As Tax Day draws near (April 15), new CivicScience data show 66% of Americans who are filing this year report they have already filed their taxes (n=1,800+ responses in April 2024). Here are three highlights that check in with how tax filing went this year, including expectations for tax payments and refunds, top filing concerns, and where people turned for tax advice.

1. A Growing Percentage Owed More Than Expected

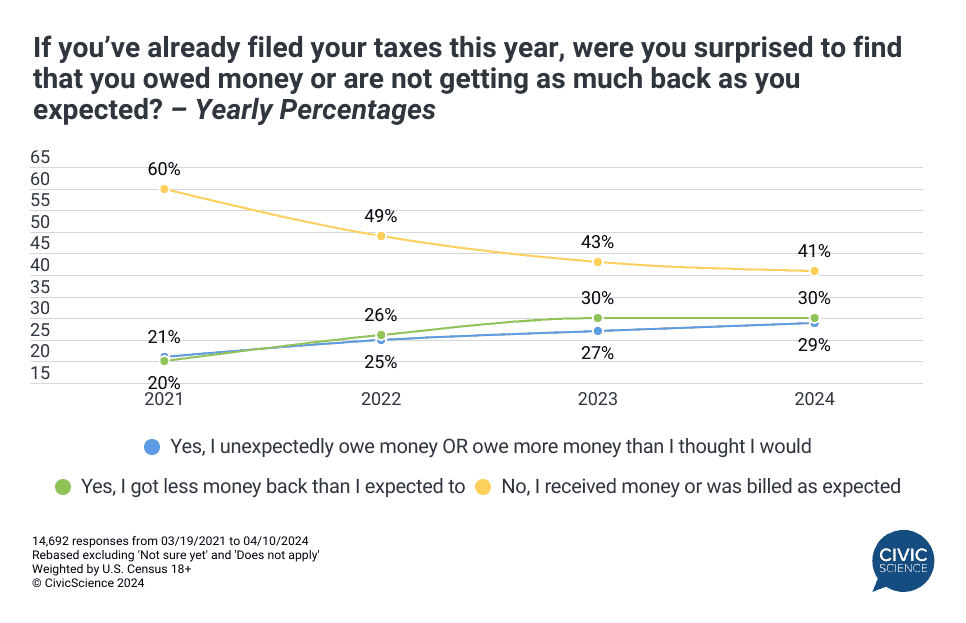

Over the course of the 2024 tax season, Americans are more likely to say they owed money unexpectedly or owed more than expected this year compared to last year. After rebasing to eliminate those who are not yet sure of what they will owe or receive, a year-over-year comparison shows a steadily growing percentage who report they owed more than expected, from 20% in 2021 to 29% this year.

The percentage of those who say they received less money back than expected remained the same as last year (30%), however there is a major change in expectations for tax refund billing and refund amounts over the last four years.

Join the Conversation: Was your tax refund bigger or smaller than you expected?

Further analysis suggests a correlation between tax refunds and economic sentiment. Within the past 30 days, a whopping 63% of those who owed more than anticipated are far more likely to report being ‘very’ concerned about the current state of the U.S. economy and jobs, compared to just 45% who were billed or refunded as expected. Higher income-earning households (earning $100K or more annually) are the most likely to say they owed more money than expected.

This is key in the context of the recent drop in economic sentiment, with confidence in the U.S. economy and job market declining the most during the last week of March and first week of April. Perhaps the final weeks of tax season helped to fuel the downturn, as more Americans filed their returns, made payments, and received (or did not receive) refunds.

