right down to it, what will encourage someone to make a purchase, instead of leaving the item on the shelf? We took a variety of labels and buzzwords into consideration, asking U.S. Women what mattered most when purchasing skincare and makeup products.

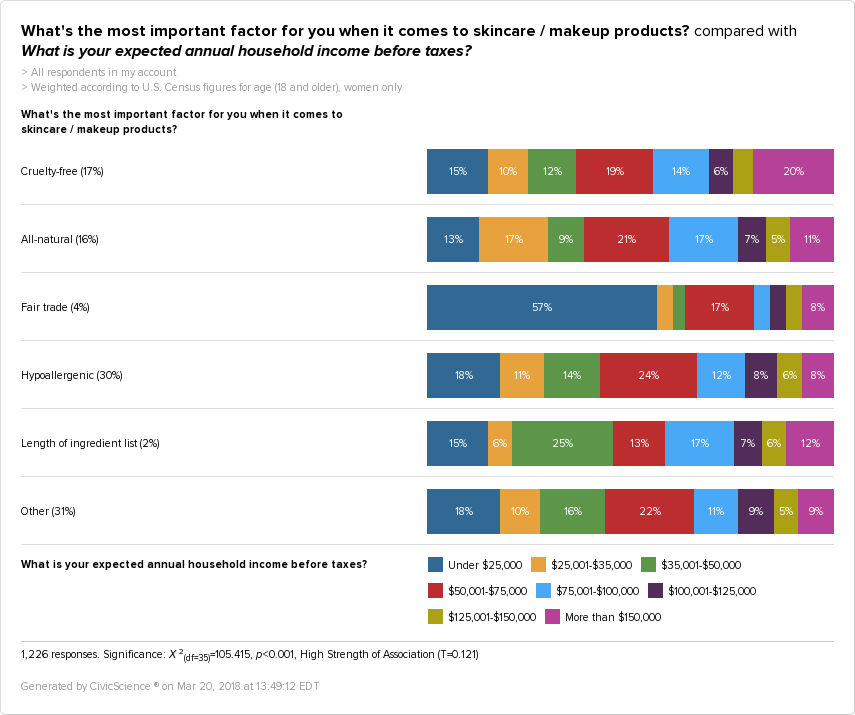

As we can see, a product’s hypoallergenic standing is a major influencer, with 29% of U.S. Women indicating that this particular label matters when it comes to their skincare and makeup purchases. The second most important factor is the designation of cruelty-free, with 19% prioritizing this. All-natural is a close third, with 17% stating this as a defining quality for their beauty products.

Of course, we had to find out who exactly held these preferences, so we took a look at the relationship between each factor and each age range.

Of the women who indicated that hypoallergenic mattered most, 39% were Gen X-ers, while 38% were Baby Boomers, meaning that the vast majority of women to whom hypoallergenic products are a concern are over the age of 35. That said, it cannot go unnoticed that Millennials made up 23% of responders, indicating that the need for hypoallergenic products may start early and continue to rise with age.

When we take a look at the next most popular response, cruelty-free, the split changes. Here, 40% of individuals are Millennials, 38% are Gen X-ers, and 24% are Baby Boomers. This is an interesting shift that could indicate greater exposure to the reality of animal testing in younger generations. The term likely was not as popular when the Baby Boomers were starting to become active buyers in the skincare and makeup markets so it may not be on the forefront of their minds when deciding to make a purchase.

That said, one term everyone can get behind is all-natural. With 38% of Gen X-ers, 34% of Baby Boomers and 28% of Millennials indicating their preference for this label. This is surprising, considering the fact that this term has come under fire in the past for lacking specificity in its standards.

Potential generational biases may also be present in the responses to fair trade. While this was a top priority for only 3% of U.S. Women who responded to the question, 60% of those women were Millennials. So those companies who choose to prioritize fair trade products should keep in mind their target audience will be the 18-34 set.

In order to gain further insight into potential biases and consumer demographics, we looked specifically at the household income of responders in each category.

While hypoallergenic products were of primary interest to women whose household income fell between $50,001-$75,000, fair trade products appealed to those with a household income of under $25,000. This is especially relevant for companies looking to market these niche-label products to their customers. Those with a hypoallergenic angle may be able to charge a little more, while those with a fair trade item may want to keep price accessibility in mind.

When it comes to cruelty-free and all natural products, while those whose household incomes that fall between $50,001 and $100,000 make up the largest contingent of responders, those with household incomes under $25,000 also demonstrate a strong interest in these options. This might encourage companies to create two product lines at different price points, or find a way to price their products in a range that feels comfortable for all.

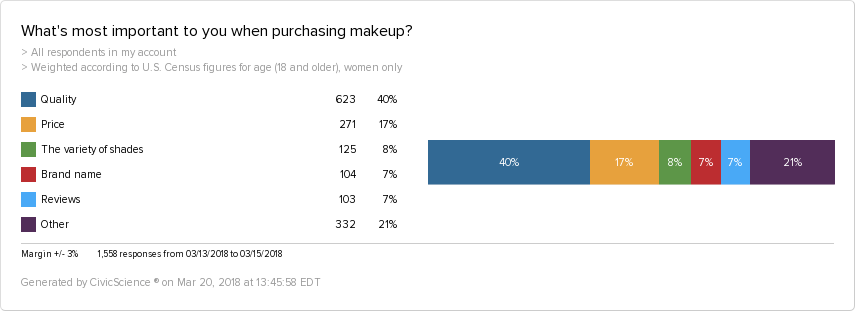

So what ultimately drives a purchase? Take a look at the data below:

When it comes to purchasing makeup, quality is key. In fact, 40% of U.S. Women feel that this is the most important factor to consider, making this the most frequent response by a long shot. As we can see, quality clearly overrules price. Does this mean that a high-quality product with a high price tag may still gain a following? It’s possible, considering that only 17% of women feel that price is the most important variable to consider.

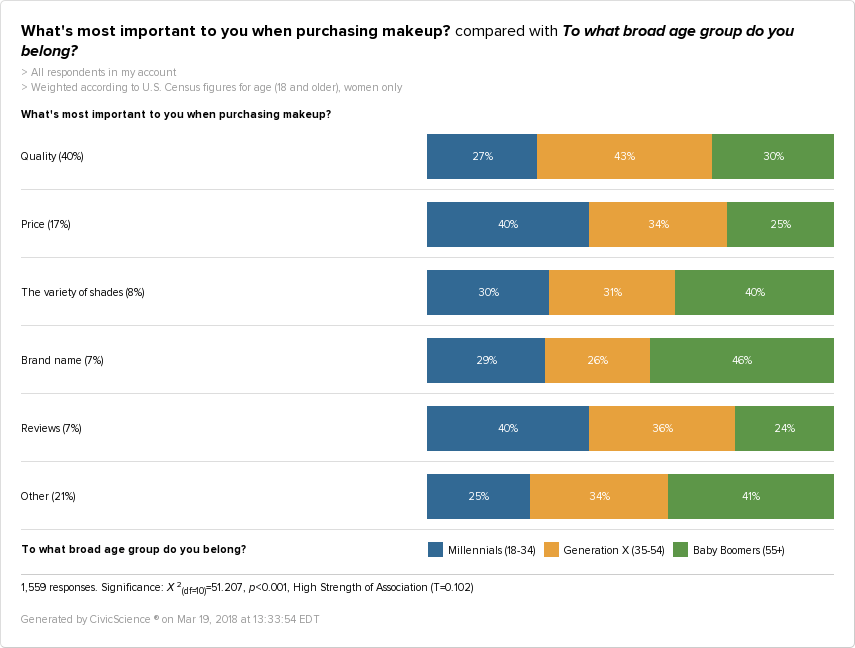

So what does this look like in terms of age? The results may speak to further evidence of the ways that makeup marketing and the beauty industry have changed over the years.