2. Tax Concerns Ranked

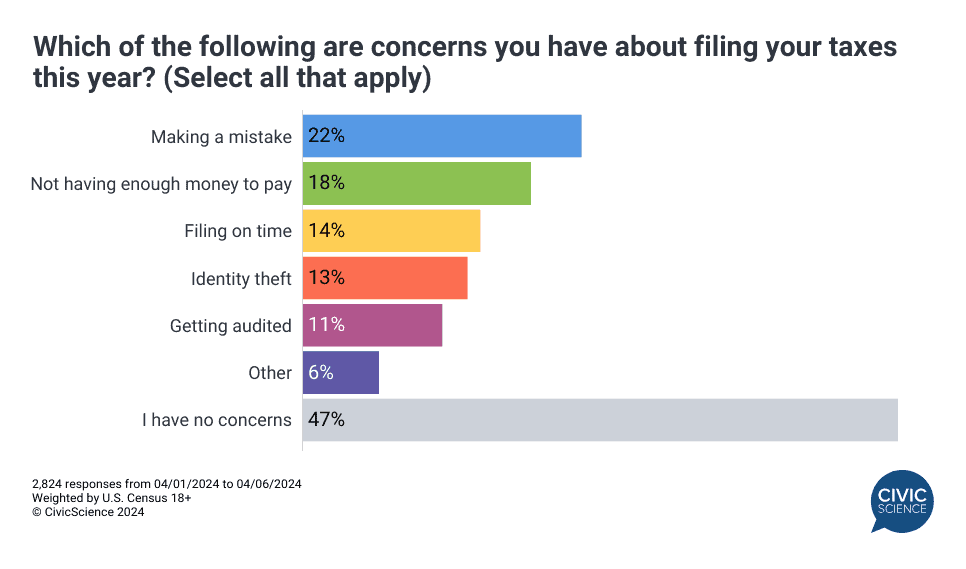

Tax season can be a stressful time for American households. New data reveal that the majority of U.S. adults (53%) have at least some type of concern about filing their taxes this year. Many are worried about making a mistake, followed by not having enough money to pay taxes due. Around 1-in-10 consumers are concerned about being audited.

3. Social Media Is One Source for Tax Advice

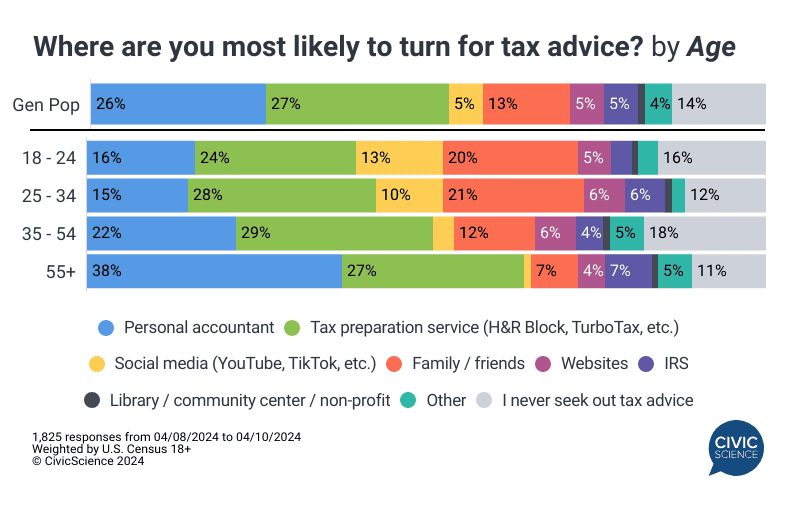

Many Americans want to educate themselves about taxes and finances, yet where to turn for knowledge and advice can be equally as confusing as the tax filing process. New data show that 86% of consumers look for tax advice. The majority are likely to turn to a personal accountant or tax preparation service, such as H&R Block. Adults under age 35 are far more likely to rely on the advice of family and friends and social media.

In fact, 10% of those aged 25-34 and 13% of those aged 18-24 say they are most likely to turn to social media for tax advice. This could be cause for concern, as reports have recently surfaced warning of bad tax advice coming from channels on TikTok and other social media platforms.

Take Our Poll: What’s the status of your taxes?

Looking for more tax season insights, including how your target audiences plan to spend their tax refunds this year? Contact us now to see these trends through the lens of your customers.