When we look at quality, Gen X-ers make up 43% of responders who felt this one factor was the most important. Baby Boomers come in at 30% and Millennials at 20%. Given the fact that Millennials made up 40% of responders who felt price was most important, this could indicate their willingness for a tradeoff–if the price is right, this age group may agree to sacrifice on quality. The fact that society places a high priority on retaining a youthful appearance may also contribute to the rise we see in the 35+ set seeking greater quality in the products they choose.

Despite living in the digital age, product reviews were the least important aspect of the makeup purchasing process, with only 7% of U.S. Women indicating this as a high priority. However, of that 7%, Millennials were the keenest to rate this their number one priority, with Gen Xers not too far behind.

These days, new makeup lines are coming onto the market faster than ever, so the brand name has become less and less important. That said, when it comes to brands, Baby Boomers care the most, with 57% listing this as the most important aspect of the decision making process.

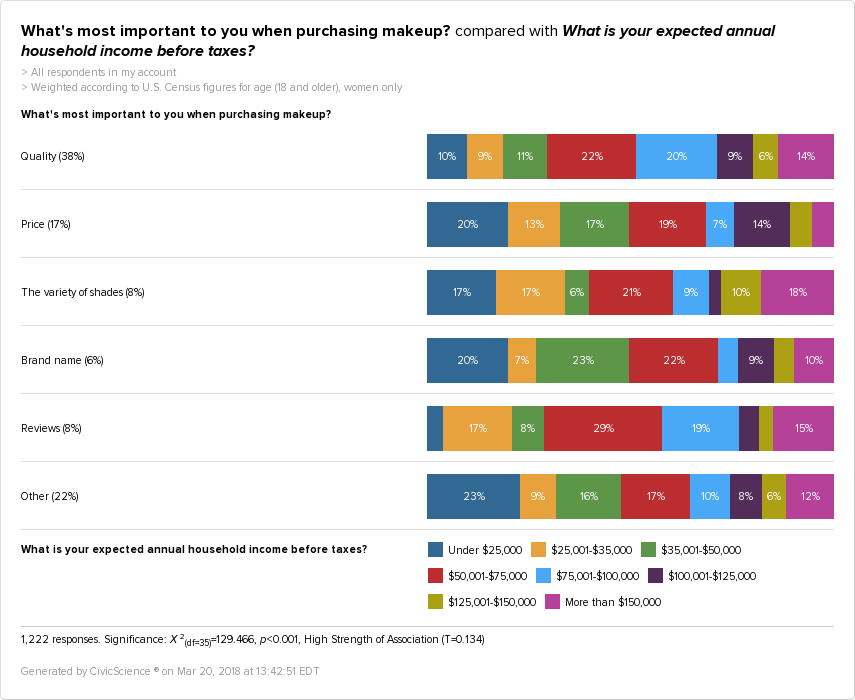

So, how does this shake out in terms of household income?

The data above shows a great deal of overlap with the question of age. Only 10% of responders whose household income is under $25,000 listed quality as the most important factor. However, for those who make anywhere from $35,001-$100,000, quality is clearly a critical determining factor in ultimately making a purchase. So, it seems that as income levels rise, at least up to the $100,000 mark, so does interest in quality.

In terms of price, those who make under $25,000 are just as interested in affordable options as those who make anywhere from $35,001 to $100,000. A good reminder for companies that the vast majority of their consumers may have a budget in mind.

So what does all of this mean? For starters, makeup and skincare companies may want to look into the hypoallergenic nature of their products. There is a demand across all age groups to see these kinds of options. While cruelty-free products appeal most to Millennials, an all natural distinction will catch the eye of women in every age group. Price should not be overlooked either since women of all ages and income levels consider this before making a final decision on purchases.

However, quality remains queen. The bottom line is that women want products that they can trust to do a good job. So, before skincare and makeup companies attempt to reinvent the wheel, it may be a better use of time and resources to recommit to creating products with a high level of quality. Ultimately, even the best priced hypoallergenic, all natural beauty items will never become a success if the ingredients and results they provide aren’t up to par.